The country’s sole satellite service provider, Thaicom Plc, is in talks with several Asian providers about creating a new satellite under a consortium-based model and is expected to finalise a deal by the end of the year.

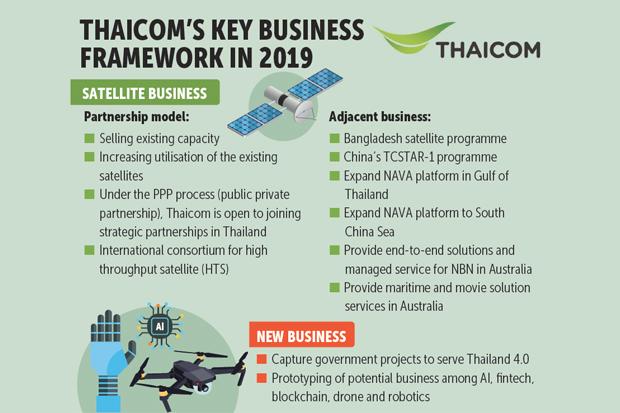

The company is trying to cope with a slowdown in the satellite business. Thaicom’s three pillars are satellite, adjacent professional services and new businesses such as artificial intelligence (AI), fintech and blockchain.

An Asia-based consortium would help reduce operating costs for a satellite and strengthen the bargaining power of providers in the region when dealing with global players.

Patompob Suwansiri, chief commercial officer of Thaicom, said the new satellite would be broadband, for which the market demand is huge because of data usage in communication.

He said the size and budget of the consortium satellite has not been determined, but cost of construction would exceed US$200 million.

Thaicom is restructuring to focus on digital businesses, hoping for a revenue stream from non-satellite services by 2023.

Its diversification aims to embrace innovative tech, robotics and AI. The company is also more focused on retail business to capitalise on end-users.

Mr Patompob said Thaicom is open to joining a strategic public-private partnership (PPP) in Thailand. The cabinet recently passed a resolution that the satellite business will have to be run on a PPP model.

The move is part of the government’s plan to terminate concessions for the satellite business and make it a real licensing regime, while maintaining the state’s benefits and promoting liberalisation.

The plan of creating a new satellite under an Asia-based consortium and the company’s plan to join with strategic partners in the country under a PPP model will be moving in parallel.

Tomyantee Kongpoolsilpa, senior vice-president of portfolio management and investor relations at InTouch Holdings, the parent company of Thaicom, said the satellite business is facing a slowdown because of intense competition from global players.

Demand for broadband and broadcast satellite, however, will support the business in the long term, she said.

“More than 50% of TV viewers still watch TV programmes via satellite, especially in Asean, which is under the footprint of Thaicom 5, 6 and 8,” Ms Tomyantee said.

Thaicom last week reported its 2018 performance. Satellite revenue was 5.85 billion baht, down 10% compared with 6.4 billion in 2017, due to the slowdown of industry and intense competition.

Mr Patompob said Thaicom will expand its NAVA maritime service platform through fibre-to-ship technology in the Gulf of Thailand and expand to the South China Sea.

The company will provide professional services for China’s TCSTAR-1 satellite programme. The scheme is expected to be concluded by 2019.

INTOUCH RESULTS

InTouch Holdings last week reported its consolidated performance. It booked total revenue of 20.4 billion in 2018, a 9.5% drop from 22.5 billion in 2017.

Net profit in 2018 was 11.5 billion, up 7.7% from 10.6 billion in 2017.