/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)

Following a bumpy few months in 2025 due to his unpredictable relationship with President Donald Trump, things are looking up for Tesla (TSLA) CEO Elon Musk again. A proposed $1 trillion pay package kick-started the good times, which was succeeded by Musk buying 2.5 million shares of TSLA stock. The spate of seemingly favorable events has led to the Tesla share price performance turning positive for the year, with a rise of 10.46% on a year-to-date (YTD) basis.

However, there can be more uptick incoming for the TSLA stock after the company reported that sales in Europe are finally gaining traction after a while. In September, sales were up 20.5% in Denmark, 14.7% in Norway, and 3.4% in Spain. Moreover, overall deliveries for the third quarter of 2025 at 497,099 were not only 7.4% higher than the previous year, but they were also higher than the Street's expectations of deliveries of 447,600 by a wide margin. Although the impending expiration of the EV tax credits helped, some believe that Musk's refocus towards Tesla also has a part to play in the revival.

Thus, as an investor, is this the right moment to add Tesla to the portfolio? Let's find out.

Declining Financials a Concern but Still Not Worrying

Over the last two years, Tesla's quarterly results have not evoked much confidence. This time period also coincided with Musk's plunge into politics, which led to protests against him, his company, and divided his customer base.

Notably, the last eight quarters have seen the company reporting an earnings beat on just a couple of occasions, with year-over-year (YoY) growth in the same also occurring for the same number of times. This contrasts heavily with its showing over the past five years, in which Tesla reported revenue and earnings CAGRs of 29.25% and 65.47%, respectively.

The results for the most recent quarter continued with this trend. Total revenues of $22.5 billion were 12% less than those of the previous year, as earnings of $0.40 per share represented an even sharper YoY decline of 23.1%. Yet, the EPS at least matched the consensus estimates, which was not the case in the previous two quarters.

Operating margins dwindled to 4.1% in Q2 2025 from 6.3% in Q2 2024. This metric in particular has been under severe pressure, thanks to the Chinese EVs, which have flooded the globe with their cheaper and, often, better products than what is offered by the world's largest carmaker in terms of market cap.

Net cash from operating activities saw a decline as well, with the figure coming in at $2.5 billion, down 30% on a YoY basis. However, the company closed the quarter with a cash balance of about $37 billion, about 20% higher than the prior year's balance of $30.7 billion. The cash balance was also higher than the company's short-term debt levels of $30 billion.

Although deliveries were down by 13% from the previous year to 384,122 vehicles in Q2 2025, there were some improvements in other areas, which have the potential to be significant value drivers for Tesla in the future. Notably, supercharger stations and connectors rose by 14% and 18% on a YoY basis to 7,377 and 70,228, respectively. For Tesla owners, the Supercharger network is a godsend as it removes “range anxiety”—one of the main psychological barriers to EV adoption.

So, worries about Tesla's sales drop and falling profitability might be genuine concerns, but its financials do not even remotely raise any alarm, considering the huge cash pile and manageable debt position. Additionally, Musk's proposed renewed pay package is difficult to ignore. If his motivation remains directed towards Tesla and nowhere else, Tesla can certainly make a turnaround, with some recent evidence already available.

What Drives (and Ails) Tesla?

Since my last analysis on Tesla, the stock is up over 35% and climbing. The analysis was a relatively muted one when compared to my previous pieces on the company, as Musk himself sounded a warning about some “tough quarters” for the business. Also, since then, Tesla has disbanded its ambitious Dojo Supercomputer project, which is strange when one considers that the company was quite upbeat about the same at the start of the year.

But that does not mean that Tesla is going slow on next-gen technologies. Tesla’s successful execution of its suite of next-generation technologies establishes a profoundly compelling foundation for its long-term growth narrative. Specifically, the company’s robotaxis are currently operational in Austin, Texas, actively servicing paying customers in a state of full autonomy. This achievement is significant because it provides crucial proof of concept within a real-world, commercial context, an operational validation far superior to simulation data, thereby substantially de-risking the broader expansion of its ride-hailing services across the United States and potentially beyond. These initial network effects generated by the Full Self-Driving (FSD) and Robotaxi programs inherently strengthen the company’s competitive moat, creating high degrees of optionality and unlocking a potentially huge Total Addressable Market (TAM).

Robots Leading the Way

Meanwhile, the company’s efforts on the humanoid robot front are advancing rapidly. Management has indicated that the design for Optimus 3 is approaching finalization, a development phase that relies heavily on applying the specialized AI learnings harvested from the vehicle fleet to the humanoid platform. The initial prototype of this design is anticipated before the conclusion of the year, an event that is widely expected to trigger a significant upward movement in the company’s stock valuation. The ambitious production target is set at scaling output to one million units per year within a five-year horizon.

Notably, this robotics initiative is critically important because it positions Tesla to enter a virtually uncontested robotics market armed with its proven AI capabilities. Early movers invariably secure a strategic advantage, allowing them to define industry standards, capture necessary talent, and secure a dominant market position. For shareholders, this translates directly into considerable optionality within what could become a multi-trillion-dollar market, assuming successful execution on production scale and market adoption, even if only a portion of Elon Musk’s long-term vision materializes. Furthermore, the program is poised to enable a platform strategy for the company, repurposing the valuable AI tools, sensor fusion technology, and real-time inference capabilities developed for its EVs directly into the Optimus product line.

However, an expectedly refocused Musk and some green shoots aside, ignoring the problems at hand for Tesla would not be prudent. For starters, the sustenance of the recent uptick in deliveries will be a key monitorable with the expiration of the EV tax credits. Further, monetization and value unlock from the Optimus and FSD, undoubtedly exciting, are still far away in the future. Yet, the optimism around the same remains palpable, leading to severely punchy valuations for the stock whose valuations have reached absurd levels, with the forward P/E, P/S, and P/CF of 296.78, 15.27, and 113.87 being much higher than the sector medians of 19.51, 1, and 11.73, respectively.

Analyst Opinion

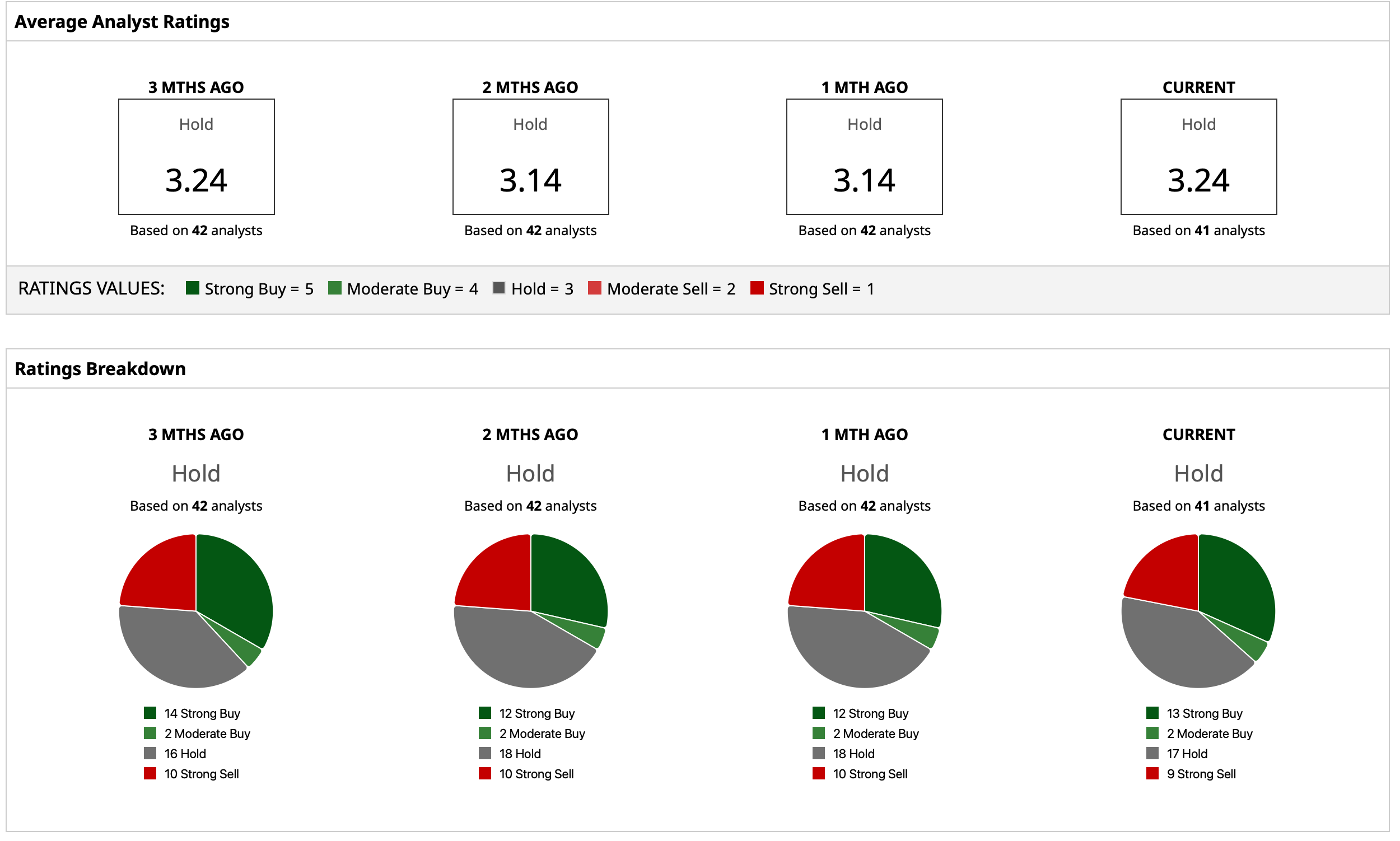

Thus, analysts have deemed the stock a “Hold,” with a mean target price of $332.03. Although this has been surpassed, the high target price of $600 denotes an upside potential of about 34% from current levels. Out of 41 analysts covering the stock, 13 have a "Strong Buy" rating, two have a "Moderate Buy" rating, 17 have a “Hold” rating, and nine have a “Strong Sell” rating.