Dividend stocks that can reliably deliver income and growth over the next decade aren’t easy to find. Still, a few stand out for their stability, strong cash flows, and commitment to shareholder returns. For investors seeking dependable dividends in a world of uncertainty, Enterprise Products Partners (EPD) and Enbridge (ENB) are the best stocks to own for the next 10 years.

Dividend Stock #1: Enterprise Products Partners (EPD)

Dividend Yield: 6.8%

Enterprise Products Partners continues to prove why it stands among the very best dividend stocks for long-term investors. Despite battling macroeconomic uncertainties, trade tensions, and unpredictable global energy markets, the company generated another solid performance in the second quarter, showcasing its resilience and shareholder-focused strategy. EPD has a forward dividend yield of 6.8%, compared to the average of about 4.2% for the energy sector.

Enterprise is a leading midstream energy company in North America. It owns and operates thousands of miles of pipelines that transport natural gas, natural gas liquids (NGLs) (NGU25), crude oil (CLU25), refined products, and petrochemicals across the U.S.

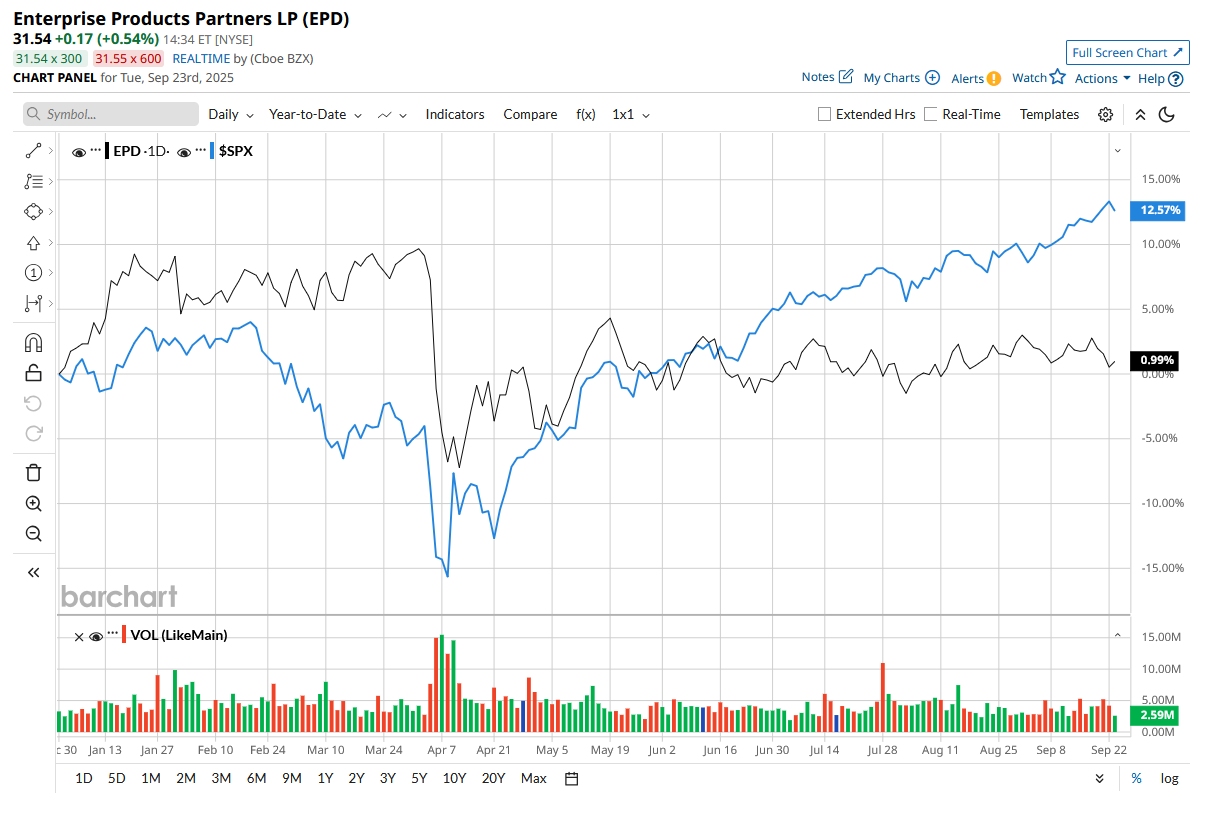

EPD shares have dipped 0.5% year-to-date (YTD), compared to the broader market gain.

Enterprise reported adjusted earnings before interest, income taxes, depreciation, and amortization (EBITDA) of $2.4 billion for the quarter, with distributable cash flow (DCF) of $1.9 billion, a 7% increase year-over-year (YoY). That DCF covered the distribution 1.6 times over, allowing the company to keep $748 million in extra cash during the quarter and $3.4 billion over the past year. This financial flexibility bolstered its balance sheet while also ensuring the long-term viability of its growing distributions.

Importantly, in the second quarter, Enterprise declared a payout of $0.545 per unit, up 3.8% YoY. This is another step in its 28-year history of dividend growth, making it a Dividend Aristocrat. Over the past twelve months, EPD has returned $4.9 billion to unitholders through distributions and unit repurchases, translating to a payout ratio of just 57% of adjusted cash flow from operations. This leaves ample room for further growth and reinvestment. Notably, Enterprise has continually increased distribution despite a high payout ratio.

During the Q2 earnings call, management stated that roughly $6 billion in organic growth initiatives are expected to come online over the next 18 months. Three new gas processing plants in the Permian Basin will increase total processing capacity to nearly 5 Bcf (billion cubic feet) per day, resulting in 650,000 barrels of liquids produced per day. This means that earnings power is set to increase further.

In addition to payouts, Enterprise has actively returned capital through buybacks. Over the last year, it has repurchased 10 million units for $309 million, increasing the total buyback spend under its $2 billion program to $1.3 billion.

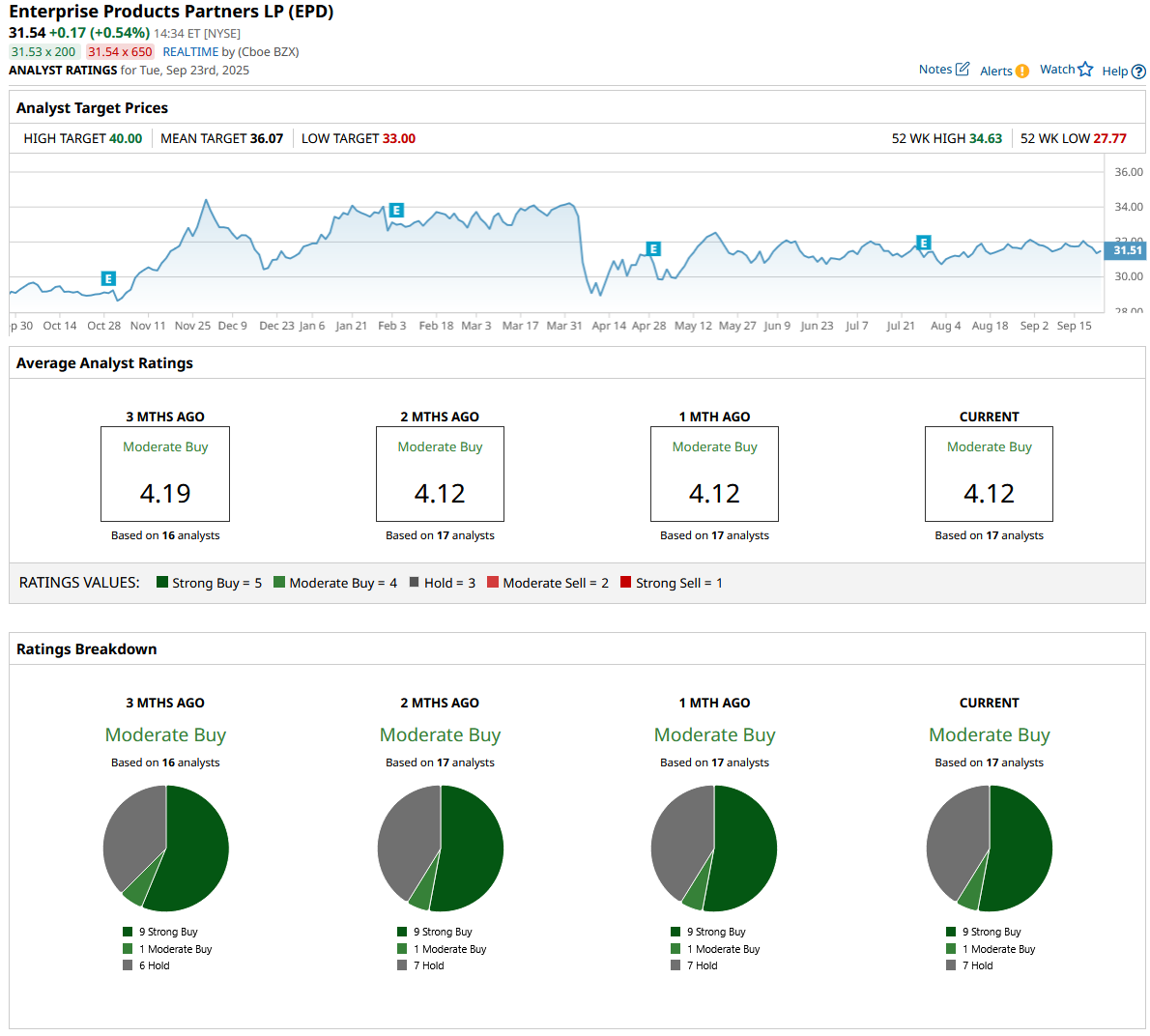

Overall, Wall Street rates EPD stock a “Moderate Buy.” Out of the 17 analysts who cover EPD, nine recommend a “Strong Buy,” one rates it a “Moderate Buy,” and seven recommend a “Hold.” The average analyst price target of $36.07 represents a potential 15% increase from current levels. Its high target price of $40 suggests the stock could climb by another 27.5% over the next 12 months.

Dividend Stock #2: Enbridge (ENB)

Dividend Yield: 5.6%

When it comes to consistent dividends and long-term growth, Enbridge continues to stand out. With a track record of 30 consecutive annual dividend increases, a stable business model, and a $32 billion secured capital program that will last well into the decade, the company makes a good case for being the best dividend stock to own over the next decade.

Valued at $148.3 billion, Enbridge operates critical energy infrastructure across North America, and its diversified portfolio spans pipelines, storage, utilities, and renewables. ENB stock has gained 17% YTD, compared to the overall market.

Enbridge’s second-quarter earnings showed the resilience of its business model. Adjusted EBITDA rose 7% YoY. Higher financing costs and taxes weighed on DCF, which stayed flat YoY, while earnings per share increased 12% despite trade concerns and geopolitical developments.

On the U.S. Gulf Coast, Enbridge is investing in optimization projects that support surging power demand from data centers. Its Gas Distribution business continues to show consistent growth, which is critical to continuing dividend payouts. Furthermore, its renewable energy projects in Texas demonstrate its capacity to invest capital in renewables using the same low-risk, long-term contract strategy that has defined its pipeline and utility operations.

Enbridge's attraction stems from its dividend. With a payout ratio in the 60% to 70% range of DCF, the dividend is entirely backed by high-quality, low-risk cash flows. Over the next five years, management plans to return $40 billion to $45 billion to shareholders while also supporting a secure backlog of growth initiatives. It also has an appealing forward dividend yield of 5.6%, which is higher than the energy sector average.

This year marked Enbridge's 30th consecutive annual dividend increase, solidifying its position as a Dividend Aristocrat. With predictable cash flows, a robust balance sheet, and noticeable growth until the end of the decade, Enbridge is one of the very few companies that can provide both stability and regular revenue growth regardless of market cycles.

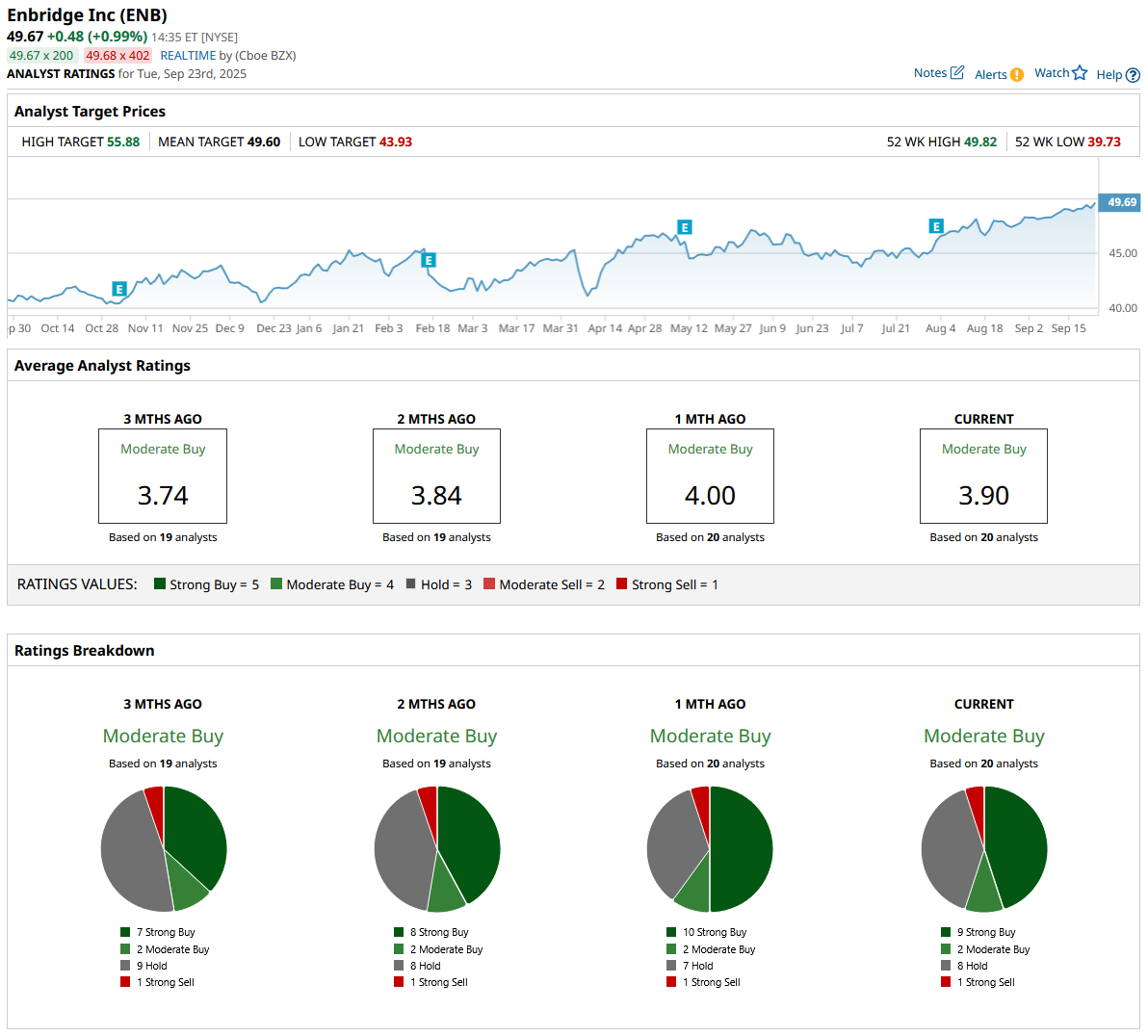

Overall, Wall Street rates ENB stock a “Moderate Buy.” Of the 20 analysts in coverage, nine recommend a “Strong Buy,” two rate it a “Moderate Buy,” eight say it's a “Hold,” and one rates it a “Strong Sell.” ENB stock is trading close to its average analyst target price of $49.60. Its Street-high price estimate of $55.88 implies an upside potential of 13.6% from current levels.