/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

In a market dominated by artificial intelligence (AI) and multitrillion-dollar cloud giants such as Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL), small-cap players are rarely recognized.

With a market cap of $2.6 billion, DigitalOcean (DOCN), a once-struggling cloud infrastructure provider, has quickly transformed into a formidable force in the cloud and AI space.

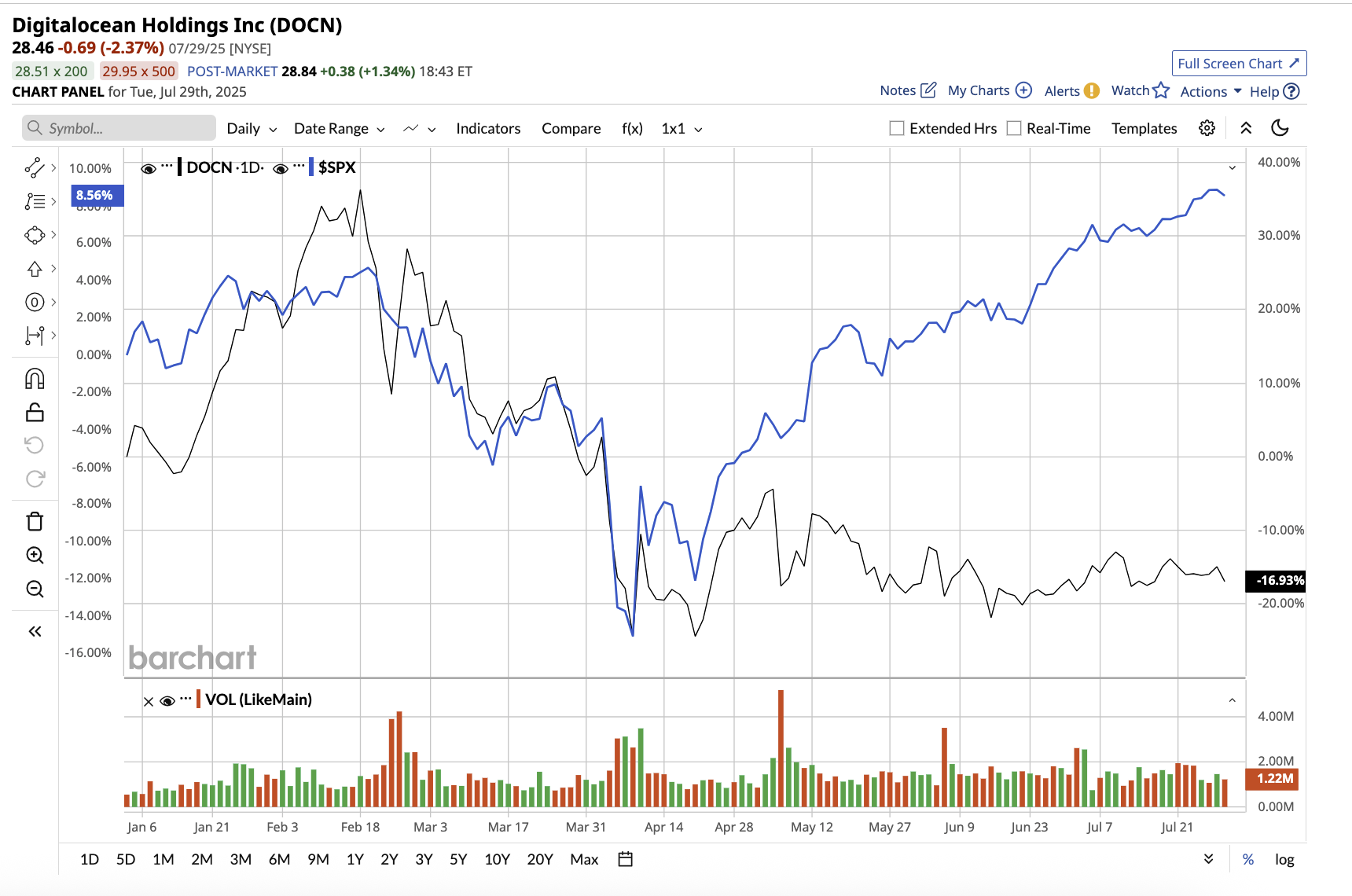

Its strong start to 2025 showed why DigitalOcean is now seen as one of the most appealing small-cap stocks to consider in August. The company is set to release its second-quarter earnings on Aug. 5. DOCN stock is down 16.9% year to date, underperforming the overall market, making it a good time to buy the stock on the dip.

A Strong Start to 2025

DigitalOcean began as a developer-focused cloud company for small teams and has since expanded into multimillion-dollar AI contracts, high-performance data centers, and complex workloads from hyperscalers.

It delivered a solid first quarter in 2025, with revenue up 14% year-over-year to $211 million. The most interesting thing to note is that the company’s AI annual recurring revenue (ARR) increased by more than 160% year over year, and its net dollar retention rate reached 100% for the first time since the second quarter of 2023. This indicates that customers are not only staying, but also increasing their spending. Gross margin stood at 61% in Q1, driven by extending server life from 5 to 6 years and ongoing optimization efforts. Adjusted earnings rose 31% to $0.56 per share.

AI Is Driving the Next Growth Chapter

Interestingly, DigitalOcean is aggressively positioning itself as a low-cost, high-performance alternative to hyperscalers such as AWS, Google Cloud, and Microsoft Azure, primarily for AI-native startups and digital-native enterprises. The company’s focus on scaling its platform for digital-native enterprises has generated results. Revenue from high-value customers spending more than $100,000 per year increased 41%, accounting for 23% of total revenue. Its investments in AI inference infrastructure have also paid off. In the first quarter, the company launched a new Atlanta data center optimized for AI inference, which features cutting-edge GPUs, including NVIDIA HGX H200 and AMD Instinct MI300X units. According to management, these high-performance GPUs are in such high demand that supply is currently falling behind customer requests.

Furthermore, it secured a $20 million-plus multi-year inferencing contract early in the second quarter. The company also introduced more than 50 new products and features, including DigitalOcean Partner Network Connect and DigitalOcean Kubernetes Service, among others. Importantly, it did so without increasing R&D spending, showing operational efficiency and effective use of AI tools.

The company ended the quarter with cash and cash equivalents totaling $360 million. To manage future financial flexibility, DigitalOcean entered into a secured five-year $800 million credit facility in Q1. While adjusted free cash flow was negative in the quarter, management maintained its full-year free cash flow margin guidance of 16% to 18%. The company repurchased $59 million in shares in the first quarter.

Management expects product innovations, such as the GenAI platform and Cloudways Copilot, to continue gaining traction in the year. For the second quarter, revenue is expected to increase by 12% to 13% to range between $215.5 million and $217.5 million, while adjusted earnings could land between $0.42 and $0.47 per share. For the full year, revenue is expected to grow by 13% at the midpoint, to $870 million to $890 million, with adjusted earnings ranging from $1.85 to $1.95 per share.

In comparison, analysts expect a 13% increase in revenue, followed by a 1.4% increase in earnings to $1.95 per share. Analysts expect revenue and earnings to climb by 14.1% and 5.2%, respectively, in 2026. DOCN, trading at 13 times forward 2026 estimated earnings, is a reasonable AI-cloud stock to buy right now.

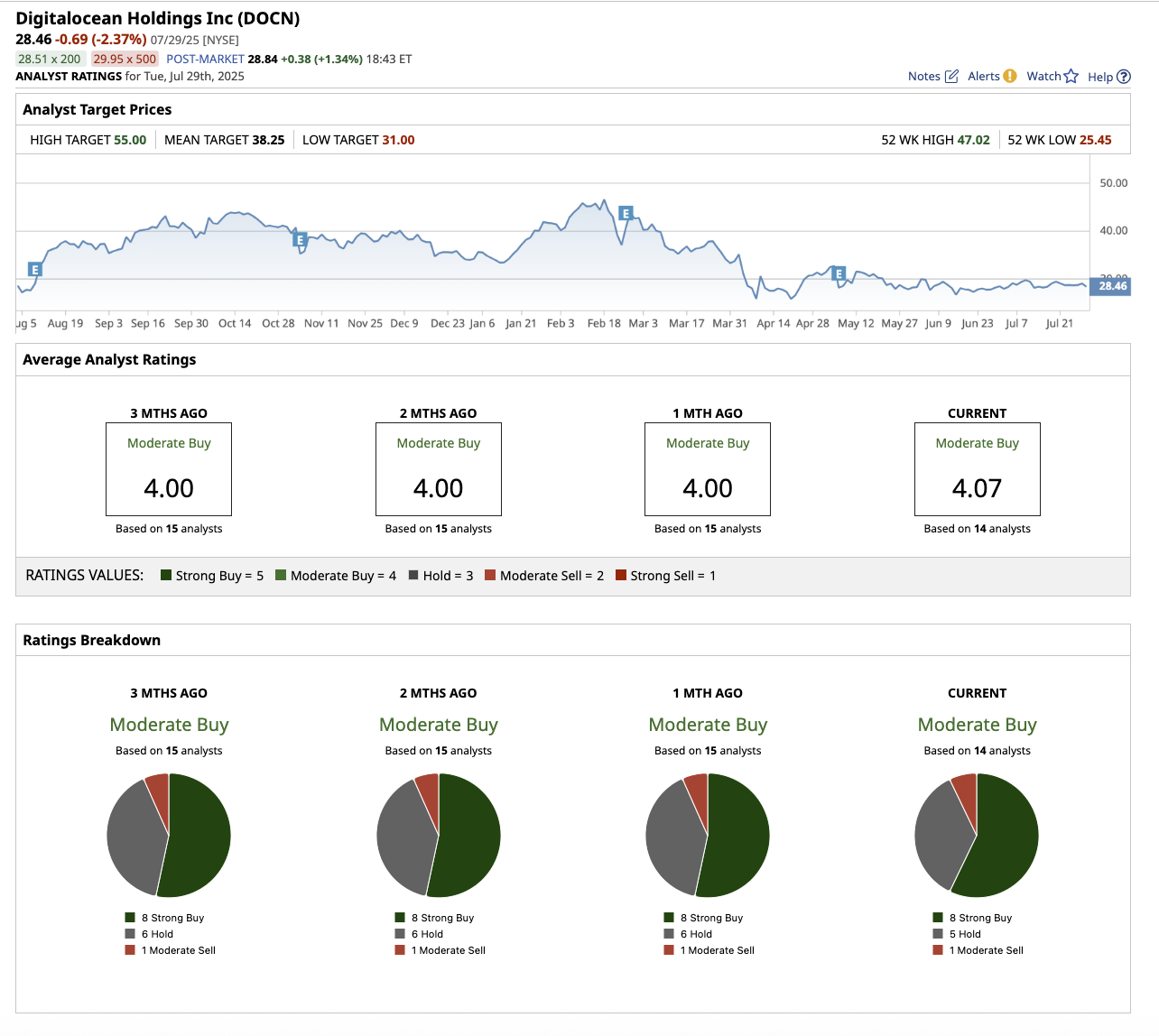

Is DOCN Stock a Buy, Hold, or Sell on Wall Street?

Overall, on Wall Street, DOCN stock is a “Moderate Buy.” Out of the 14 analysts covering DOCN, eight have a “Strong Buy” recommendation, five suggest a “Hold,” and one recommends a “Moderate Sell.” Analysts’ average price target of $38.25 suggests an upside potential of 35% from current levels. Its high price estimate of $55 implies potential 96% upside over the next 12 months.

The Bottom Line on DOCN Stock

In a market filled with AI promises but few profitable models, DigitalOcean’s combination of capital efficiency, increasing ARR, expanding margins, and deepening enterprise traction is catching attention. Furthermore, as a small-cap company with long-term tailwinds, it has plenty of room to grow. Investors looking to capitalize on the next wave of cloud and AI growth may find this small-cap growth stock to be a good buy on the dip now.