No matter how far away you think you are from retirement it’s never too early to think about your pension and to make sure that you are on track to receive the right amount when you do give up work.

Last year the UK Parliamentary and Health Service Ombudsman recommended that 3.6 million British women should be financially compensated by the government in light of the way the State Pension Age Rise was handled.

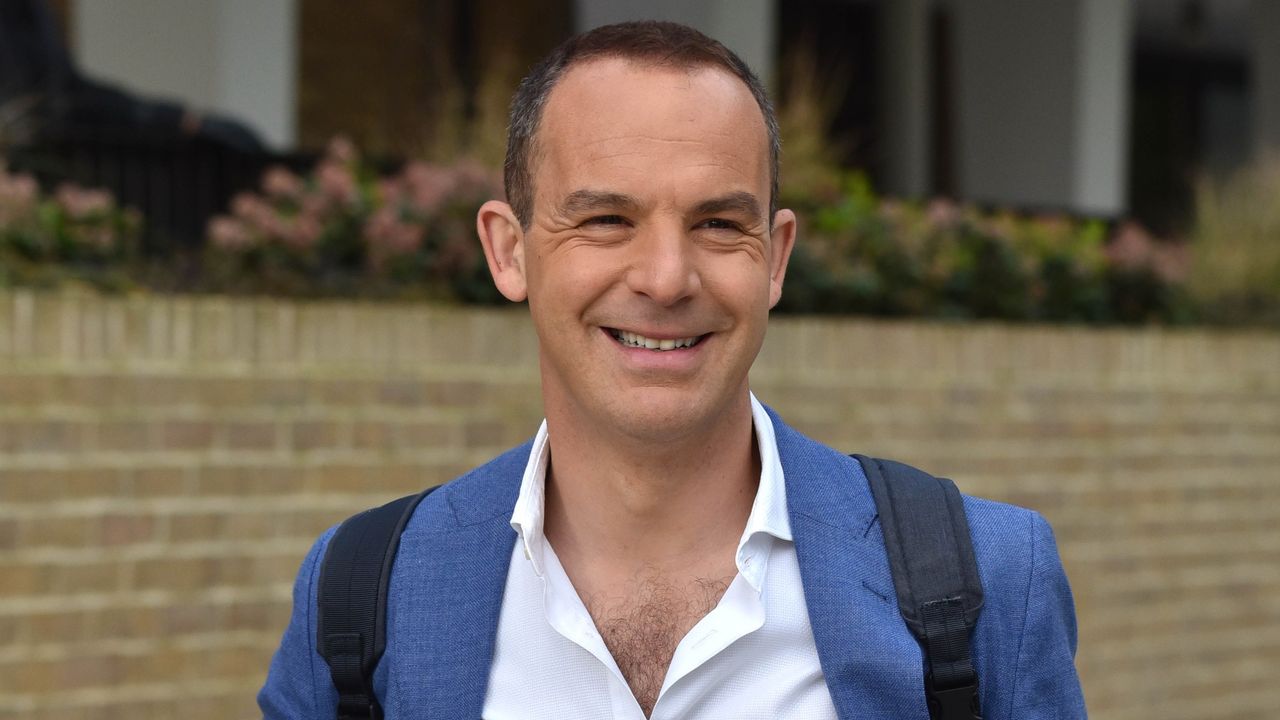

This pension scandal has likely made many of us consider their retirement finances more than ever and now financial journalist and expert Martin Lewis has explained how an alleged "error" could lead to some people missing out on their full State Pension without realising it.

Do You Meet The Criteria?

Appearing on This Morning on 29th July, the financial journalist talked viewers through this issue, which he suggested "primarily" affects women, and revealed how to go about ensuring you receive the State Pension amount you’re entitled to.

"This primarily impacts women, although not solely women," Martin declared on the ITV show. "But women between the ages of 41 and 90, but most generally they’ll be in their 60s and 70s, right, but it could be of any age. It’s those who took time away from paid work to either look after their child or to look after someone with a long-term disability or illness between 1978 and 2010."

This isn’t the only criteria laid out by Martin, however. He went on to share that to be affected by the error, you will have to have been claiming Child Benefit or Income Support before May 2000.

Martin continued, "[This is] why we tend to be talking [about] women in their 60s and 70s, because they fit that age profile, or your partner could have claimed Child Benefit, but you were then the one staying at home."

Child Benefit is paid by the UK government to those who have the responsibility of raising children and is intended to assist with the costs associated with this.

The financial expert clarified that there was also Home Responsibilities Protection which meant that if you stopped working to care for a child or someone who was sick, it ensured your National Insurance contributions were what’s needed to get the full State Pension.

"So there could be many women who are not getting the full State Pension because they should have got Home Responsibilities Protection and they didn’t get it because of an error," he added.

What Should You Do If You're Affected By This?

Thankfully, if you believe that this is the case for you, there is a way to get this reported "error" resolved - as outlined by Martin. Although he stated afterwards that this process was a "bit too complicated to do on the telly", he revealed the basic steps to take and said that there were many articles and people to turn to out there that walk you through it.

"You need to go to GOV.UK, you need to check your State Pension forecast. If you’re not forecasted to get a full State Pension when you hit retirement age then you need to go and look, have you got any missing National Insurance years," Martin divulged.

He went on, "If those years are missing at the same time that you were off work for childcare or for the long-term, then you were probably due Home Responsibilities Protection and you need to go and check that. You can also check your child benefit records and you apply on the Home Responsibilities Protection part of GOV.UK."

If you search for Home Responsibilities Protection on the government website, you will also find additional, helpful information regarding eligibility and how to claim it. Those who are eligible for HRP can apply online or by post and you can also contact the HMRC National Insurance helpline for an application form.

To apply by post you’ll need to supply the tax years you are applying for HRP for, the dates you claimed Child Benefit and any dates that you lived outside the UK during the period you’re applying for.