Tech stock futures were bullish this morning—contracts for the Nasdaq 100 were up 0.22% prior to the opening bell in New York—after a fistful of tech companies said they would increase their capital expenditures (capex) on AI, promising a vast wave of cash big enough to effect U.S. GDP growth. S&P 500 futures were up 0.19% this morning, too.

The only bad news? Some analysts have begun to warn that the pace of capex growth will start to slow down this year and next.

Shares in Meta and Tesla rose in overnight trading. Meta was up 7.85%, and Tesla rose 3.29%. Microsoft, by contrast, declined 6.53% overnight.

All three stocks were driven by their earnings calls, on which each company promised to keep spending on AI:

- Meta said its capital expenditures could reach $135 billion this year, nearly double what it spent last year.

- Microsoft said it had spent $72.4 billion in the first half of its fiscal year, and capex in its most recent quarter was greater than in the one previous, but growth at its Azure cloud unit was slowing—hence the hit to the stock.

- Tesla said it would double capex in 2026 as it shifts away from EV production toward AI and robots. The company also said it would plow $2 billion into Elon Musk’s xAI company, which makes the Grok chatbot.

- In South Korea, Samsung also said it would grow AI capex. “AI-related demand [at Samsung] is likely to continue expanding, and memory capex should rise substantially,” according to Jefferies analysts Masahiro Nakanomyo and Hisako Furusumi’s summary of the call. “Capital outlays in 2026 will focus on … future business expansion.” Memory-chip maker SK Hynix will do the same, they said.

- And OpenAI will take $40 billion in new investment from Nvidia, Microsoft, and Amazon as part of a $100 billion fundraising round, according to the Financial Times. Much of that cash will be spent on AI data centers.

Clearly, tech stock valuations—and those of companies that supply them with real estate, parts, and power for their data centers—are going to be driven by AI capex this year.

So how big will this incoming wave of cash be?

Here’s a selection of estimates from various Wall Street analysts:

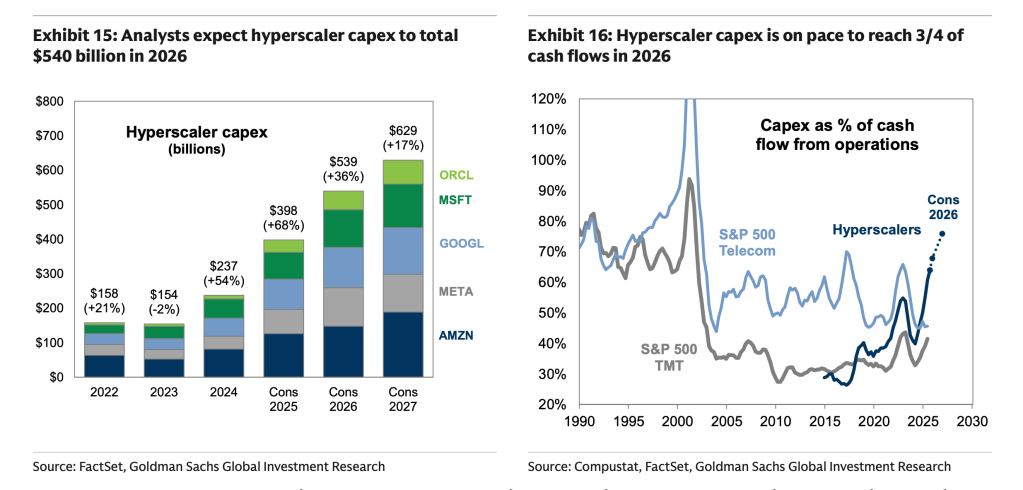

Goldman Sachs predicts AI capex will hit $539 billion, up 36% from $398 billion in 2025. It will grow to $629 billion in 2027, the bank said, but that rate of growth would only be 17%.

Analyst Ben Snider and his colleagues warn that the slowing growth rate of AI capex will force investors to choose winners and losers.

“While odds are good that some of today’s largest companies achieve … success, the magnitudes of current spending and market caps alongside increasing competition within the group suggest a diminishing probability that all of today’s market leaders generate enough long-term profits to sufficiently reward today’s investors,” they advised clients earlier this month.

Bank of America estimates there will be $641 billion in AI/cloud capex this year, up 36%, followed by $739 billion next year, up 15%. “Importantly, we flag [chipmaker] TSMC’s CY[calendar year]26 capex guide of ~$54bn (+32% YoY) [as] a good leading indicator of overall appetite for industry spending, given they speak with all hyperscalers closely and put down the first [amount] of risk capital in the industry,” analyst Vivek Arya wrote in a note seen by Fortune.

Wells Fargo’s Ohsung Kwon and colleagues see 34% growth in AI capex: “Consensus points to a big deceleration (+34% in 2026E [estimated] vs. +70% LTM [last 12 months]), but their capex consistently surprised to the upside, beating consensus capex from a year ago by 50 percentage points over the [past 12 months]. TSMC sales also suggest hyperscalers’ capex could grow +49% year over year in 2026. Our analysts expect higher capex for Meta, Microsoft, and Amazon. It’s an AI arms race.”

Piper Sandler believes the spending is so massive it will boost U.S. GDP, in part owing to knock-on effects for the builders and energy suppliers needed to serve all the data centers being constructed. “While data center construction spending has increased ‘just’ $18 billion, we estimate it’s triggered roughly $175 billion of incremental spending—equivalent to ~0.6% of GDP,” Nancy Lazar and her team said.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.22% this morning. The last session closed flat at 6,978.03 after briefly going over 7,000, a new record high.

- The STOXX Europe 600 was up 0.26% in early trading.

- The U.K.’s FTSE 100 was up 0.38% in early trading.

- Japan’s Nikkei 225 was flat.

- China’s CSI 300 was up 0.76%.

- The South Korea KOSPI was up 0.98%.

- India’s Nifty 50 was up 0.3%.

- Bitcoin declined to $87.9K.