While early signs of tariff-driven inflation had sparked a controversial debate, U.S. businesses are now sending a clear message—price pressures are mounting fast, and inflation is making a comeback.

- QQQ ETF is moving fast. Check live prices here.

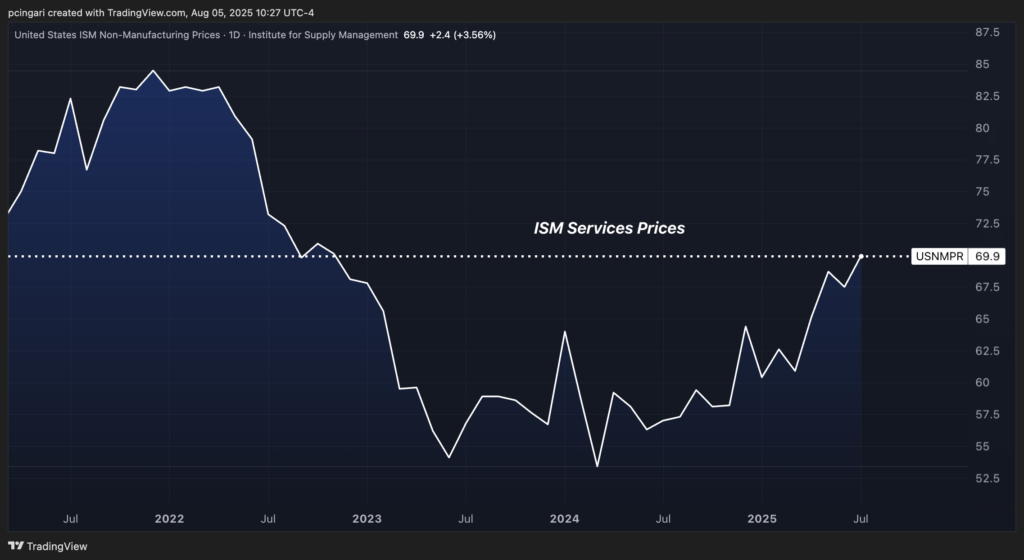

U.S. inflationary concerns reignited after the July Purchasing Managers’ Index for services, released by the Institute for Supply Management, showed input prices climbing at the fastest pace since late 2022, adding weight to growing fears that President Donald Trump's tariff policies are starting to bite.

The ISM Services Prices Index jumped to 69.9% in July, up from 67.5% in June and reaching the highest level since November 2022.

This surge in costs is occurring alongside signs of stagnation and contraction in other economic metrics, indicating that the U.S. economy may be transitioning into a phase of stagflation—a period of slowing growth and rising prices.

Growth Stalls, Jobs Shrink, Prices Soar: Are Tariffs Starting To Hit?

The broader ISM services index slowed from 50.8% in June to 50.1% in July, falling short of the 51.5 expected by economists and edging closer to stagnation territory.

The Business Activity Index eased from 54.2% to 52.6%, while New Orders dropped by a whole percentage point to 50.3%.

On the employment front, the ISM Services Employment Index slumped to 46.4%, the lowest level since March 2025. The decline confirms signs from last week's official July jobs report, which showed nonfarm payrolls rising by just 73,000, well below consensus expectations of 110,000.

Taken together, the data highlight a rapidly softening labor market picture and a rising inflationary environment, challenging the Fed’s dual mandate of stable prices and maximum employment.

Steve Miller, chair of the ISM Services Business Survey Committee, said that "July's PMI continues to reflect slow growth." Yet, he noted that both weather-related and seasonal factors had impacted business activity.

He added that the combination of contracting employment and rising input prices remains "worrisome."

“The New Exports (a 3.2-percentage point decrease in July) and Imports (a 5.8-point drop) indexes, which both moved from expansion to contraction, provided signals that tariff tensions are impacting global trade,” Miller said.

Several ISM survey respondents flagged a surge in transportation congestion and a growing list of commodities showing price increases. These developments are feeding into longer supplier delivery times and intensifying cost pressures across service industries.

“The most common topic among survey panelists remained tariff-related impacts, with a noticeable increase in commodities listed as up in price," Miller added.

Chief U.S. Economist at Oxford Economics, Ryan Sweet, noted that “the July data reinforce the risks toward further slowing in the economy and higher inflation.”

“The increase in the price-paid index is likely partially attributed to tariffs,” he added.

Market Reaction: Wall Street Turns Cautious

Wall Street responded with caution. The S&P 500 slipped 0.3% to 6,316 in early trading on Tuesday, erasing premarket gains.

The Nasdaq 100 edged 0.1% lower to 23,175, cushioned by an 8% surge in Palantir Technologies Inc. (NASDAQ:PLTR) after the company posted stronger-than-expected results.

Precious metals markets reflected inflationary hedging. Gold rose 0.2% to $3,380, while silver edged up 0.7% to $37.55.

Read Next:

Photo: Shutterstock