/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)

President Donald Trump introduced sweeping 25% tariffs on the United States’ two largest trading partners, Canada and Mexico, calling it a necessary move to protect American industries. The tariffs officially went into effect earlier this month following an initial one-month delay. However, in a last-minute shift, the White House confirmed on March 5 that the automotive sector would receive an additional one-month reprieve.

This unexpected development sent shares of several automakers, including Elon Musk’s Tesla (TSLA), soaring. Given that Tesla relies on Mexico for over 20% of its parts, alongside additional components from Canada, the electric vehicle (EV) giant faces a potential financial squeeze once the tariffs are fully enforced. In fact, during Tesla’s Q4 earnings call, CFO Vaibhav Taneja highlighted the company’s ongoing push to localize its supply chain but admitted that global sourcing remains essential to its operations.

With tariff threats looming, he acknowledged that the added costs could take a toll on Tesla’s profitability. That said, the Trump administration expects automakers to use this one-month grace period to accelerate domestic investment and manufacturing, potentially reshaping supply chains in the long run.

For investors, does this tariff relief create a window to buy the shares of this beaten-down EV maker?

About Tesla Stock

Texas-based Tesla (TSLA) may dominate the U.S. EV market, but its ambitions stretch far beyond electric cars. The company is actively expanding into energy storage, automation, and robotics, positioning itself in multiple high-growth industries shaping the future of technology. The company’s market cap presently stands at approximately $844.9 billion.

Tesla stock soared roughly 29% over the past year, peaking in December as investors bet on a regulatory boost under Trump. Hopes ran high for regulatory tailwinds to accelerate TSLA’s advancements in autonomous driving and robotics. But 2025 has painted a completely different picture. So far this year, TSLA shares have crashed 44%, dragged down by Musk’s political controversies, intensifying competition in the EV space, and a sharp decline in European sales.

Nevertheless, despite a sluggish start to 2025, TSLA continues to trade at a hefty premium. Priced at 103.21 times forward earnings and 8.67 times sales, the stock trades significantly above its sector medians of 15.5x and 0.9x, respectively, suggesting high investor confidence even amid mounting challenges.

Tesla Misses on Q4 Earnings

The EV maker published its fiscal 2024 fourth-quarter earnings results on Jan. 29, which fell short of both top- and bottom-line predictions. Total revenue inched up just 2% year-over-year to $25.7 billion, falling well short of analysts’ $27.1 billion forecast. Meanwhile, adjusted EPS came in at $0.73, marking a slight 3% improvement from the prior year but still trailing Wall Street’s target by 4.8%.

Tesla’s latest earnings report showed growth in some key areas, with energy generation and storage revenue skyrocketing 113% year-over-year and services revenue rising by a solid 31%. However, the company’s core automotive business struggled, with revenue declining 8% to $19.8 billion from $21.6 billion a year ago.

The company linked the decline in automotive revenue to lower average selling prices across its Model 3, Model Y, Model S, and Model X lineup. While these price cuts aim to fuel higher sales volumes, they’ve also taken a toll on revenue, highlighting the challenge of balancing demand with profitability.

Although Tesla didn’t reveal any specific guidance for 2025, it didn’t hold back on making some bold declarations in its Q4 shareholder deck, calling 2025 a “seminal year” in the company’s history. A major focus is the advancement of Full Self-Driving (FSD), with Tesla aiming to surpass human safety levels and roll out an unsupervised FSD option for customers.

Adding to the excitement, the company’s robotaxi service is set to debut in select U.S. regions later this year. Plus, Tesla is also accelerating its FSD (Supervised) expansion, with plans to bring its cutting-edge autonomous tech to Europe and China in 2025.

What Do Analysts Expect for Tesla Stock?

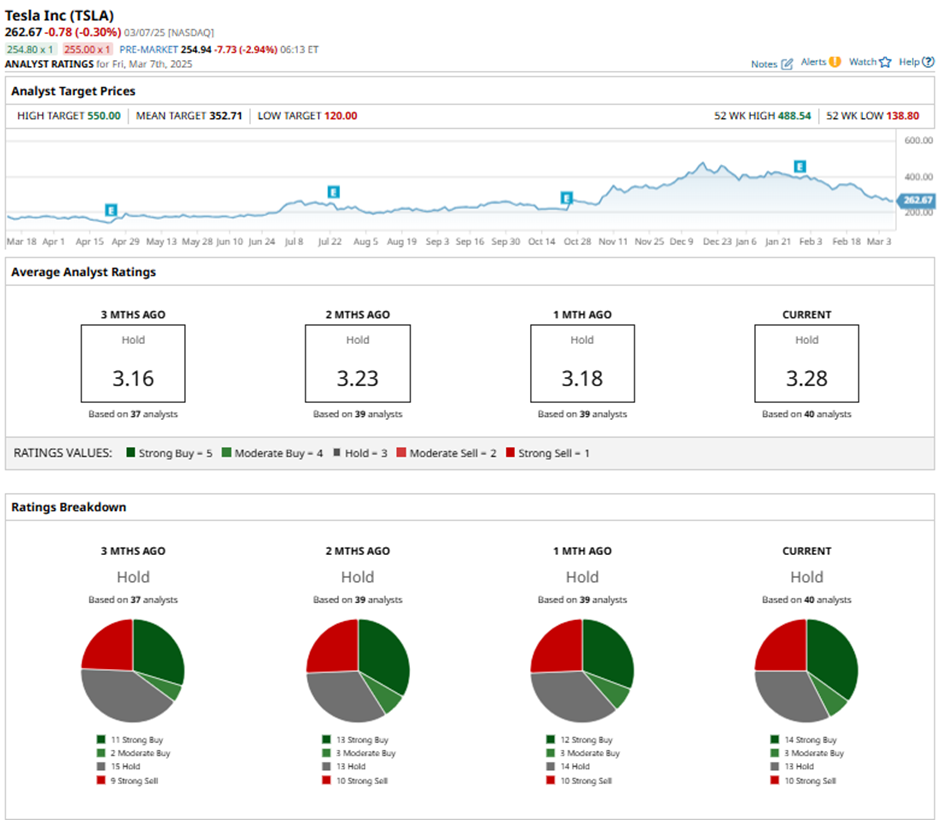

Despite the temporary boost in investor sentiment for the company on March 5 following Trump’s one-month tariff relief for automakers, Wall Street still remains cautious on TSLA stock, keeping a consensus “Hold” rating overall. Of the 40 analysts offering recommendations, 14 back it with “Strong Buy,” three give a “Moderate Buy,” 13 advocates a “Hold,” and the remaining 10 maintain “Strong Sell.”

The average analyst price target of $352.71 indicates 56% potential upside from the current price levels, while the Street-high price target of $550 suggests that TSLA could rally as much as 144% from here.