Enterprise AI startup, BigBear.ai Holdings Inc. (NYSE:BBAI), says that the “One Big, Beautiful Bill” represents a significant opportunity for the company.

BBAI is getting crushed by bearish pressure. See what the numbers say here.

Massive Federal Funding For AI, Border Tech, Defense

During the company’s second-quarter earnings call on Tuesday, CEO Kevin McAleenan described the controversial new legislation as providing “a transformative level of investment” across core areas where the company already operates.

This includes $170 billion in supplemental funding to the Department of Homeland Security and $150 billion to the Department of Defense, with billions more for shipbuilding and other national security priorities.

“This is not incremental funding for innovation. This is a transformative level of investment,” McAleenan said, noting that the $70 billion earmarked for U.S. Customs and Border Protection, the $6.2 billion for border technology and $673 million for biometric exit programs are all areas tied to BigBear.ai's VeriScan biometric solutions.

This funding is “directly in our lane,” McAleenan says, adding that the company had anticipated all of these developments, and is now well-positioned “to capitalize on.”

McAleenan further notes that the bill includes a $16 billion military AI autonomy fund, which he says aligns with BigBear.ai’s ConductorOS platform for unmanned aerial systems, along with $29 billion for domestic shipbuilding, in favor of its Shipyard AI supply chain technology.

Stock Plunges After Hours, Following Q2 Results

Despite the broad range of tailwinds aligning in its favor, investors were unimpressed with BigBear.ai’s second-quarter results on Monday.

The company reported $32.47 million in revenue, down from $39.78 million a year ago, and fell short of consensus estimates of $41.17 million. It also posted a massive loss of $0.71 per share, significantly worse than what analysts were expecting at $0.06 per share.

As a result, the stock was down 0.70% on Monday, closing at $7.09 per share, but has since plunged 28.11% after hours, following the earnings announcement.

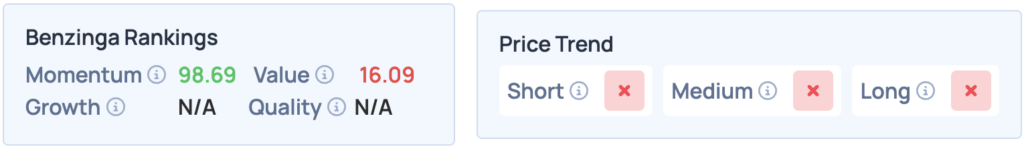

BigBear.ai scores remarkably high on Momentum in Benzinga’s Edge Stock Rankings, but does poorly on most other fronts, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: PJ McDonnell / Shutterstock.com