Tesla Inc. (NASDAQ:TSLA) has announced it will offer leases on Powerwall connections in the U.S.

Check out the current price of TSLA here.

Tesla Promises Low Monthly Payments

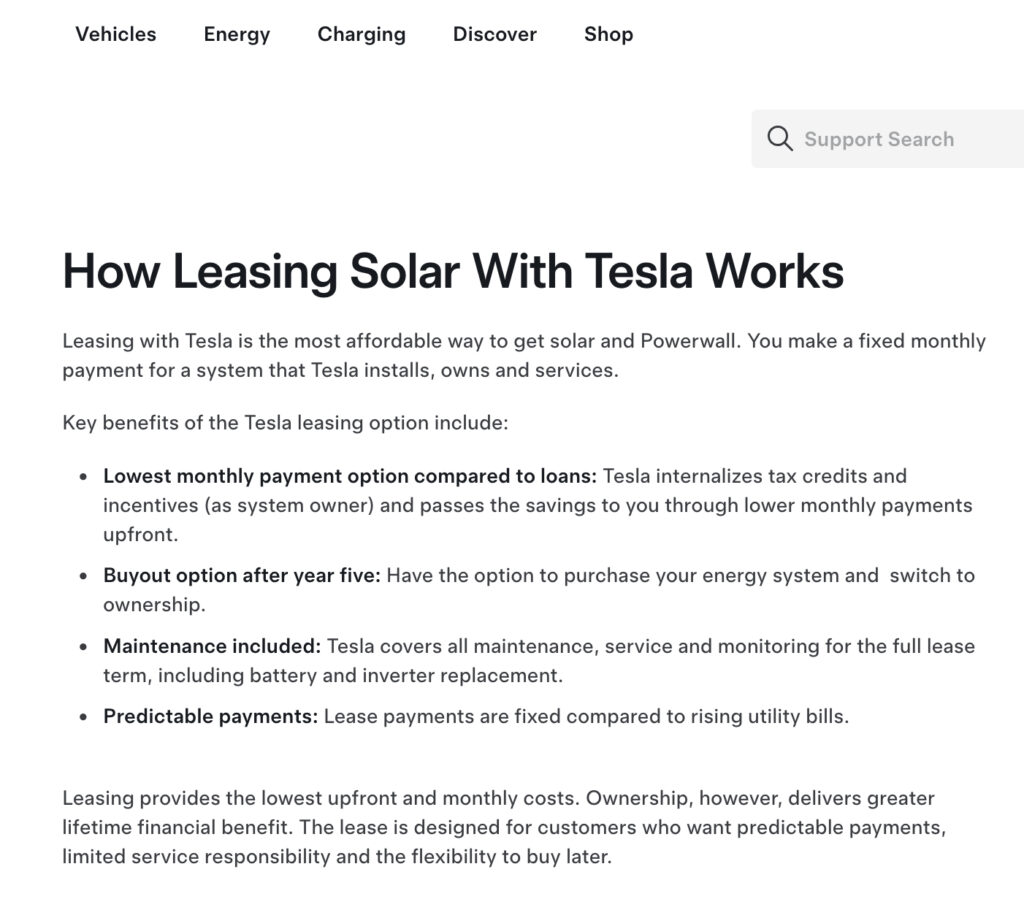

The company released a statement on its official website on Thursday, detailing the terms of the lease, offered on Powerwall and Solar connections in the U.S. "Tesla internalizes tax credits and incentives (as system owner) and passes the savings to you through lower monthly payments upfront," the company said on the official website.

It also added that the company will offer customers a chance to buy out the service after the fifth year of the lease. Tesla also said that the company will cover the maintenance and upkeep of the system for the duration of the lease, "including battery and inverter replacement."

Source: Tesla

Tesla's Finance Chief Says The Service Will ‘Pay For Itself'

Taking to the social media platform X on Thursday, the company's Vice President of Finance, Sendil Palani, said that the company expects the Solar + Powerwall lease can “pay for itself” from Day 1, generating utility bill savings that exceed the monthly lease price in many cases."

Palani added that customers are effectively getting paid "to enjoy clean energy + backup protection" in these cases.

Tesla's 1 Million Powerwall Milestone, LG Energy Deal

The news comes as Tesla had announced back in June that it had reached 1 million Powerwall installations. "Congratulations Tesla Nevada team on building our 1,000,000th Powerwall powering American homes, boosting energy independence, and strengthening U.S. manufacturing," the company had said.

The company also signed a $4.3 billion deal with South Korean battery manufacturer LG Energy Solutions, which will supply the EV giant with LFP batteries for its Energy storage business. LG will supply the batteries out of its U.S. manufacturing plant for three years from 2027 to 2030.

Tesla's Falling Sales Despite Q3 Surge

The company's auto division, meanwhile, continues to grapple with poor sales as the latest data released by the authorities in Italy suggests that Tesla's sales fell 25% in the region during the month of September, despite the company's deliveries beating analyst expectations in Q3.

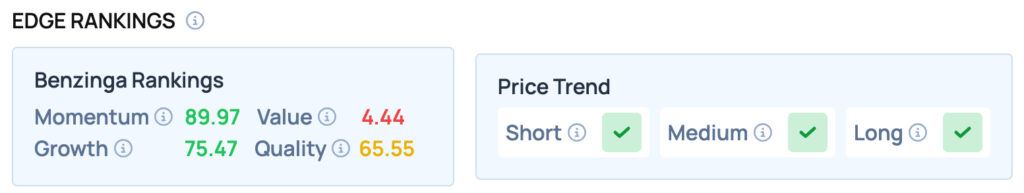

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock