When one looks at a chart of Tesla (TSLA) stock, they’ll notice it’s stuck between two technical levels.

It’s like watching a live tug-of-war play out and if the EV scene wasn’t volatile enough, it’s unfolding amid marketwide whiplash, where oil prices are soaring and the Volatility Index remains elevated.

Tesla is a constant focus among investors, both from those who love and hate the Austin electric-vehicle company.

Then there’s the emergence of Ford’s (F) EV strategy and Rivian (RIVN) consistently being in the news as well. Let's also not forget General Motors (GM) and Lucid. (LCID)

For better or for worse, Tesla will continue to attract attention, particularly with its market cap hovering near $890 billion.

The decline in Tesla stock has obviously hurt Elon Musk’s net worth, but I think investors have to be impressed with the way the stock is holding up. That's especially today with union talks in the discussion.

On the flip side, investors are weighing the positive news of Tesla reportedly verging on the beginning of production in Germany.

Trading Tesla Stock

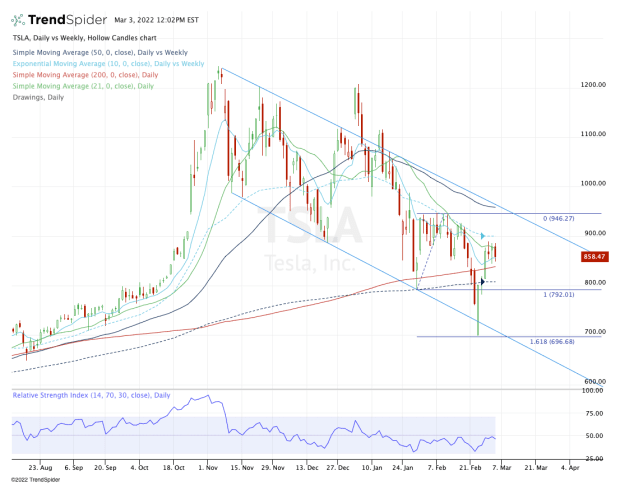

Chart courtesy of TrendSpider.com

Tesla shares are down 31% from the high, which isn’t too bad all things considered. For instance, Ford is down 32%, while NIO (NIO) is 70% off its all-time high.

While Tesla is underperforming the market, it’s outperforming its peers.

On the chart above, notice that Tesla stock is trapped between the 200-day moving average on the downside and the declining 10-week on the upside.

Underneath it also has the 10-day as support, while squeezing it lower is the 21-day.

Downside support sits between $845 and $850 in the short term, while resistance is between $885 and $890.

Traders need this range to break, and for those without bias, they don’t care which way the break is. If it’s lower, they can short. If it’s higher, they can buy.

Clearing resistance and the 10-week moving average near $900 opens the door to the next resistance level between $940 and $950, followed by the declining 50-day moving average and channel resistance.

On the downside, a break of support and the 200-day puts this week’s low near $815 and the 50-week moving average in play, currently near $808.

Below that opens the door to the $792 to $795 area, then $772.

If you’re trading this one, try not to let your bias for Tesla get in the way (whether you’re bullish or bearish).