Here’s a dark stat for corporates: More than half of corporate venture teams haven’t had a single exit in their portfolio over the last 12 months.

That’s according to the new research published this morning by Counterpart Ventures, Silicon Valley Bank (now a division of First Citizens), and PitchBook. The report, which surveyed more than 200 corporate venture teams, offers much-needed insight into how corporate investors (and the board rooms that fund them) are responding to the 2022 market crash.

Corporate venture is a sector I’ve been watching closely. After all, it was 20 years ago during the last major venture crash that we saw companies take a huge step back as they were forced to report billions of dollars of losses on startup investments. The venture losses didn’t go over well with public market investors and created a blemish on many a balance sheet.

Of course, that was 20 years ago. Corporations have since roared back into the market in full force, and CVCs participate in about a quarter of all funding rounds. Many companies have moved their venture arms off their balance sheet with allocated capital. While there are various reasons a company would want to do that (carry, independence, etc.), I’ll point out another: CVCs that operate more independently and don’t invest from their owner’s corporate balance sheet conveniently don’t have to disclose volatile investment performance in quarterly filings, and sometimes hardly any information about their venture arms at all.

All of this makes it extraordinarily difficult for nosy journalists like me to get a real sense of how corporations are responding to this market crash versus the last. This report offers a few pointers on CVC sentiment.

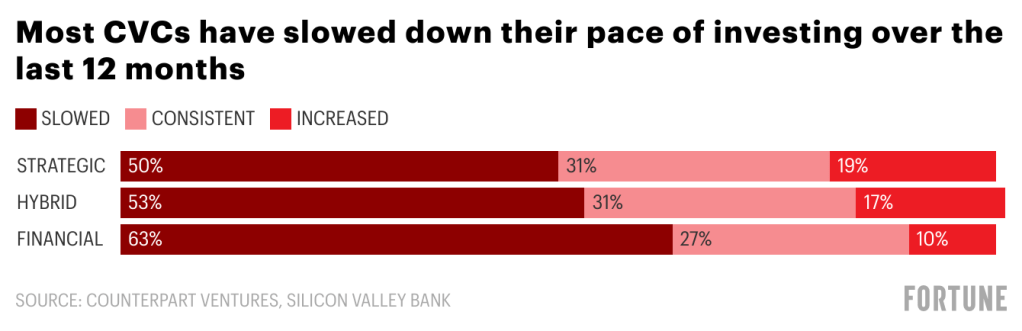

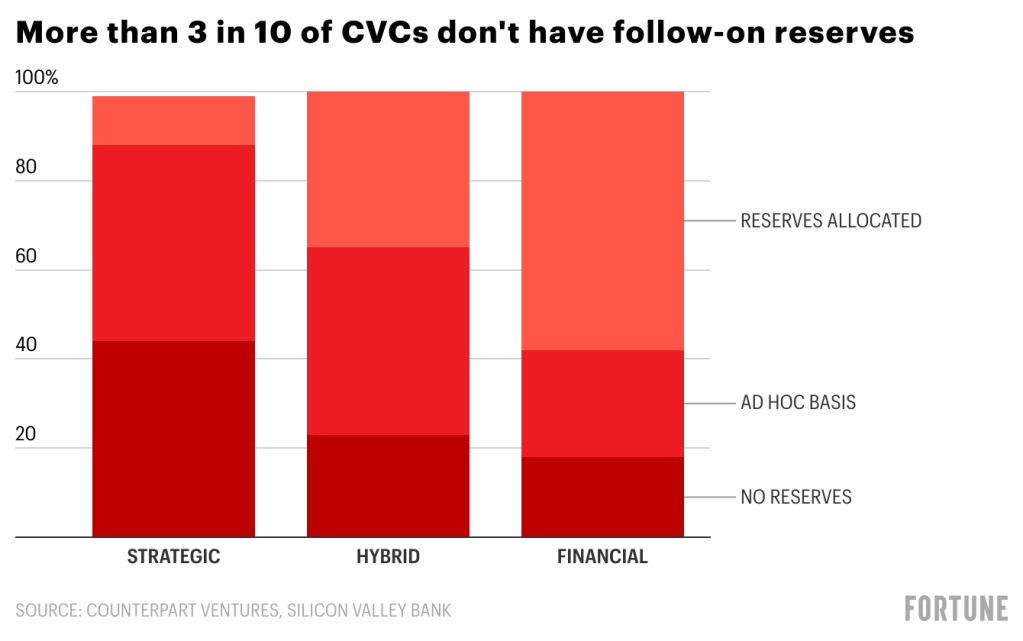

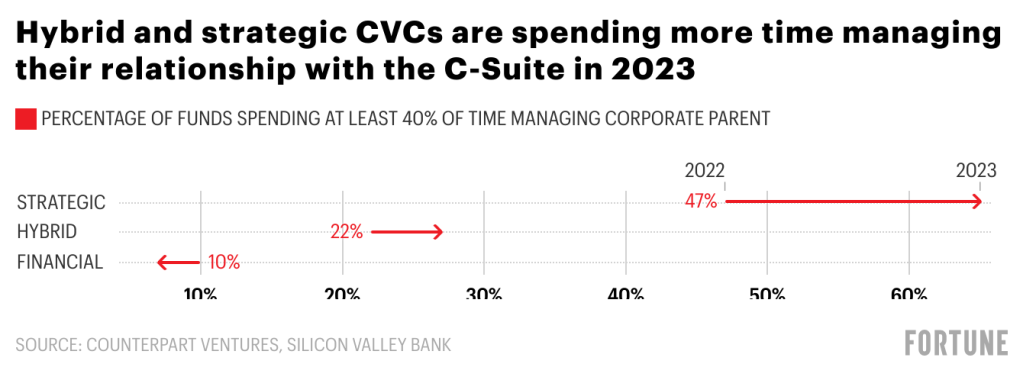

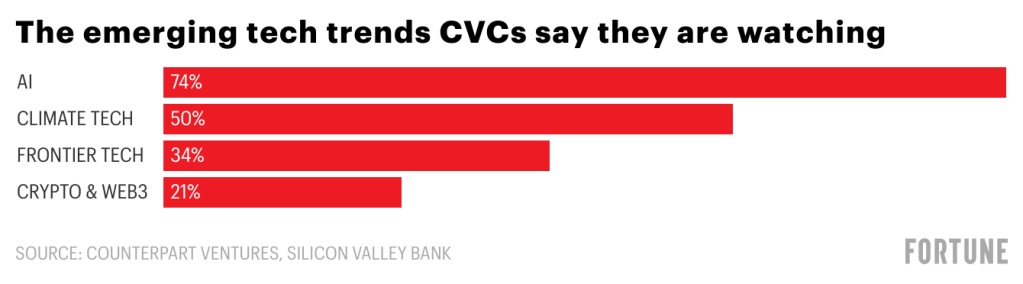

Patrick Eggen, who used to lead all the U.S. investments at Qualcomm Ventures before cofounding early-stage VC firm Counterpart Ventures, described this year’s CVC activity as “sobering.” Private companies are resetting their valuations and corporate shareholders are upping their scrutiny—and we are seeing the lowest CVC participation in VC deals since 2015, Eggen said. CVCs seem to have adopted the sentiment of institutional VCs: They are pulling back how many deals they are doing, upping the scrutiny for new investments, and assigning challenging next steps for their existing portfolio companies.

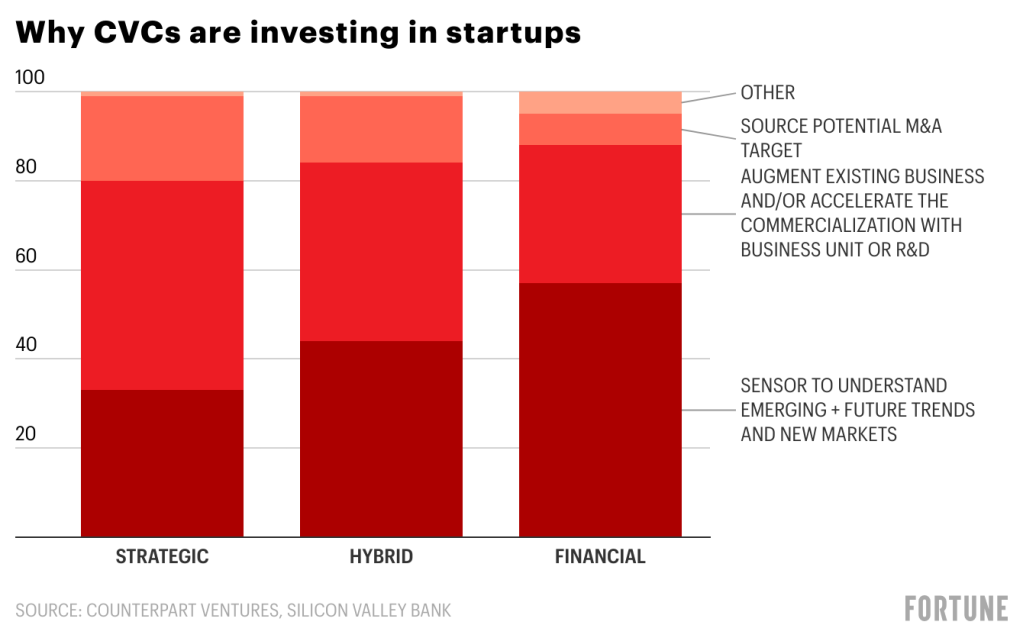

What’s more, Eggen tells me that CVCs will “pick a side going forward.” This means their path forward could entail a “more strategic” or financial mandate, he said. That may include dialing things back and going dormant for a while. Alternatively, some corporate venture teams (particularly those whose executive suites have more risk tolerance) may lean into this market cycle, Eggen said, getting “increased autonomy around decision making,” the ability to lead and price a majority of their deals, and go the route of traditional carried interest.

Here’s some of the data below. You can download the full report here.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.