Shares of The Metals Company (NASDAQ:TMC) are rising Thursday afternoon, hitting a new 52-week high as investors flock to domestic rare earth and battery metal stocks. Here’s what you need to know.

What To Know: The rally is fueled by a dual catalyst of potential U.S. government backing and fresh export restrictions from China. Earlier this week, reports that the Trump administration was interested in direct investments in the strategic metals sector triggered a rally, with The Metals Company highlighted as a key beneficiary. This momentum intensified Thursday as China, a dominant global supplier, announced it was tightening controls over its rare earth exports.

The move has stoked fears of a supply crunch and spurred a rush into U.S.-based producers. For The Metals Company, which focuses on deep-sea mining for vital battery metals like cobalt and nickel, the geopolitical tensions underscore its strategic importance. The stock is up over 29% in the last five days and has seen a gain of more than 830% over the past year.

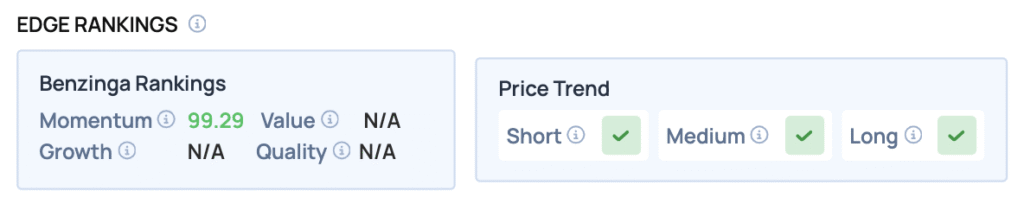

Benzinga Edge Rankings: The stock’s powerful rally is reflected in its Benzinga Edge momentum ranking, which gives the company an exceptionally high score of 99.29.

TMC Price Action: The Metals Company shares were up 2.47% at $9.34 at the time of publication Thursday, according to Benzinga Pro. The stock is trading near its 52-week high of $9.55.

The stock is significantly above its 50-day moving average of $5.78 and 100-day moving average of $5.83, indicating strong bullish momentum. Key resistance is observed near the recent high of $9.86, while support can be identified around the 50-day moving average.

Read Also: What’s Going On With United Airlines Shares Thursday?

How To Buy TMC Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in The Metals Company’s case, it is in the Materials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock