Hong Kong toymaker Jeffrey Lam Kin-fung is feeling the pressure from US President Donald Trump’s import tariffs, even though his products are not yet subject to any duties.

His company, Forward Winsome Industries, a pioneer in the manufacture of rubber ducks, has been rushing to meet a spike in orders from American customers keen to stockpile products before they are hit by the next round of tariffs.

On May 5, Trump said on Twitter that his administration would extend punitive 25 per cent duties to the remaining US$300 billion of untaxed Chinese imports. Forward Winsome’s goods, which are largely assembled at its mainland Chinese factories, would be squarely in the cross hairs.

“Our orders suddenly increased substantially in May and June. Our peak season usually would be between July and September but the orders in July have been pushed forward.”

The rush of orders has created its own challenges.

“We rushed to buy raw materials, we tried different ways to get a big enough workforce. We even needed to get together more cardboard boxes for packaging,” said Lam.

“We could not get the whole year’s orders of goods shipped by June, our production lines have a limitation of production capacity.”

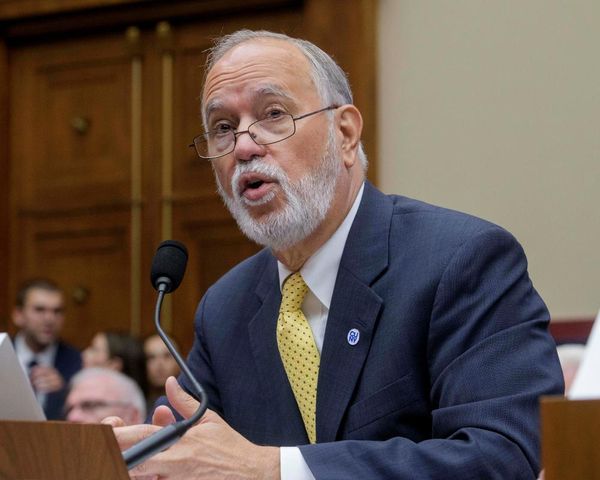

Lam is a member of Hong Kong leader Carrie Lam Cheng Yuet-ngor’s Executive Council and a representative of the business sector in the Legislative Council.

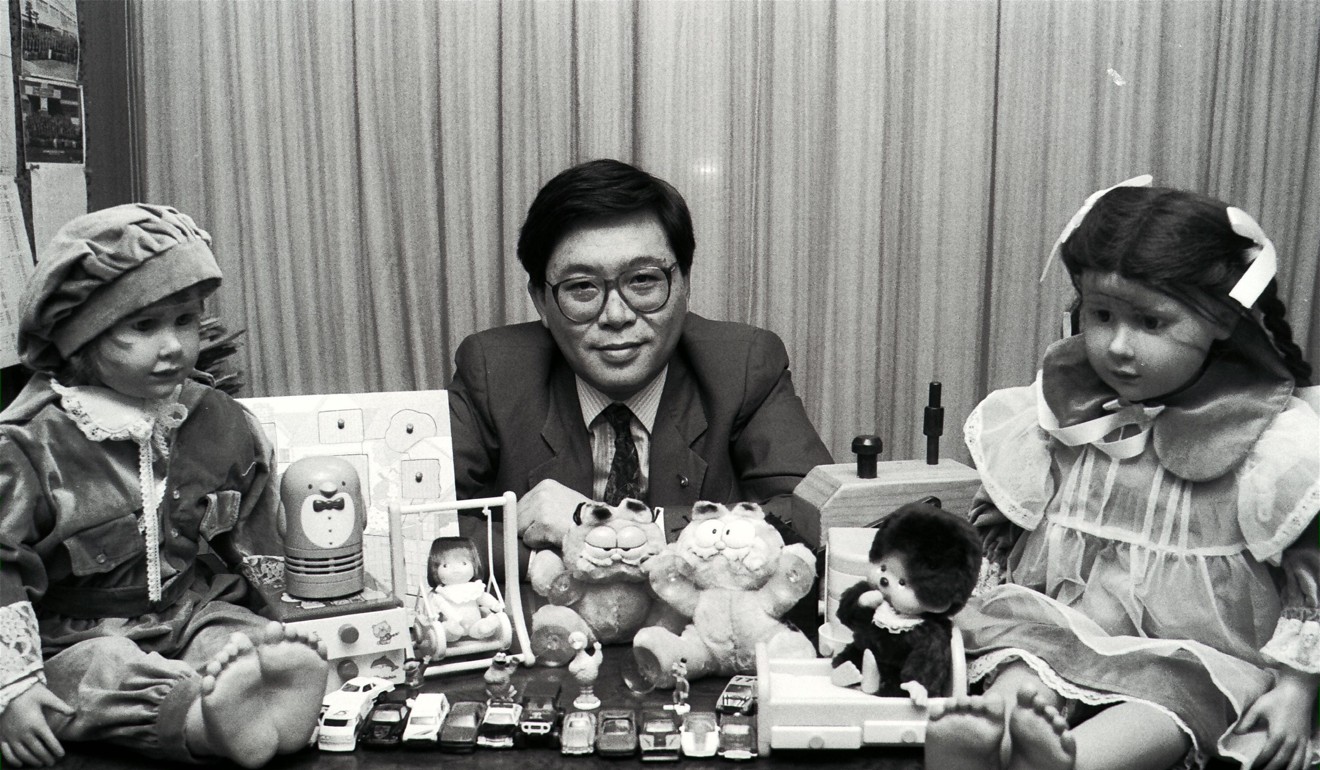

Forward Winsome was founded in 1960 by Lam’s father, Lam Leung-tim, who made his name launching the famous yellow rubber duck. His family made its fortune by manufacturing goods that are sold on by their American customers.

They also make plastic educational toys, die casts and electronic toys for customers in the US, Europe and elsewhere.

It is one of the countless manufacturers with factories in China who have found themselves caught in the trade war. They are trying myriad ways to reduce the impact of potential and real tariffs.

On Thursday, Trump said he was “probably planning” to slap tariffs on the remaining Chinese imports some time after he meets with Chinese leader Xi Jinping at the G20 summit in late June.

Analysts said many US retailers in different industries have been stockpiling Chinese-made products for months to minimise the blow to their bottom line, at least in the short term.

They are hoping that front-loading goods – stocking up now to avoid future tariffs – can keep retail prices low going into the holiday shopping season.

Evidence of the tactic was visible in the latest data from China’s manufacturing sector, according to some analysts.

The Caixin manufacturing PMI, a gauge of China’s factory activity focusing more on small- and medium-sized enterprises (SMEs) and export-oriented enterprises located in the eastern coastal regions, beat expectations in May, remaining unchanged at 50.2. Anything above 50 reflects expansion.

Front-loading explained the surprisingly positive reading, according to Lu Ting, chief China economist at Japanese investment bank Nomura.

“The significant rise in new export orders and stock of finished goods suggest some exporters may have front-loaded their US-bound shipments in May to avoid potential tariff hikes on the US$300 billion list,” Lu said in a research report last week.

Wilfred Li Kwok-ming, chairman of Hong Kong’s Carmelton Group that makes nappies, feminine care and adult incontinence products, said front-loading of exports is not a solution for manufacturers in the long run.

“Customers did not ask us to ship goods earlier. But they are more reluctant to place orders of goods that are scheduled for retail sales during Christmas,” said Li.

Denied the front-loading option, Li is looking for new markets to reduce reliance on the US.

“The US is one of the single largest markets, with total sales accounting for 20 per cent of our revenue,” said Li. All good are produced at his factory in Dongguan.

Li, who is also chairman of the Hong Kong Children, Babies, Maternity Industries Association, said some of the 150 members shipped their goods solely to the US.

“They indicated to me they may close their production line if the tax is imposed,” said Li.

Like many manufacturers, Li is planning to shift part of his production capacity to Bangladesh to avoid the tax.

V Tech, a Hong Kong-based global supplier of cordless phones and electronic learning toys, said it is planning to expand its existing production lines in Malaysia and shift some of the business there from China to avoid tax tariffs.

The largest manufacturer of residential phones in the US could shift some of the financial burden of tariffs to customers, chairman Alan Wong told media after the company’s annual meeting on May 20.

Forward Winsome is planning to shift more of its production to the factory in Thailand that Lam set up more than 20 years ago. And they are exploring the possibility of setting up new production lines in Vietnam.

In China, the company runs three factories in Guangdong province – two in Lam’s ancestral hometown of Nanhai, Foshan, and one in Qingyuan.