The signs of a crypto bear market must be heeded as the first half of the year draws to a close.

Why it matters: The last bear market in crypto scattered institutions and yet — this time it feels different. This time there are a few opportunists looking to buy while prices are "fear-cheap."

State of play:

- Startups are suspending services.

- At least one fund is liquidating.

- Big-time companies are laying people off, publicly.

Yes, but: This crypto boom, unlike the last, was marked by debt, debt that needed to be paid off at just the wrong time as trades placed on coins also turned bust.

- Our thought bubble: This is a greed problem, not a blockchain one.

The big picture: The business models of crypto exchanges, lenders and funds aren't very different from their Wall Street counterparts'. They all have to be very large to stay competitive, because they are effectively running commoditized businesses.

- What's happening: A sharp, sustained decline in coin prices, tightening capital markets and a looming recession are testing the mettle of crypto shops. And many are being found wanting.

More than a dozen crypto companies were reducing headcount by 5% to 45%, citing market turmoil and possible recession. At the same time, few are instituting hiring freezes, instead selectively hiring for key positions.

- Coinbase was among the largest of firms on the list, reducing headcount by 18% as well as instituting other cost-cutting measures.

- Crypto.com, the Winklevoss twins' Gemini, Coinbase-backed Vauld, BitMex, BitOasis as well as others are on the list.

- Argentina-based exchange Buenbit in May said they cut 45% of their staff in a months-long endeavor unrelated to the UST and Luna unwinding.

- Austria-based BitPanda, is reducing headcount by 30%. Huobi Global was reportedly lowering headcount by more than 30%. Australia's Banxa, too, by 30%.

What they're saying: The bear market has changed priorities.

- Banxa: "As a leaner, more focused company, Banxa can better prioritize higher margins and profitability in the face of industry headwinds."

- BitMex: "Earlier this year we revisited our strategy and took proactive measures to set ourselves up to be more profitable in the long term. As a result, we are a leaner and more agile firm which puts us in an advantageous position to weather the current market downturn, however long it may last."

- BitPanda: "We made the tough decision to scale back to a target organizational size of 730 people to ensure that we are robustly well-capitalized to navigate the storm and get out of it financially healthy, no matter how long it takes for markets to recover."

- Huobi: "Due to the current market environment, Huobi Global is in the process of reviewing both its hiring policies and its current manpower, with the goal of re-aligning them to its operational needs. Further to such review, lay-offs are a possibility."

Threat level: Celsius included, at least eight lenders, exchanges and brokerages suspended customer withdrawals or are limiting services.

- CoinFlex paused withdrawals last week over a $47 million debt the exchange says Bitcoin evangelist Roger Ver owes them.

- Voyager Digital, which was a lender to Three Arrows Capital, limited daily withdrawals of $10,000, with a maximum of 20 withdrawals in a 24-hour period.

- 3AC-exposed Finblox also limited withdrawals.

The other side: BlockFi, which is also reportedly exposed to 3AC, is not among them.

- Genesis, which is reportedly exposed to 3AC, has not announced layoffs either.

The big picture: Crypto shops with scale are faring better than others.

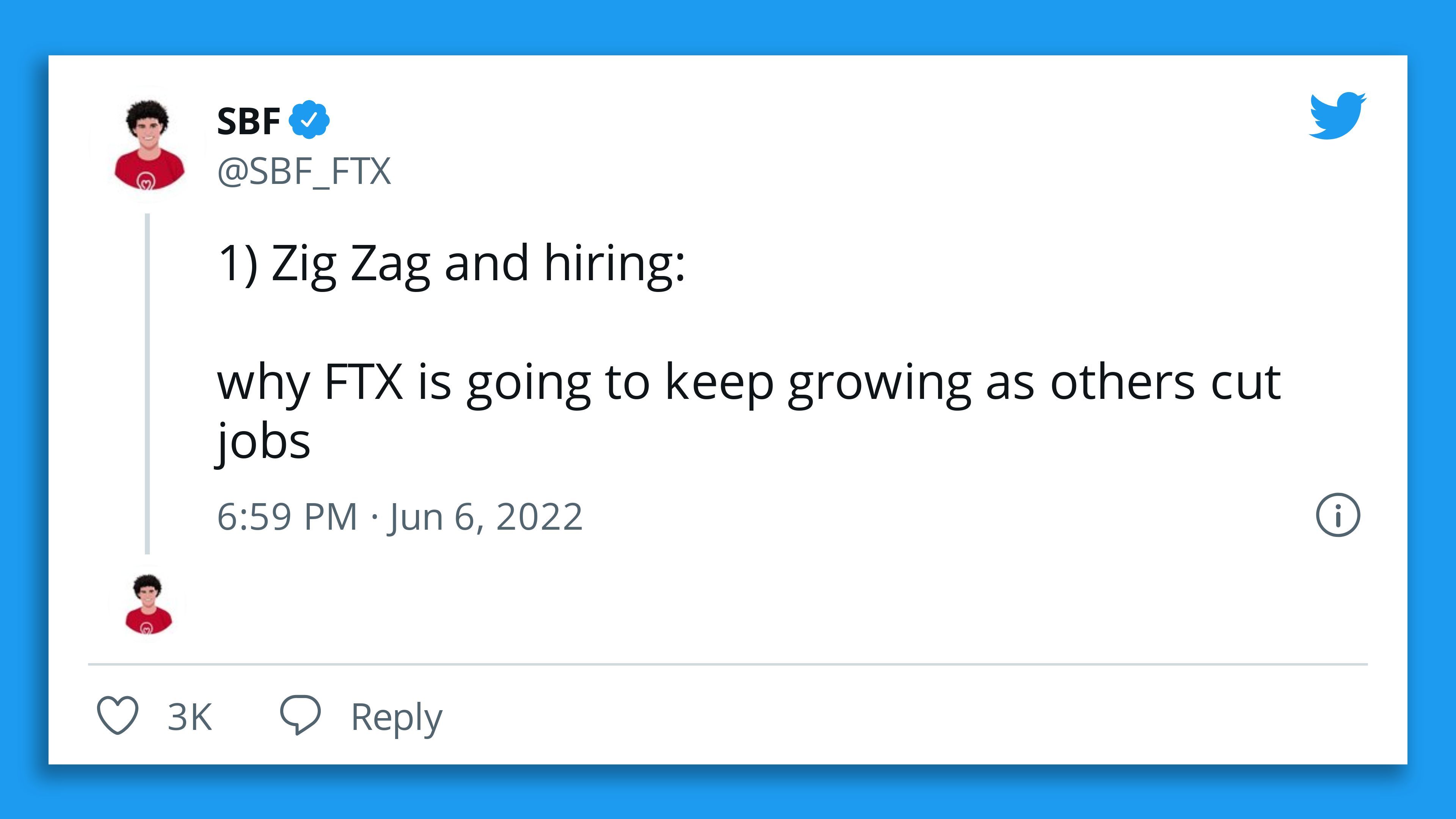

- FTX, Binance and others have said they are hiring in the face of this crypto winter.

Meanwhile, FTX's Sam Bankman-Fried said some small exchanges will close.

- He is also staying mum on whether his own very large firm is in the middle of acquiring some of them at substantially lower valuations.

.jpg?w=600)