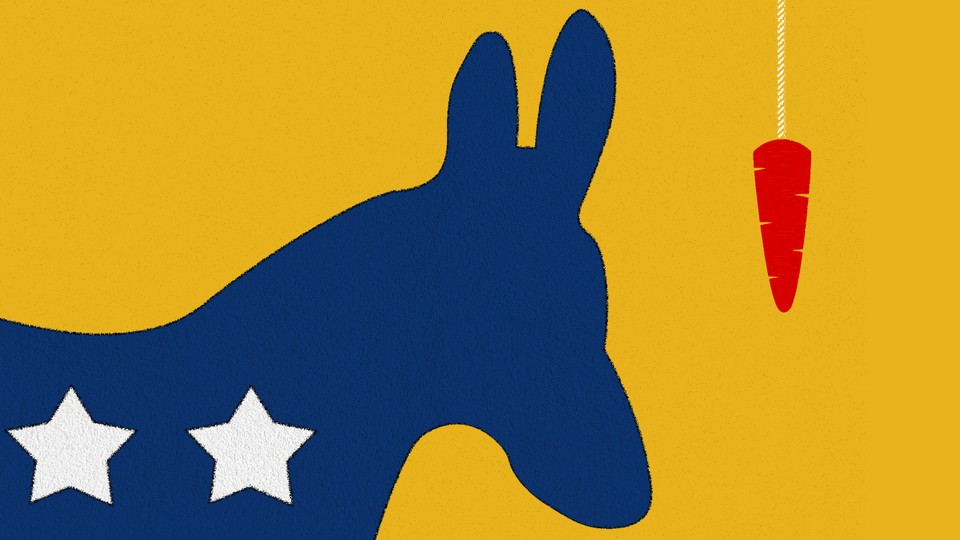

All carrots, no sticks. That is the story of the Inflation Reduction Act. Since the law was unveiled last month, savvy commentators have noted that its policies consist almost entirely of “carrots,” incentives meant to encourage companies to decarbonize, with very few “sticks,” policies meant to punish them for using fossil fuels or emitting carbon. (Just so we’re clear: This analogy is meant to invoke a stubborn donkey that, Looney Tunes–style, is craning to reach a carrot hanging in front of its face while its driver whacks its behind with a stick.)

Indeed, although the IRA includes dozens of new benefits, it creates only one new penalty for pollution: the methane-emissions fee, which will charge oil and gas companies at least $900 for every ton of methane that they leak into the atmosphere.

However you feel about the IRA, it probably has something to do with this fact. While some climate activists have fretted that the law does not punish fossil-fuel companies enough, centrists have argued that its complicated industrial policy would have been better as a simple carbon tax. But just about everyone has recognized that this all-carrots, no-sticks aspect is why the law passed in the first place. It’s a big part of why Senator Joe Manchin, who has criticized and even directed a lawsuit against the Environmental Protection Agency during his political career, could champion the IRA.

But this pat formulation overlooks something important. While it’s true that the IRA itself consists almost only of carrots, that is not true of the broader structure of American climate law. There is, in fact, a big “stick” for tackling carbon pollution already on the books in the United States, as well as an agency tasked with wielding that stick. I’m talking about the Clean Air Act and the EPA. And the IRA, by design, strengthens the government’s ability to wield that stick.

It does this in at least two ways. The first is that the IRA confirms that carbon dioxide is a type of air pollution covered by the Clean Air Act, as initially reported by The New York Times earlier this week.

This has broader consequences than it might seem. In 2007, the Supreme Court ruled in Massachusetts v. EPA that carbon dioxide counted as an air pollutant, and that, if the EPA decided that CO2 harmed human health and the environment, it could regulate CO2 under the Clean Air Act. That ruling—and the EPA’s official determination, a few years later, that CO2 is dangerous—has anchored the agency’s climate regulations on cars and trucks, and its proposed rules for the power grid.

But then in June, the Court circumscribed some of the EPA’s authority over the power grid. Conservative justices have harped on the fact that Congress has never clearly delegated the power to regulate greenhouse gases to the EPA.

Now it has. The IRA repeatedly defines greenhouse gas as a form of air pollution. It amends several sections of the Clean Air Act to define “greenhouse gas” as encompassing “the air pollutants carbon dioxide, hydrofluorocarbons, methane, nitrous oxide, perfluorocarbons, and sulfur hexafluoride.” In another section, it grants money under the Clean Air Act for any project that “reduces or avoids greenhouse gas emissions and other forms of air pollution.”

Congress has now clearly spoken: Carbon dioxide is a form of air pollution. And though this will not undo this year’s ruling, it buttresses the EPA’s underlying legal authority to regulate climate pollution.

But that change is not the only—or even the most important—way that the IRA strengthens the EPA’s ability to regulate greenhouse gases. The law will also allow the EPA to pass much stricter rules than it could have previously.

The reason has to do with a quirk of American law. Since the 1980s, every major proposed regulation has had to show that it passes a cost-benefit analysis demonstrating that its benefits to the economy as a whole exceed its costs. In the EPA’s case, that means that the cost of complying with a regulation can’t exceed the benefit to society of cleaner air or water. Over the years, this has turned out not to be much of an impediment to the EPA, because even small amounts of air pollution are massively damaging to public health, so preventing any air pollution has very high benefits.

But the IRA’s many carrot-like policies, such as its clean-electricity subsidies and carbon-capture incentives, would functionally lower these limitations on the EPA even more by skewing the cost-benefit analysis in the agency’s favor.

That will happen in two ways. First, the IRA’s economy-wide tax credits and subsidies will reduce the costs that companies face in complying with broad EPA rules that encourage wind, solar, or electric-vehicle adoption. Second, the IRA contains new grants that will allow the EPA to subsidize the cost of compliance directly by writing checks or issuing loans to oil and gas firms and other regulated companies so that they can meet the terms of the rules. This works in the EPA’s favor because the cost-benefit analysis looks only at the effect of the regulation itself; it does not include any funding from Congress that makes achieving that regulation more feasible. Both of these moves will lower the costs of regulation, allowing the EPA to pass much more expansive rules.

This effect is important, but it was not accounted for in the law’s projected 40 percent reduction of U.S. carbon emissions. That was not a mistake—the modelers design their studies to look at what the new law alone will do, and so they assume zero further EPA action—but it means that the IRA’s emissions-cutting power could very well exceed what the models suggest today.

The whole point of the IRA is that it brings down the cost of clean energy. It makes renewables cheaper, it makes nuclear power cheaper, and, as I wrote last week, it even makes the technologies that we’ll need to fight climate change in the 2030s cheaper. So far, most commentary on the law has focused on the immediate effects of that shift, and on how the law’s new incentives will reduce emissions simply by driving turnover in the energy system. But in the weeks and years to come, the secondary effects could become more important. Now that the IRA has passed, it will be easier for states and cities to pursue aggressive climate policy, and it will be simpler for companies to cut their emissions faster than would otherwise be economical.

That’s why looking at the modeled emissions effects of the IRA—something that, to be clear, I did in this newsletter—is a little silly. The IRA isn’t like an EPA regulation that will modestly bend the curve of U.S. emissions. Instead, it catapults the country into a whole new landscape where the economics of every other climate action are different.

We thought the IRA was doling out carrots. It was actually planting an entirely new garden.