/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

Palantir Technologies (PLTR) has been on a remarkable upward trajectory. On Aug. 4, the company’s stock surged to a fresh 52-week high of $161.40 ahead of earnings. Adding to the positives, Palantir delivered solid second-quarter results last night that exceeded expectations, showcasing the solid demand for its Artificial Intelligence Platform (AIP). The market responded positively, sending PLTR shares up more than 6% in early trading today.

This growth adds to what has already been a stellar year for Palantir. PLTR stock has skyrocketed more than 127% year-to-date and an eye-popping 614% over the past year. However, due to this extraordinary rally, Palantir stock trades at ultra-high valuation levels.

Palantir’s Sky-High Valuation

PLTR is trading at a price-to-sales ratio of 127.05x and a forward price-to-earnings ratio of 432.65x. These multiples are not just above industry averages - they dwarf them, including those of far larger and more established tech giants. For many investors, these figures would typically signal caution. But in Palantir’s case, the market seems content to keep fueling the rally, betting on its growth potential.

So, how is Palantir managing to hold investor interest at these seemingly unsustainable multiples?

The AI Advantage

Much of the bullish sentiment around Palantir centers on its AIP, which continues to gain traction across both commercial and government sectors. Unlike many of its peers in the AI and data analytics space, Palantir offers a proven platform with growing customer demand. This track record, combined with its deep-rooted government relationships, positions the company uniquely in a fast-evolving market.

The company’s second-quarter results support that narrative. Palantir posted quarterly revenue exceeding $1 billion for the first time, marking a 48% year-over-year increase. While its revenue growth rate accelerated once again, customer count rose to 849, up 43% from the prior year and 10% from the previous quarter. Revenue from its top 20 customers also continued to rise, reaching an average of $75 million per customer, an impressive 30% increase.

Perhaps even more striking is the company's margin profile. Its adjusted operating margin expanded to 46%, indicating that Palantir isn’t just growing - it’s growing efficiently.

Palantir’s U.S. Business: A Powerhouse of Growth

What’s driving Palantir’s growth engine in particular is its performance in the U.S. market, especially within its commercial business. The company’s U.S. commercial revenue grew by a jaw-dropping 93% year-over-year and 20% sequentially. Palantir also booked its highest-ever U.S. commercial Total Contract Value (TCV) at $843 million, up 222% from a year ago.

Over the past year, the company secured $2.8 billion in U.S. commercial TCV bookings, reflecting a 141% jump from the previous 12-month period. Its U.S. commercial customer count rose to 485, up 64% year-over-year, reflecting increasing demand for real-world AI solutions.

The government segment also continues to contribute meaningfully. In Q2, U.S. government revenue increased 53% year-over-year and 14% sequentially. A recent highlight was the 10-year, $10 billion agreement with the U.S. Army. This significant deal consolidates 75 smaller contracts and signals long-term trust in Palantir’s capabilities. Given that the Army is one of Palantir’s oldest clients, the agreement is both a validation of past work and a commitment to future collaboration.

Palantir Delivers Upbeat Guidance

As AIP continues to drive the expansion of its existing customer relationships and helps in the acquisition of new clients in the U.S., this momentum is setting the stage for even stronger future growth, offering meaningful support for Palantir's stock performance.

Reflecting this positive trajectory, Palantir has raised its full-year 2025 revenue forecast. The new midpoint stands at $4.146 billion, reflecting a year-over-year growth of 45%. This is a significant improvement, and is roughly nine percentage points higher than what the company projected just a quarter ago. In parallel, Palantir also revised its U.S. commercial revenue target upward to over $1.302 billion, which now points to at least 85% year-over-year growth, 17 points higher than its earlier guidance.

These upward revisions signal continued strong demand, especially as more companies look to integrate AI into their operations.

Here’s What Analysts Say About PLTR Stock

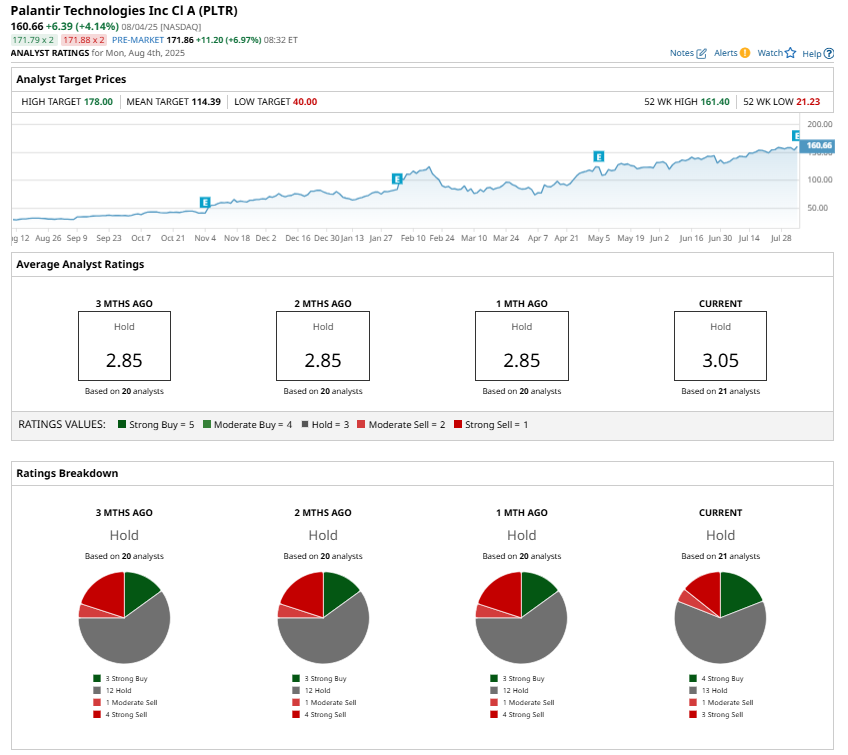

Despite all of this momentum, Wall Street remains cautious. The consensus rating on the stock is still a “Hold,” mainly due to concerns over its elevated valuation. This indicates that PLTR's current price already bakes in much of the optimistic growth projections, leaving little margin for error.

The Bottom Line on PLTR After Earnings

Palantir’s stock may be super expensive by valuation metrics, but the company’s growth trajectory, robust financials, and unique positioning in both the commercial and government AI sectors have kept the rally going. The premium price tag is hard to ignore, but so is the company’s momentum.

Right now, the market appears comfortable paying that premium, suggesting the rally could have more room to run.

For existing shareholders, holding could be a prudent choice to ride the continued momentum. For new investors, however, waiting for a pullback before buying may offer a more favorable risk-reward balance. While the company’s fundamentals are solid, its premium price tag demands cautious optimism.