Market Overview

Stocks finished up across the board, and rallied to new all-time highs with the Nasdaq leading the way. The tech-heavy index finished 2.31% higher, while the Dow Jones Industrial Average followed by closing up 2.20%. The S&P 500 closed 1.92% higher. We finally got a pullback in metals and it looks like the market is going through a profound rotation from high-beta speculative names into high-quality growth names. The rotation is healthy rather than sign of defense precautions being taken. Crypto is trying to hammer out a low before the rate cut this week, which could send risk appetite soaring again.

Stocks I Like

Nu Holdings (NU) – 39% Return Potential

What's Happening

- Nu Holdings Ltd. (NU) is a leading digital banking platform in Latin America, offering innovative financial services like mobile banking, credit cards, and investment products, providing investors exposure to the rapidly growing fintech and digital banking sector with a focus on customer-centric, technology-driven solutions.

- The latest quarter showed revenue of $3.25 billion and revenue of $557.2 million.

- This valuation on NU is elevated. P/E is at 32.81, Price-to-Sales is at 8.42, and Book Value is 1.98.

- From a technical standpoint, NU is starting to breakout from a descending price channel, which is pointing to a continuation in the rally

Why It's Happening

- Nu Holdings Ltd. is revolutionizing digital banking in Latin America, boasting a staggering 123 million customers as of Q2 2025, up from 105 million a year prior with 18 million new additions over the past 12 months. This relentless customer acquisition, averaging 1.5 million sign-ups monthly, cements Nu’s position as the region’s undisputed leader in financial inclusion, serving underserved populations with seamless, fee-free services that drive viral adoption.

- Explosive revenue and profitability trajectory fuels Nu’s growth story. Q2 2025 revenues soared 40% year-over-year to $2.9 billion, while net income jumped 143% to $487.2 million, reflecting maturing monetization strategies like credit card issuance and cross-selling that transform free users into high-value, lifelong customers in Brazil’s massive underbanked market.

- Rapid international expansion beyond Brazil unlocks massive untapped potential. Mexico’s customer base exploded to 13 million by October 2025, capturing 23% of the banked population and adding over 1 million users in under three months, while early traction in Colombia signals Nu’s blueprint for conquering high-growth emerging markets with localized, tech-driven financial solutions.

- Diversification into high-margin products enhances Nu’s ecosystem resilience. Beyond core banking, surging adoption of investments, insurance, and lending products is boosting ARPU by 25% year-over-year, creating a flywheel of recurring revenue that positions Nu as a one-stop financial superapp for millions, insulating it from traditional banking disruptions.

- Analyst Ratings:

- UBS: Neutral

- JP Morgan: Overweight

- Susquehanna: Positive

My Action Plan (39% Return Potential)

- I am bullish on NU above $13.50-$14.00. My upside target is $22.00-$23.00.

Globalstar (GSAT) – 129% Return Potential

What's Happening

- Globalstar, Inc. (GSAT) is a leading satellite communications company providing mobile voice and data services, offering investors exposure to the rapidly growing satellite connectivity and IoT sector with a focus on global coverage and innovative low-earth-orbit satellite solutions.

- The latest quarterly report showed revenue of $67.15 million and earnings of $4.92 million.

- Valuation is high in GSAT. Price-to-Sales is at 21.57 and EV to EBITDA is at 58.60. Book Value is just 2.85.

- From a technical perspective, GSAT is coiled up nicely within a triangle formation. This implies that another leg higher in prices is on the horizon.

Why It's Happening

- Globalstar Inc. is revolutionizing global connectivity with the commercial launch of its RM200M two-way satellite IoT module on October 21, 2025, driving a 4.1% stock surge on the same day. This compact, globally certified module leverages Globalstar's Low Earth Orbit (LEO) network to enable seamless asset tracking and monitoring across industries like logistics, energy, and agriculture, positioning the company as a leader in the rapidly expanding $4.9 billion satellite IoT market by 2030.

- Strategic infrastructure expansions enhance Globalstar's global reach and service reliability. The deployment of new ground stations in Alaska (Talkeetna and Wasilla) and a $9 million investment to double its Estonian facility with three 6-meter antennas for the C-3 mobile satellite system demonstrate a commitment to meeting rising demand for IoT and direct-to-device solutions, strengthening its narrative as a backbone for next-generation connectivity.

- Robust government contracts provide a stable revenue foundation. Securing $60 million in multi-year deals, including support for Apple's iPhone emergency SOS feature, underscores Globalstar's critical role in mission-critical communications, offering a defensive moat and long-term cash flow visibility in a volatile market, while fueling optimism for sustained growth.

- Strategic partnerships amplify market potential. Collaborations like the October 2025 Conekt.ai deal for integrated Band 53 spectrum and XCOM RAN solutions, alongside a Singapore ground station expansion with Singtel, unlock new IoT and private network opportunities, reinforcing Globalstar's story as a versatile innovator bridging terrestrial and satellite connectivity for enterprise and consumer markets.

- Analyst Ratings:

- Clear Street: Buy

- Craig Hallum: Buy

- Morgan Stanley: Equal Weight

My Action Plan (49% Return Potential)

- I am bullish on GSAT above $38.00-$39.00. My upside target is $67.00-$68.00.

Bakkt Holdings (BKKT) – 136% Return Potential

What's Happening

- Bakkt Holdings, Inc. (BKKT) is a leading digital asset platform offering cryptocurrency trading, custody, and financial services, providing investors exposure to the rapidly growing blockchain and digital currency sector with a focus on secure, regulated solutions for institutional and retail markets.

- BKKT had revenue of $13.4 million but a loss of $19.56 million in their latest quarterly report.

- Valuation in BKKT is mixed. Price-to-Sales is solid at 0.06, but Book Value is very low at 2.22.

- From a charting point of view, BKKT is retesting former resistance turned support of a saucer formation. If it holds, it's very bullish.

Why It's Happening

- Bakkt Holdings Inc. is capitalizing on the Bitcoin rally, leveraging its Bitcoin treasury strategy to bolster financial flexibility and align with the growing institutional adoption of cryptocurrencies. With Bitcoin prices soaring, the company's strategic pivot to a pure-play digital asset infrastructure platform positions it to capture significant value in the $2.7 trillion crypto market, creating a compelling narrative of growth in a high-demand sector.

- Streamlined focus on crypto infrastructure enhances Bakkt's scalability. The October 2025 sale of its loyalty business to Project Labrador Holdco, LLC, and the planned Up-C reorganization to a single-class stock structure by November 3, 2025, simplify its operations, positioning Bakkt as a lean, crypto-focused player ready to attract institutional investors and drive long-term shareholder value.

- Debt-free balance sheet strengthens Bakkt's growth runway. By redeeming all outstanding convertible debentures in October 2025, the company eliminated long-term debt, providing the financial agility to fund expansion into high-growth areas like stablecoin payments and AI-driven finance, reinforcing its story as a resilient innovator in the digital asset space.

- Strategic leadership enhancements signal bold ambitions. The appointment of macro strategist Lyn Alden and fintech veteran Mike Alfred to the board in September and October 2025 brings deep expertise in digital assets and financial infrastructure, positioning Bakkt to execute on its vision of redefining money movement and market trading in a rapidly evolving fintech landscape.

- Analyst Ratings:

- Benchmark: Buy

- Rosenblatt: Buy

My Action Plan (136% Return Potential)

- I am bullish on BKKT above $27.00-$28.00. My upside target is $68.00-$70.00.

Market-Moving Catalysts for the Week Ahead

The Rate Cut is Coming

We're in the middle of earnings season, and the results so far have been a mixed bag. Netflix had a terrible response to its earnings, but Tesla held up okay. But I think the bigger story right now is the fact that the next rate cut is coming this week.

This is going to help ease some of the liquidity concerns brewing in the market, but the big question is whether it's too little and too late? I'm not expecting anything more than a 25-basis point cut this week, but I'm most curious to see what they signal in terms of future cuts.

This rate cut has the potential to restore some confidence back into the marketplace, especially after some recent volatility. The fact that we're not seeing stocks explode higher per se during this earnings season suggests that the market wants more from the central bank.

Will the Government Ever Reopen?

The federal government has been shut down for over three weeks now, and we'll actually be entering the fourth week in just a few days. Markets continue to brush this off, even as major trade negotiations continue with China.

Could the government reopening be a "buy the rumor, sell the news" situation for markets? Perhaps, but I think the bigger news would come from a trade deal with China. Remember, President Trump is set to meet Xi Jinping this week, just days before tariffs are set to go into full effect.

I think a bigger catalyst for a breakout higher in stocks would be for a lasting trade deal to be struck with China. It's amazing how we've come full circle in so many ways on tariffs and trade, but here we are. Markets love to take its participants for a loop.

Sector & Industry Strength

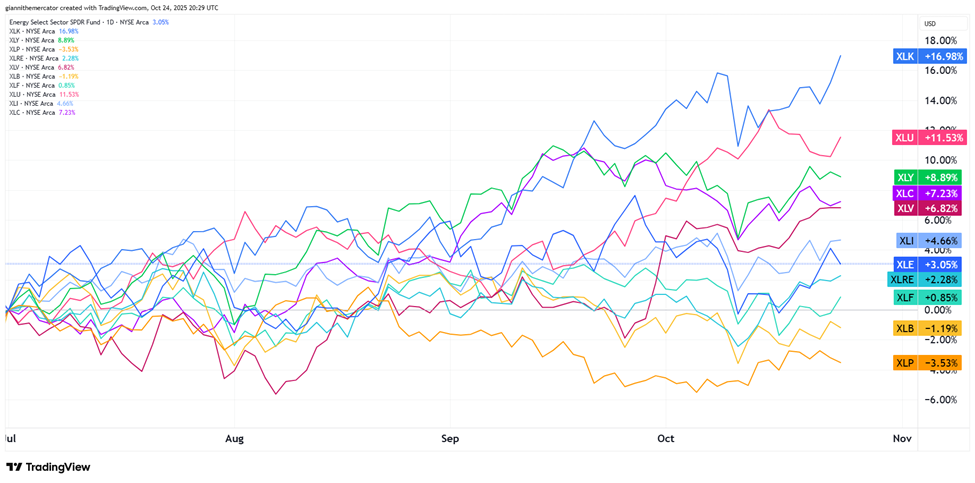

Since we're in the final week of the first month of the fourth quarter, I wanted to tighten up the timeframe to measure the sector performance rankings. We're now looking at the various market sectors going back to the start of the third quarter.

The good news is that we still see technology (XLK) as the top-performer by a long-shot. This is key to maintaining the integrity of the bullish market internals. But we do have utilities (XLU) in second-place, which places a bit of caution on the rally.

I'm glad to see consumer staples (XLP) in last place, although I am paying close attention to the rallies in energy (XLE) and healthcare (XLV). There's more risk creeping into the tape now over the past couple of months compared to the low from April.

| 1 week | 3 Weeks | 13 Weeks | 26 Weeks |

| Energy | Consumer Staples | Technology | Technology |

Editor's Note: Energy and staples creeping onto the board is cautionary, but tech making reinforcing itself simultaneously. Looks like a healthy rotation right now.

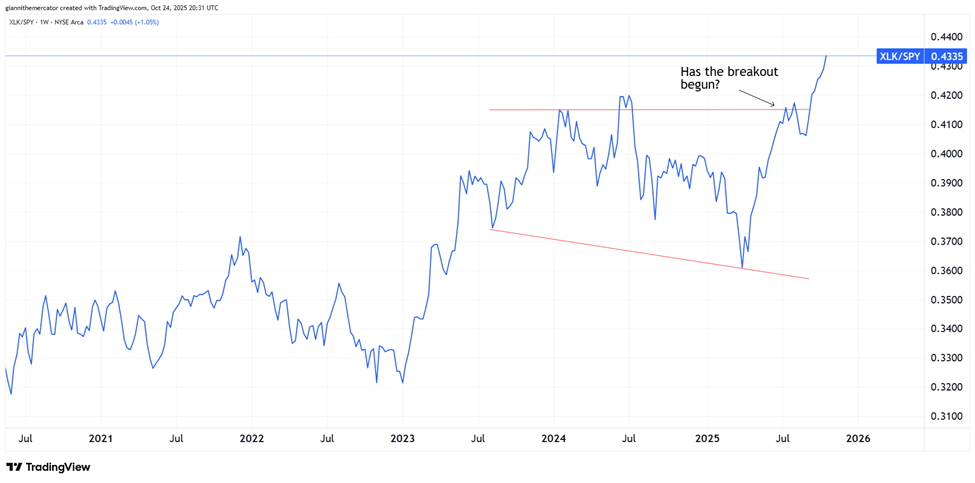

We Already Have the Signal (Sector ETF: XLK/SPY)

This may be the most important breakout for the stock market over the past couple of months. We finally saw the ratio between technology (XLK) and the S&P 500 (SPY) breakout to the upside after a multi-year consolidation.

The consequences of this breakout cannot be understated – the tech sector accounts for roughly 30% of the S&P 500, and if anything, this breakout suggests that the number is going grow substantially in the coming years.

The wedge formation points to an acceleration in upside momentum in this ratio. It looks to be gathering its bearings after realizing what just happened. This is bullish for the overall market, and as long as this is the case, dips should continue to be bought.

A Sleeper Coin (Sector ETF: SOL/ETH)

While crypto is struggling to find its rhythm again, I'm keeping a close watch on two of the big DeFi coins – Solana (SOL) and Ethereum (ETH). There's been a lot of talk about Solana being a better alternative to Ethereum, especially when it comes to gas fees.

Now, let's see if that's being reflected in the money flows into each of these coins. As you can see, the ratio has maintained a generally upward trajectory over the past couple of years, but since April, Ethereum has had the edge.

This could be on the verge of changing, however, if we are in the process of completing a higher-low with respect to the trend. If it holds above the trendline, then we could be looking at Solana flipping Ethereum in time.

Is the Rate Cut Going to Ignite Inflation? (Sector ETF: TIP/IEF)

The moment is here! Another rate cut is coming this week, which means the printing presses are already running for more money. It's a great time to check back on my favorite ratio to measure the bond market's expectations for inflation.

I'm looking at the ratio between Treasury Inflation Protected Securities (TIP) and 7-10 Year Treasuries (IEF). When TIP outperforms, it means that inflation expectations are rising, but when IEF outperforms, it means that inflation is contained.

This ratio suggests that inflation will eventually return, but the question is when? If we breakout from the symmetrical triangle, it would send a powerful signal that inflation is making a comeback, but as long as we remain range bound, there's no need to worry.

My Take:

The trillion dollar question is – where is all the new money going to go? At first, it's going to funnel into stocks and probably even bonds, but at some point, it's going to find its way to commodities, and that's when the danger begins.

As long as commodity prices remain subdued, the goldilocks market environment can continue. I would expect commodity prices to continue trending in a positively correlated manner with this ratio.

Cryptocurrency

This week, my attention is on Solana, which is starting to show some notable relative strength against both Bitcoin and Ethereum. This cryptocurrency held wonderfully in key technical support in the 185.00-190.00 zone, and is trying to form a higher-low.

If this holds, it will further reinforce the uptrend that's been in effect since April. It's been in a corrective pullback since September, but the longer-term trend remains in favor of the bulls. We'll have to exceed that high from September to fully confirm the uptrend.

But my bigger focus is on the multi-month saucer formation on the daily chart. This is pointing to a monster rally as high as 500.00 in time. The big resistance zone to watch is in the 250.00-260.00 zone, so if that clears, look out above.

Legal Disclosures:

This communication is provided for information purposes only.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but Benzinga does not warrant its completeness or accuracy except with respect to any disclosures relative to Benzinga and/or its affiliates and an analyst’s involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Benzinga does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, Benzinga may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a Benzinga subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Benzinga. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Benzinga. Copyright 2022 Benzinga. All rights reserved.