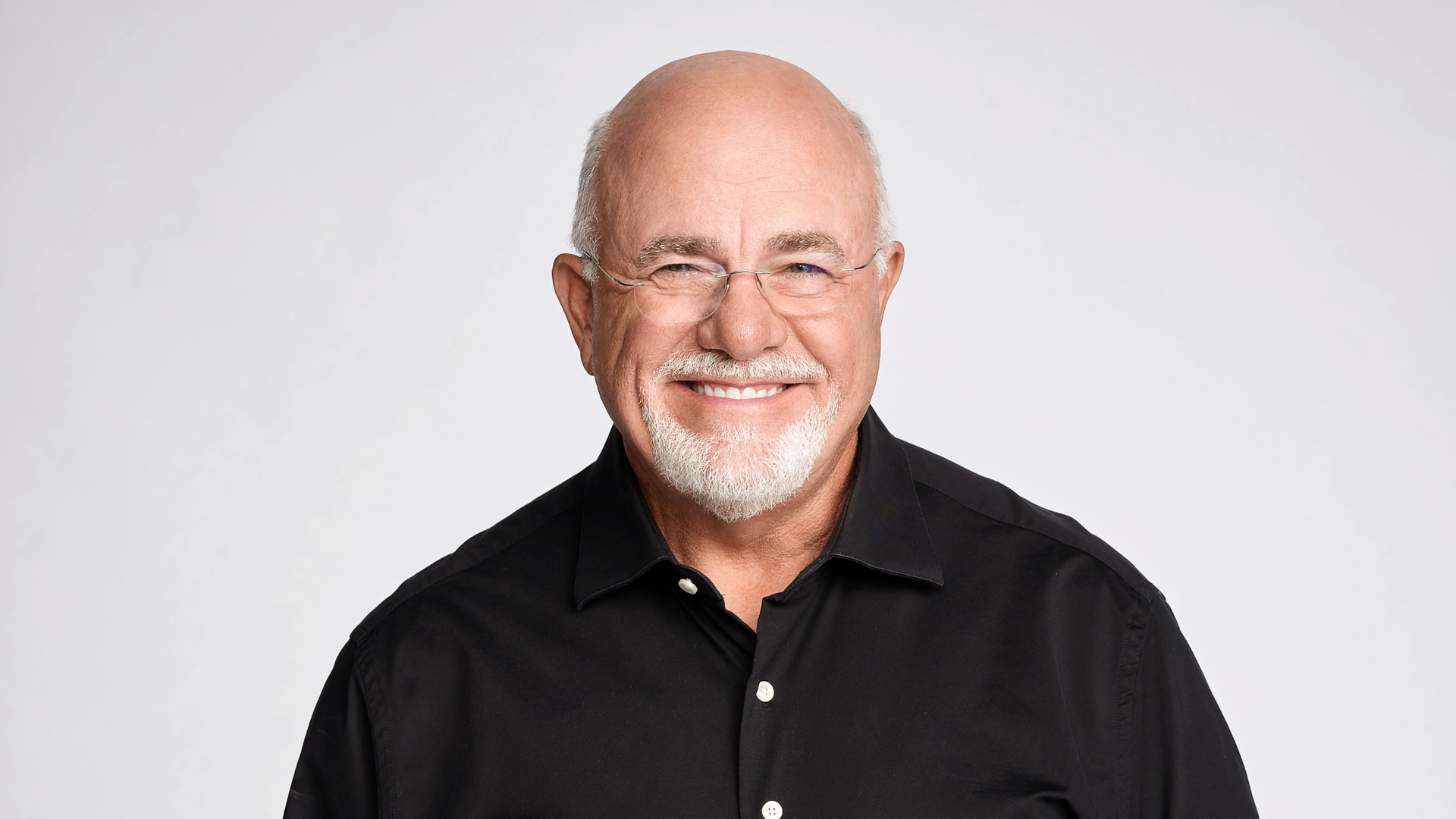

Personal finance expert Dave Ramsey doesn’t just talk about money — he takes his own advice, and he made sure his kids did too.

Find Out: 9 Downsizing Tips for the Middle Class To Save on Monthly Expenses

Read Next: 6 Things You Must Do When Your Savings Reach $50,000

From matching savings to enforcing budgeting rules, here are some of the unique tactics he used to raise financially responsible children.

The ‘401 Dave Plan’ for Buying Their First Car

Instead of buying a car for his kids outright when they were old enough to drive, Ramsey made each of them contribute to the cost of whatever car they wanted.

“We had to pay for half of our car when we turned 16,” Ramsey’s daughter and fellow money expert Rachel Cruze told People. “The quality of the car depended upon us working and saving. And he called it the ‘401 Dave Plan,’ so he would match whatever we saved.”

No Allowances for His Kids

Ramsey wanted his kids to learn the value of a dollar, so instead of giving them an allowance, he made them work for every dollar they got.

“We were never given an allowance — we were always on commission,” Cruze said. “So you work, you get paid, you don’t work, you don’t get paid. That was definitely a lesson early on that was pretty drilled into our minds that if you want money, you have to work for it.”

Hands-On Budgeting With the Envelope System

Ramsey enforced a version of the envelope budgeting system for his kids growing up. With this method, you divide any cash you receive into multiple envelopes, each with a different purpose. This hands-on budgeting method allows you to see exactly where your money is going.

“[My parents] made us put some money into a giving envelope that we could give somewhere, and then you had a savings envelope, and then there was a ‘spend’ envelope that you could spend and enjoy,” Cruze said. “It was broken up in those three categories, which honestly is so smart.”

Teaching Teens To Budget With Student Accounts

When Cruze was in high school, Ramsey opened a student checking account for her.

“[My parents] would put a certain amount of money in the account, and we had to budget that,” she said. “And if we wanted more money, obviously, we had to get a job.”

Instilling Generosity as a Core Money Value

Cruze said the top money lesson she learned from her father was to be generous.

“I see how much it changes who you are,” she said. “I think it changes your outlook in life, how you see people. I think it changes the whole character of who you are when you’re a generous, more selfless person than the opposite. I’m so thankful that that’s a habit that’s part of me.”

More From GOBankingRates

- 5 Items With Greater Value at Dollar Tree Than Costco

- Why You Should Start Investing Now (Even If You Only Have $10)

- How Middle-Class Earners Are Quietly Becoming Millionaires -- and How You Can, Too

- 5 Things You Must Do When Your Savings Reach $50,000

This article originally appeared on GOBankingRates.com: The ‘401 Dave Plan’ and 4 Other Money Lessons Dave Ramsey Taught His Kids