Investing in dividend stocks is a balancing act. If you want more yield, you’ll need to take on more risks. Want more reliable dividends? You’ll have to settle for less.

That’s why, when you get a chance to maximize both while minimizing the downside, you should take a look at what’s on the table.

And that’s exactly what Barchart’s Investing Ideas are offering: the best, highest-yielding dividend stocks in the market right now.

However, with 199 companies on this list, it does need a little pruning. And that’s exactly what I’ll do today.

How I Came Up With This List

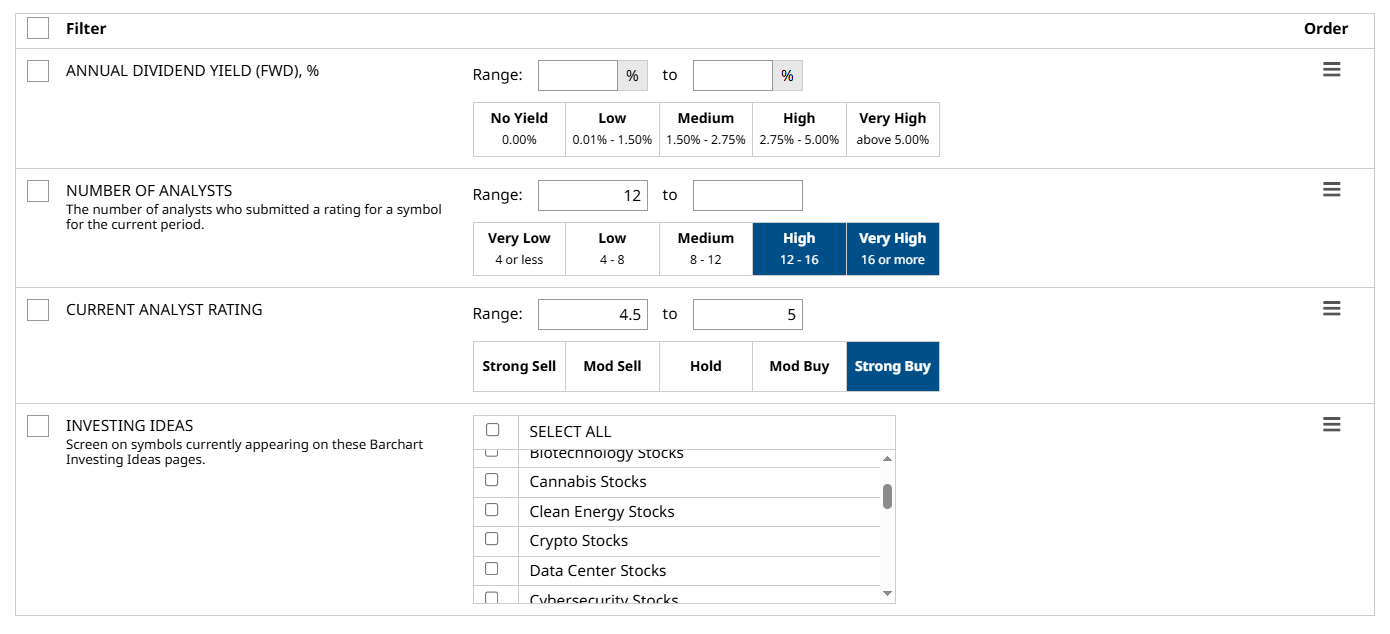

Let’s start with Barchart’s Stock Screener, and the filters I used:

- Annual Dividend Yield (Forward): Left blank so I can arrange the list with it.

- Number of Analysts: 12 or more analysts. This filter limits the results to companies that are well-covered on Wall Street. It makes the next filter more convincing.

- Current Analyst Rating: 4.5 to 5 (Strong Buy). Companies falling under this filter have some of the best scores from Wall Street analysts and are expected to perform well within the next 12 months.

- Investing Ideas: Best Dividend Stocks.

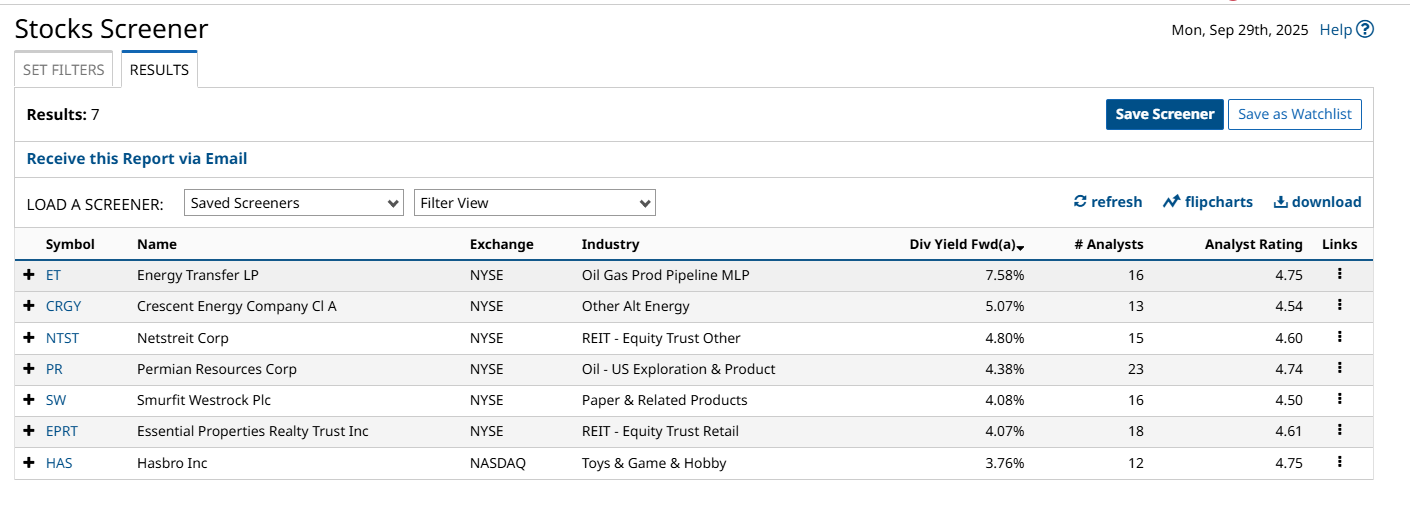

I ran this screen with these specifications and got the following results, arranged from highest to lowest forward yields.

Now, I’ll take the top three out of the seven best dividend stocks right now, so let’s get started on number one:

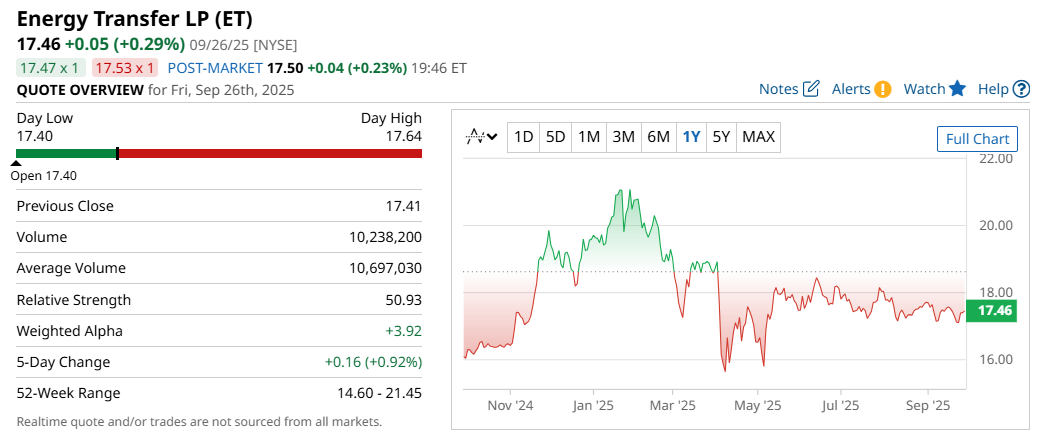

Energy Transfer LP (ET)

Sitting at the top of the list is Energy Transfer LP. According to its website, it’s one of North America’s largest and most diversified midstream energy companies, which is saying something, given the hundreds of midstream companies in the region. Energy Transfer has assets in 44 states in the US, and its operations include transport, storage, and terminaling of crude oil, liquefied natural gas, and more.

Now, let’s talk about the dividends. Energy Transfer has the highest forward yield on this list, at 7.58%, or a 33-cent per-share payout per quarter. The more interesting part of its dividend history is that the company’s been both regularly and reliably increasing its annual payouts since 2021.

Still, Wall Street sees potential in the stock, as a consensus among 16 analysts rates the stock a “Strong Buy.”

Crescent Energy Company (CRGY)

Next up is Crescent Energy Company, which focuses on the acquisition, development, and operation of oil and natural gas properties here in the United States.

The company labels itself as a “differentiated” energy company, which means it has a balanced portfolio that aims to generate stable cash flows through a combination of conventional and unconventional assets, with operations spread across key basins, including the Rockies, Eagle Ford, and Permian.

The company has paid a flat rate of 12 cents per share per quarter since its establishment in late 2021 - at its current trading price, that translates to a decent 5.07% forward yield. What makes this dividend stock more attractive is its 25.94% dividend payout ratio. That means it has more than enough headroom to increase dividends, should it decide to.

Currently, a consensus among 13 analysts rates CRGY stock a “Strong Buy,” with a high target price of $20 - that’s nearly double its current trading price.

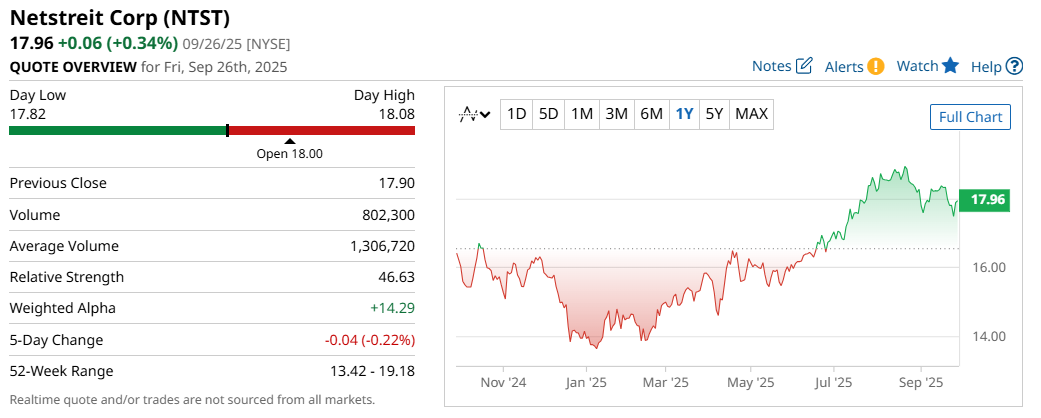

Netstreit Corp (NTST)

Of course, no list of the best, highest-yielding dividend stocks is complete without a REIT. Netstreit is an internally managed real estate investment trust that specializes in acquiring and operating single-tenant net lease retail properties.

This REIT operates properties across 45 states, focusing on renting to long-term tenants with investment-grade credit ratings and durable cash flows. Their tenants include Dollar General, Home Depot, Dollar Tree, CVS, Walmart, Stop & Shop, Kroger, and many more. So, they get cash flow from dependable tenants, which has the potential to drive the company’s long-term stability and dividend growth.

Currently, the company pays 21.50 cents a share quarterly, which translates to 86 cents per share per year, or a 4.80% forward yield. Meanwhile, a consensus among 15 analysts rates NTST stock a “Strong Buy.”

Final Thoughts

Investing in high-yield stocks certainly has a place in an income portfolio. However, these companies typically involve higher risk, so be sure to limit your exposure to whatever you’re comfortable with. And, as always, be sure to keep an eye out for new developments within the companies you invest in, as they may affect the future outcome.