Tesla (TSLA) released its Q3 delivery report yesterday, Oct. 2. The company’s deliveries rose 7% year-over-year (YoY) to a record high of 497,099 and came in better than expected. Importantly, it was the first time this year that the Elon Musk-run company reported an annual rise in deliveries. However, even with the record high deliveries, which were released on a day when U.S. stocks closed at record highs on optimism over a Fed rate cut and artificial intelligence (AI) euphoria, TSLA stock slipped off its record highs and closed over 5% lower.

Let's examine why Tesla shares closed lower despite record deliveries and examine TSLA stock’s outlook.

Why Tesla Stock Fell Despite Record Q3 Deliveries

I believe analysts were a bit too conservative with Tesla’s delivery estimates, and I was expecting a higher number. Remember, the electric vehicle (EV) tax credit expired last month, and it was natural for buyers to expedite their purchases to grab the $7,500 credit. Despite the apparent demand pull forward, Tesla could only manage a 7% yearly rise in deliveries. Other players like Ford (F) and Rivian (RIVN) reported a much stronger yearly rise in Q3 deliveries, even as they admittedly came from a much lower base.

Despite the Q3 bump, Tesla’s deliveries are still down on an annual basis in the first nine months of the year, and the company looks on track to report its second consecutive year of negative growth. Musk warned of a “few rough quarters” during the company’s Q2 2025 earnings call, and it could pretty well be a “few rough years” if the upcoming low-cost model goes the Cybertruck way, whose sales have been disappointing at best.

Finally, Tesla was heading into the Q3 delivery release after a stellar rally that helped it recoup its 2025 losses and turn positive for the year. Among others, a strong Q3 delivery report was baked into that price action, and the actual release turned out to be the typical “sell the news” event.

Do Tesla Deliveries Matter?

While Tesla bulls and Musk have been trying to position the company as an artificial intelligence (AI) and autonomous driving play—which I would agree it is—the automotive business remains core to Tesla. It accounts for the bulk of the company’s revenues and profits, which then fuel investments in its emerging businesses like the Optimus humanoid. It won’t be at least a couple of years until these businesses start meaningfully contributing to Tesla’s earnings. Also, more Tesla cars on the roads would increase the captive market for the company’s autonomous driving subscription.

To sum it up, while Tesla has managed to shrug off the pessimism over falling deliveries and boycotts, particularly in Europe, markets still attach importance to the company’s automotive business.

TSLA Stock Forecast

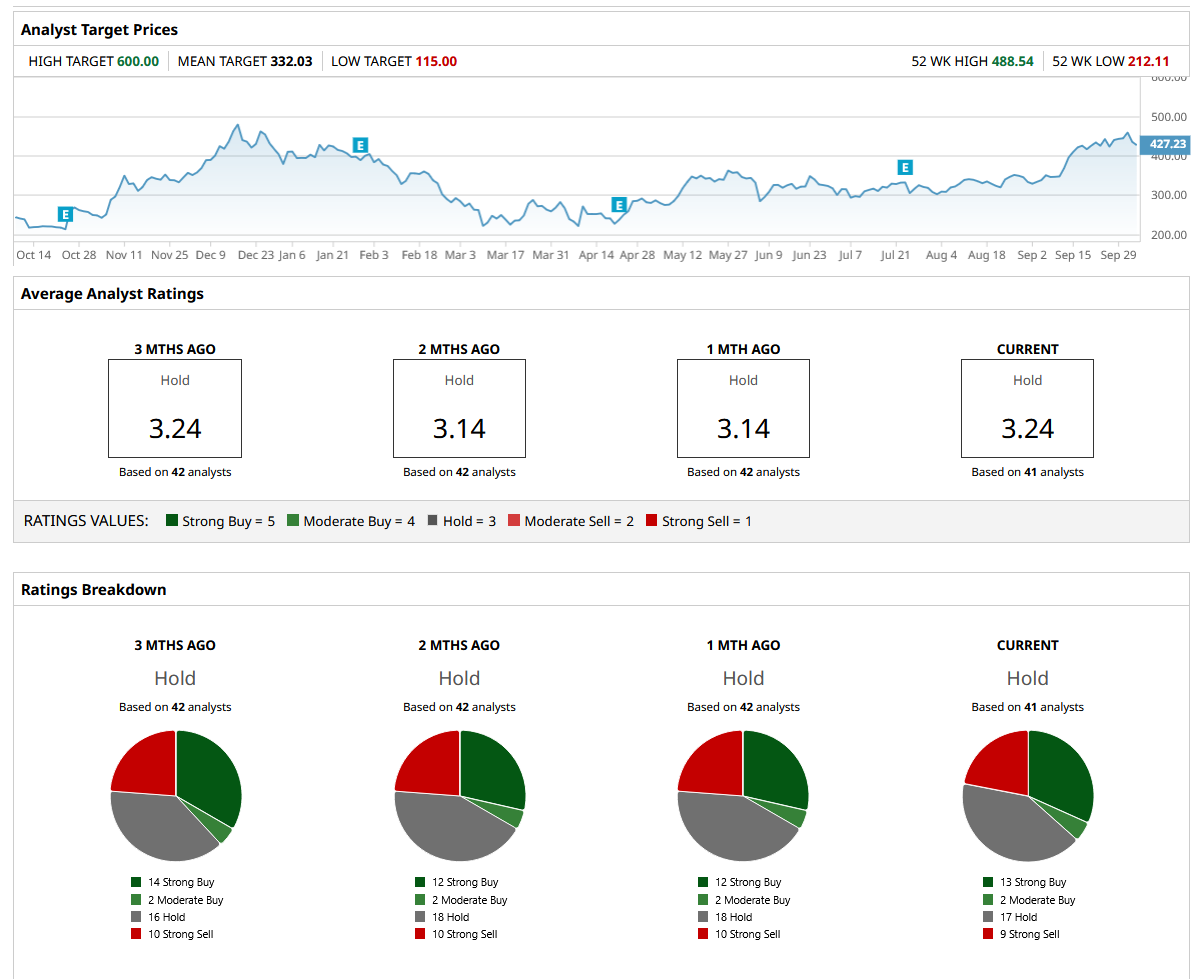

Sell-side analysts remain as divided as ever on TSLA stock and have given it a consensus rating of “Hold.” The stock continues to trade well ahead of its mean target price of $322.03, even as the Street-high target price of $600—via Wedbush’s Dan Ives, a perma Tesla bull—represents an upside of over 37%.

Should You Buy or Sell Tesla Stock?

Tesla has always been a story for believers in the company as well as Musk’s vision. The multi-billionaire who recently became the first person ever to have a net worth of half a trillion dollars has an impeccable ability to move Tesla shares with his actions, which was well illustrated by his recent purchase of Tesla shares worth $1 billion.

The action was well-timed and came after the company’s board recommended a fat pay package for him, which would be worth a trillion dollars if the set milestones, including Tesla’s market cap reaching $8.5 trillion, are met.

I am not in the Tesla and Musk skeptic camp and believe that physical AI of the sort Tesla is developing would be the next big thing. However, there is always an execution risk. While Tesla has a strong record in execution, it is facing some serious competition from Chinese EV companies, which, by Musk’s own assertion, would “demolish” competitors in the absence of trade barriers.

Tesla is losing market share in China and Europe to Chinese rivals who offer attractive models at competitive prices. Given the strides Chinese companies are making in AI, including the development of AI chips, we can reasonably expect them to undercut Western rivals, such as Tesla, on pricing and performance in AI products like humanoids in global markets, just as they are doing in the EV industry. Tesla would need to compete with them to fully realize the kind of gigantic numbers that Musk has touted for Optimus, and unlike the EV industry, where Tesla has a head start and a literal home run as legacy automakers neglected the then-niche industry, the race for AI hardware is wide open, and Tesla would face stiff competition, particularly from China.