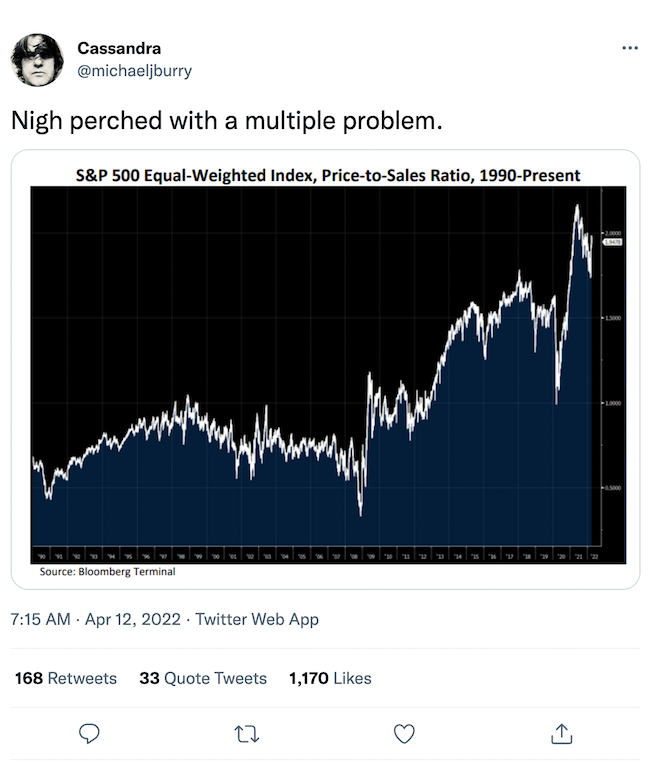

The “Big Short” fame investor Michael Burry put out a tweet Monday night containing a chart that tracks the rising S&P 500 price-to-sales ratio.

What Happened: Burry said in his tweet, “Nigh perched with a multiple problem," before deleting it.

See Also: How To Buy GameStop (GME) Shares

Why It Matters: A low price-to-sales ratio implies the underlying asset is undervalued, while a higher than average ratio indicates that the asset is overvalued.

While on Dec. 31, 2008, the S&P 500 price-to-sales ratio was 0.87 — by April 1, 2022, it had risen to 3.07.

Burry is a well-known short-seller and has bet against market darlings like Tesla Inc (NASDAQ:TSLA) in the past.

The Scion Capital founder said last year that he put GameStop Corporation (NYSE:GME) on the radar of retail investors.

Price Action: The SPDR S&P 500 (NYSE:SPY) closed 1.7% lower at $440.12 on Monday, according to data from Benzinga Pro.