Dividend stocks remain a reliable choice for investors seeking consistent income in a volatile market. Companies with robust balance sheets, consistent cash flows, and a history of rewarding shareholders are particularly appealing. Here are five of the best dividend stocks to consider for a steady income this year.

Dividend Stock #1: Verizon Communications

My first pick is Verizon Communications (VZ), a strong candidate for investors looking for income over growth. Verizon is one of the largest telecommunications companies in the U.S., offering wireless services, broadband, fiber, fixed wireless access, and other network & infrastructure services.

Verizon is known for offering a high dividend yield of 6.3% and maintains a healthy payout ratio of 56.7%, which leaves room for growth as well. The company has a 21-year history of paying and increasing dividends fueled by relatively stable cash flows and an established business model. It expects to generate free cash flow (FCF) between $19.5 billion and $20.5 billion in 2025, which should support its dividend payments.

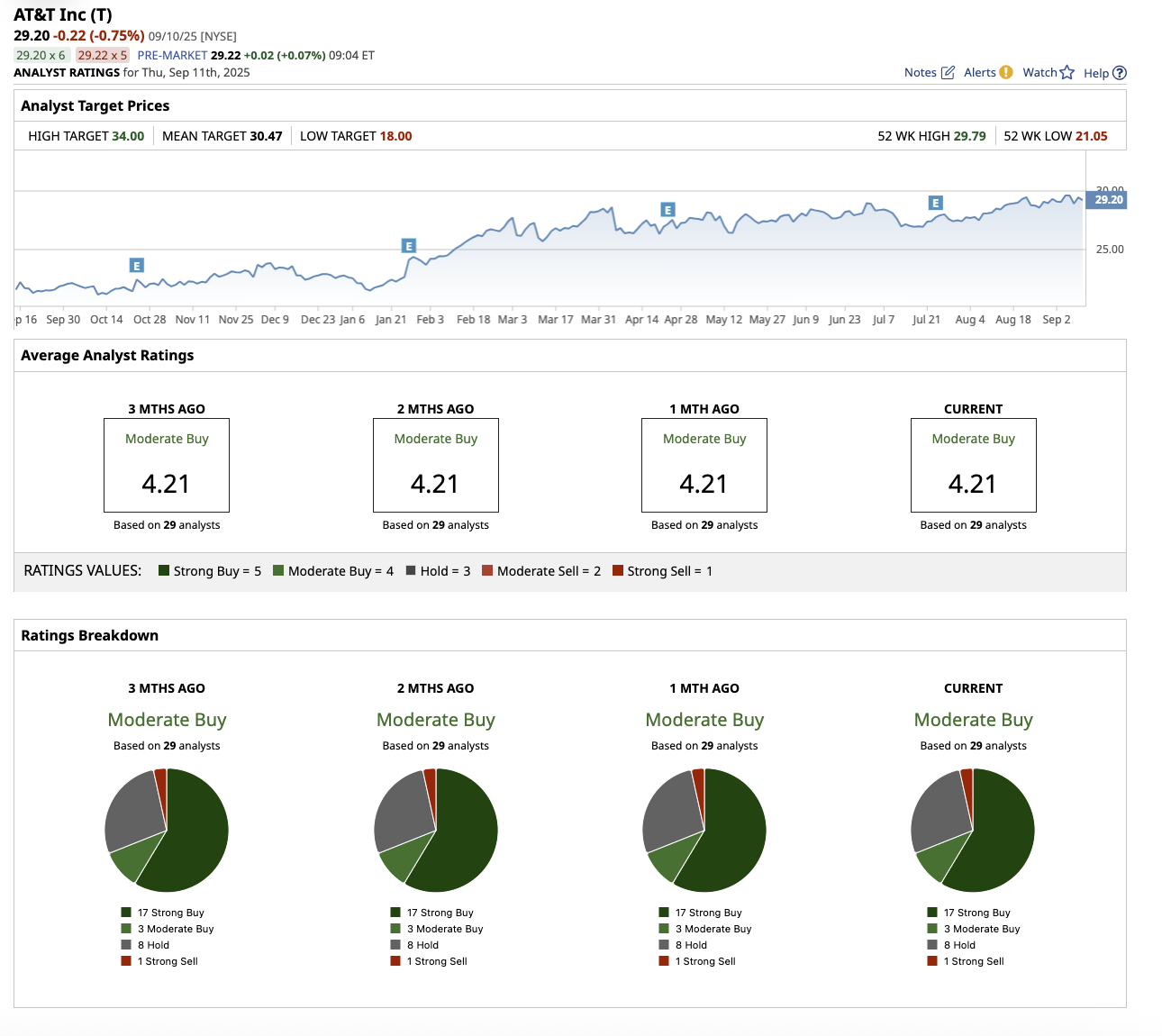

Overall, Wall Street rates VZ stock as a "Moderate Buy." Of the 29 analysts that cover the stock, nine rate it a “Strong Buy,” three recommend a “Moderate Buy,” and 17 suggest a “Hold.” Based on the average target price of $48.43, the stock has an upside potential of 10.9% from current levels. Its Street-high estimate of $58 further implies VZ stock can go as high as 33.4% in the next 12 months.

Dividend Stock #2: NextEra Energy

NextEra Energy (NEE) is a large U.S. utility and clean energy company. It operates a regulated utility business (Florida Power & Light) and a large, fast-growing renewable energy & storage business (NextEra Energy Resources). Its portfolio consists of solar, wind, battery storage, and other renewable energy efforts.

It pays a dividend yield of 3.1%, compared to the utilities sector average of 3.7%. NextEra has a strong track record of increasing its dividend for over 31 consecutive years, earning the title of a Dividend Aristocrat. Its low payout ratio of 56.9% has allowed it to commit to growing its dividends at roughly 10% annually through at least 2026.

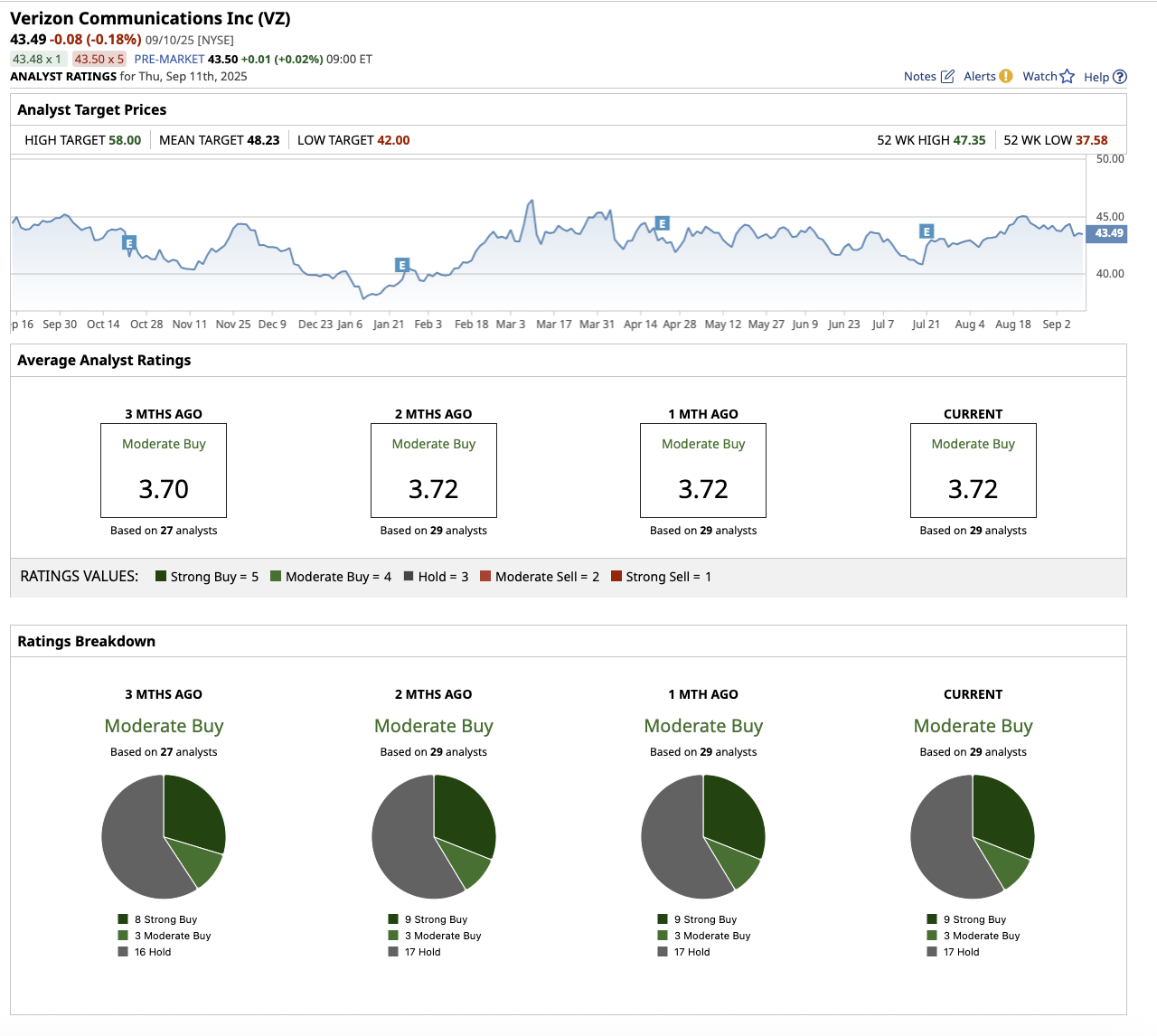

Overall, Wall Street rates NEE stock as a “Moderate Buy.” Of the 21 analysts that cover the stock, 12 rate it a “Strong Buy,” eight suggest a “Hold,” and one suggests a “Strong Sell.” Based on the average target price of $82.17, the stock has an upside potential of 15.6% from current levels. Its Street-high estimate of $97 further implies NEE stock can go as high as 36.5% in the next 12 months.

Dividend Stock #3: AbbVie

AbbVie (ABBV) is one of the largest pharmaceutical companies in the U.S. It develops, manufactures, and sells drugs in immunology, oncology, neuroscience, aesthetics, and other therapeutic areas. Humira was formerly one of its greatest revenue drivers, but after its patent expired, it faced generic and biosimilar competition. With Humira’s decline, AbbVie has leaned on rising sales from drugs like Skyrizi and Rinvoq to sustain revenue growth. The performance of these newer medications is helping to stabilize and increase earnings.

AbbVie offers a dividend yield of 2.9%, compared to the healthcare sector average of 1.58%. Its earnings can sustain its reasonable payout ratio of 46% for now, leaving room for further increases. The company has a 53-year-long history of raising its dividend, making it a Dividend King.

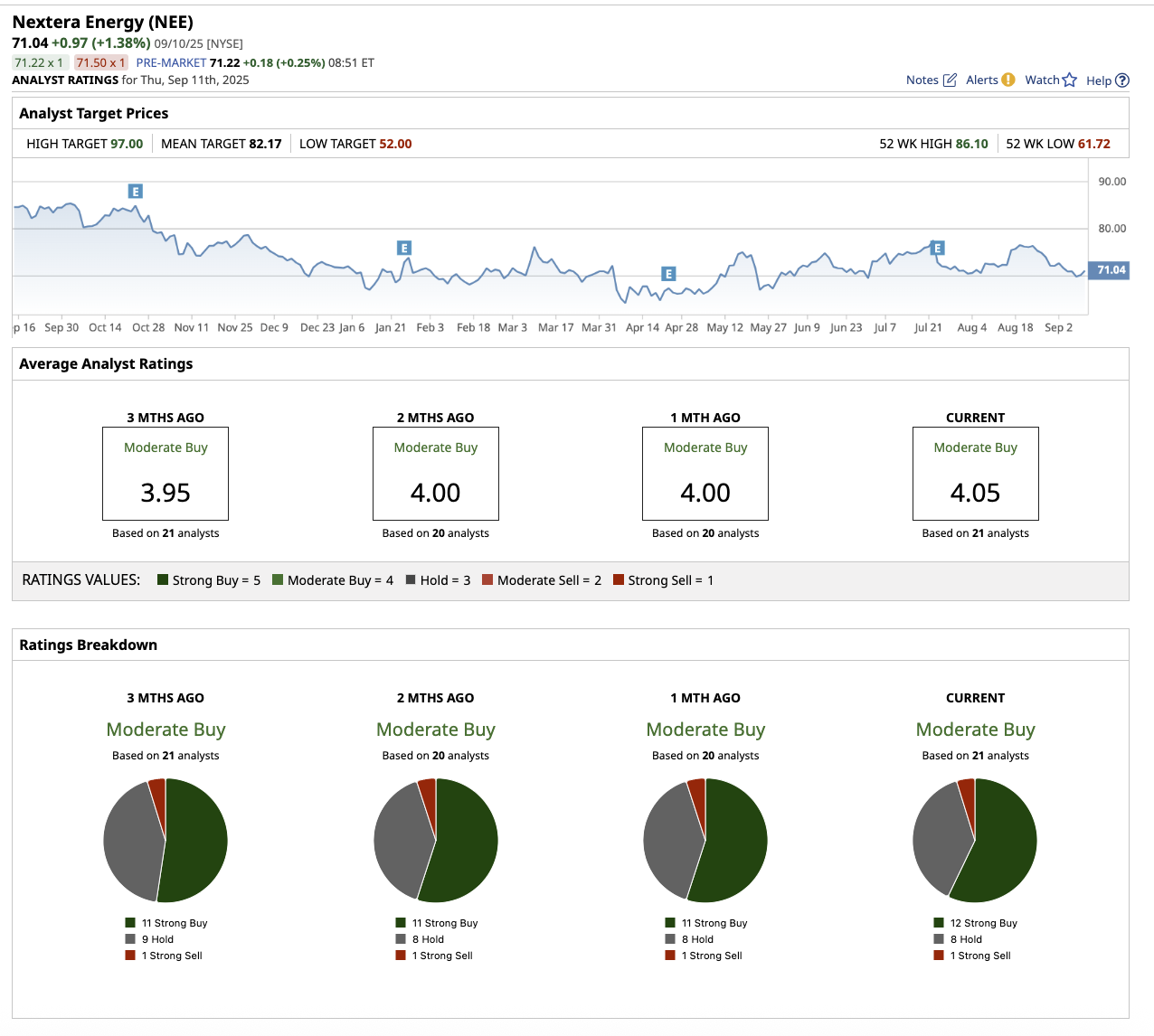

Overall, Wall Street rates ABBV stock as a "Moderate Buy." Of the 29 analysts that cover the stock, 16 rate it a “Strong Buy,” two rate it a “Moderate Buy,” and 11 rate it a “Hold.” Based on the average target price of $216.58, the stock has an upside potential of 2.3% from current levels. Its Street-high estimate of $255 further implies ABBV stock can go as high as 20.5% in the next 12 months.

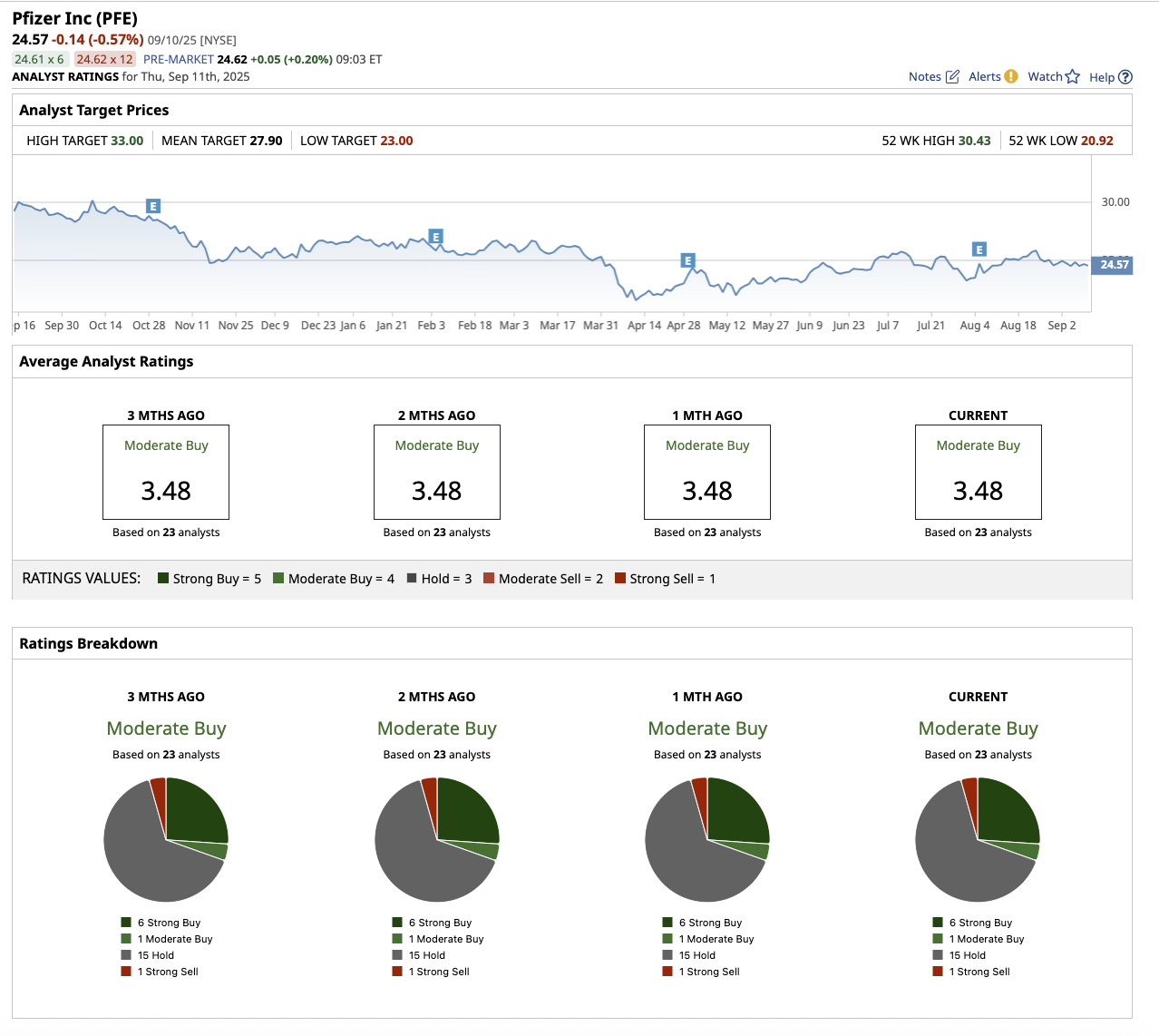

Dividend Stock #4: Pfizer

Pfizer (PFE) develops and sells vaccines and therapeutics across many disease areas (cardiovascular, oncology, rare disease, etc.). While Pfizer is best known for its Covid-19 vaccine, the company is focusing on expanding its non-Covid product range. New product releases, recently acquired products, and non-pandemic revenue are all contributing significantly.

Pfizer offers a comparatively high yield for a large pharma stock—around 6.9%, compared to the healthcare sector average of 1.6%. The company has been increasing its dividend for the past 16 years in a row. Its forward payout ratio of 54.6% also seems sustainable for now.

Overall, Wall Street rates Pfizer stock as a "Moderate Buy." Of the 23 analysts that cover the stock, six rate it a “Strong Buy,” one suggests a “Moderate Buy,” 15 suggest a “Hold,” and one rates it a “Strong Sell.” Based on the average target price of $27.90, the stock has an upside potential of 13.5% from current levels. Its Street-high estimate of $33 further implies PFE stock can go as high as 34.3% in the next 12 months.

Dividend Stock #5: AT&T

AT&T (T) is one of the major players in U.S. telecommunications. Over recent years, the company has restructured by spinning off or selling off its non-core assets (like DirecTV and WarnerMedia) to focus on its core telecom operations—wireless, 5G, fiber broadband, etc. This refocus has been critical to its objective of increasing financial stability and cash flow.

AT&T offers a dividend yield of 3.8%, higher than the communications sector average of 2.6%. It also has a low payout ratio of 49.9%. The company has been generating sizeable FCF. Notably, its FCF in Q2 stood at $4.4 billion, comfortably covering its dividend payouts. Furthermore, the company plans to create FCF of around $16 billion in 2025, over $18 billion in 2026, and more than $19 billion in 2027. This means that it has the potential to maintain and potentially enhance its dividend if things go smoothly.

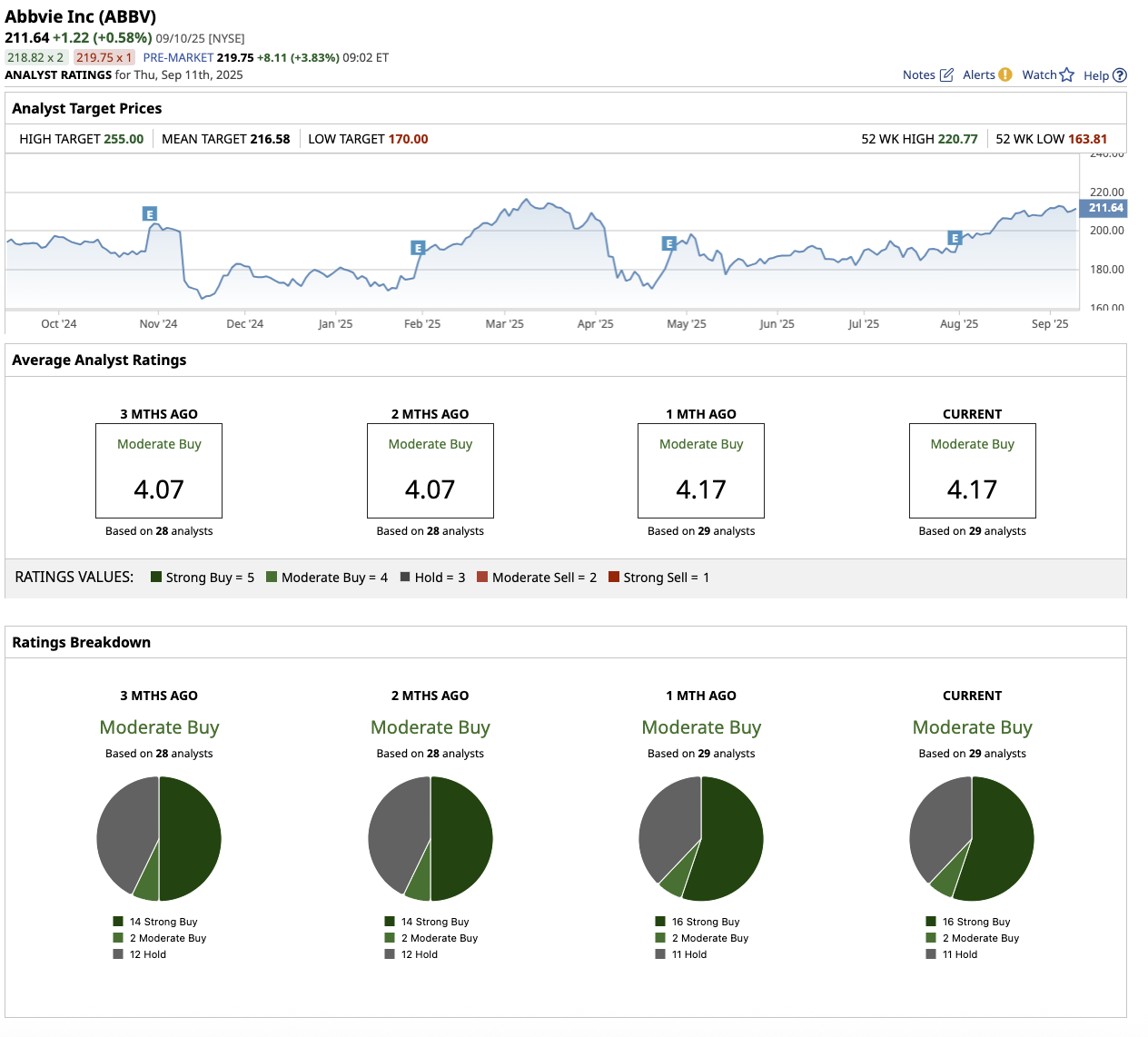

Overall, Wall Street rates AT&T stock as a “Moderate Buy.” Of the 29 analysts that cover the stock, 17 rate it a “Strong Buy,” three say it is a “Moderate Buy,” eight rate it a “Hold,” and one suggests a “Strong Sell.” Based on the average target price of $30.47, the stock has an upside potential of 4.4% from current levels. Its Street-high estimate of $34 further implies the stock can go as high as 16.5% in the next 12 months.