/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

Core Scientific (CORZ) is a leading provider of digital infrastructure specializing in high-density colocation and digital asset mining services. The company operates purpose-built facilities across seven states, supporting self-mining and hosting for major cryptocurrencies, primarily Bitcoin (BTCUSD). After emerging from Chapter 11 bankruptcy in early 2024, Core Scientific expanded its focus from Bitcoin mining to artificial intelligence (AI) and next-generation compute workloads.

Located in Austin, Texas, the company was founded in 2017.

About CORZ Stock

Core Scientific has shown strong momentum lately, with a 3% gain in five days and a 15% rise over the past month. In six months, the stock has rallied about 133%, and its year-to-date (YTD) return is 38%, far outpacing the Russell 2000 Index, which is up only 13% in the same period. Over the last 52 weeks, Core Scientific shares have soared approximately 41%, while the Russell 2000 advanced just 13.5%.

This outperformance reflects investor optimism in the company’s strategic transition toward high-density colocation services and robust digital asset mining growth, though earnings remain under pressure.

Core Scientific Results

Core Scientific reported Q3 2025 results on Oct. 24, posting revenue of $81.1 million, which fell short of analyst expectations of $107.2 million and declined 15% year-over-year (YoY). The company posted a net loss of $146.7 million, a significant improvement compared to a $455.3 million loss in the prior-year quarter. Earnings per share came in at ($0.46), beating the consensus estimate of ($0.85), although this is wider than the ($0.13) per share a year ago.

The quarter saw a clear strategic shift as digital asset self-mining revenue decreased to $57.4 million due to a 55% reduction in Bitcoin mined but was offset by an 88% rise in average Bitcoin price. High-density colocation (HDC/HPC) revenue grew to $15 million, reflecting an increased focus on AI infrastructure. Hosting revenue continued to decline in line with this strategic transition.

Gross profit rebounded to $3.9 million from last year’s $0.2 million loss, while adjusted EBITDA turned negative at ($2.4) million. Core Scientific closed the quarter with $694.8 million in total liquidity, made up of $453.4 million in cash and $241.4 million in Bitcoin holdings.

Looking ahead, the company reiterated guidance to deliver 250 MW of billable colocation capacity by year-end as it transitions facilities for AI/HPC workloads. The pending $9 billion merger with CoreWeave (CRWV) and an upcoming shareholder vote on Oct. 30 could bring further strategic changes, but management remains focused on expanding colocation margins and expects long-term growth as enterprise demand for AI infrastructure accelerates.

Core Scientific Upgraded by Analyst

Roth Capital Partners upgraded Core Scientific to “Buy” from “Neutral” while raising its target to $23.50, reflecting an upside potential of 21% from market rate, reflecting a reduced likelihood that its $9 billion merger with AI infrastructure firm CoreWeave will be completed.

The upgrade follows significant opposition from large CORZ shareholders and proxy advisors, who argue that the current deal undervalues Core Scientific and exposes investors to risk from CoreWeave’s declining stock performance. CoreWeave’s management has called its offer "best and final," while the fixed-ratio spread between both companies’ shares has inverted, signaling doubts about the transaction.

The shareholder vote for the deal is scheduled for Oct. 30, but contrary to previous expectations, Roth now views Core Scientific as well-positioned to capitalize on opportunities as an independent data center and Bitcoin mining operator. Under this scenario, the company would focus on leasing its power pipeline for high-performance computing, maintaining its strategic flexibility and upside potential.

Should You Look Into CORZ?

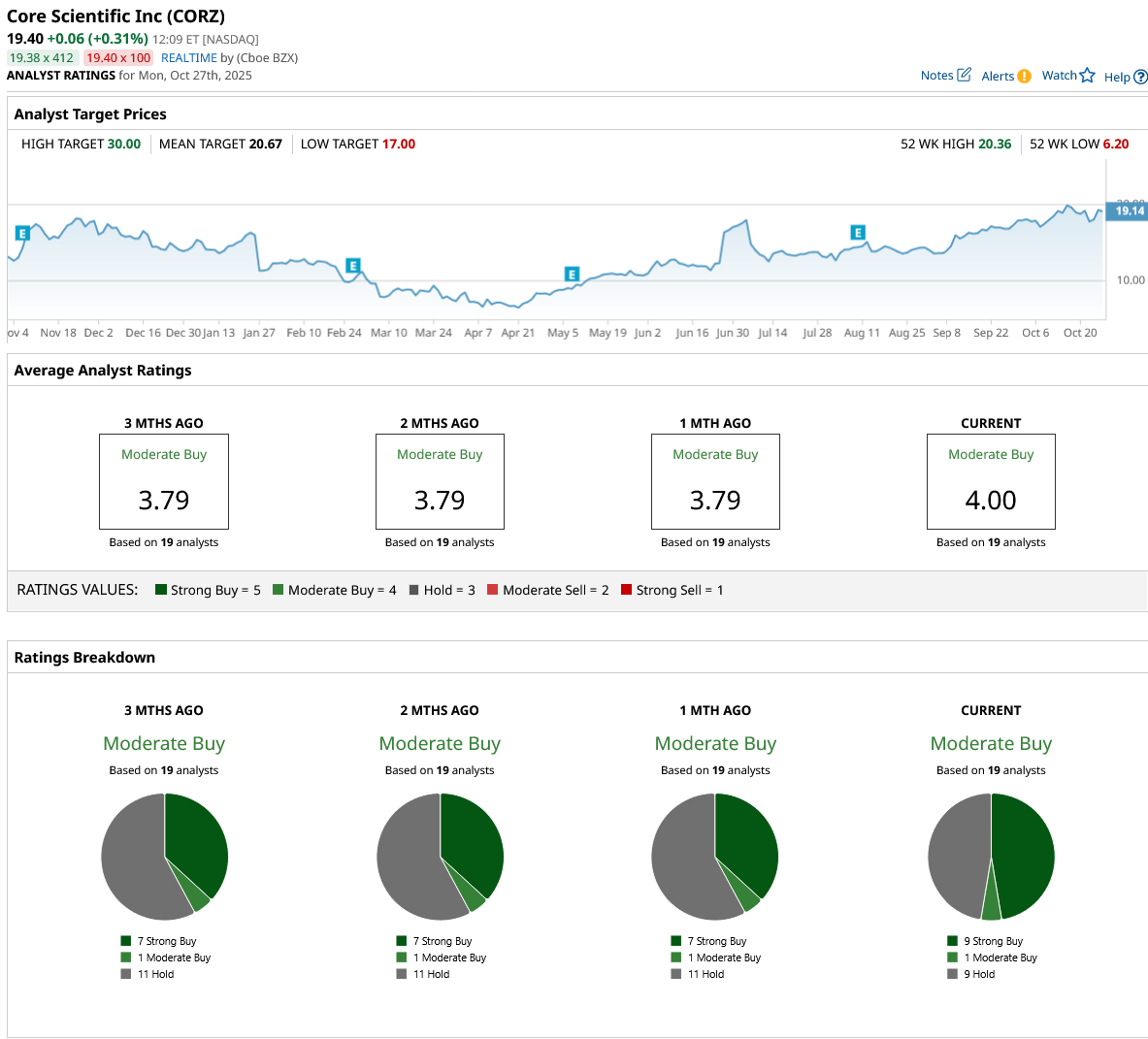

Amid the merger uncertainty, analysts have given a consensus “Moderate Buy” to CORZ stock with a mean price target of $20.67, indicating an upside of 6.5% from the market rate. The stock has been reviewed by 19 analysts so far and has received nine “Strong Buy” ratings, one “Moderate Buy” rating, and nine “Hold” ratings.