/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

Tesla (TSLA) will release its Q2 earnings on July 23. While the earnings are expected to be soft, considering the double-digit fall in deliveries in the second quarter, all eyes will be on CEO Elon Musk’s commentary during the earnings call. In this article, we’ll look at Tesla’s Q2 earnings estimates and examine some of the topics that might be featured and some issues that ought to be discussed, but might not be.

Tesla’s Q2 Earnings Estimates

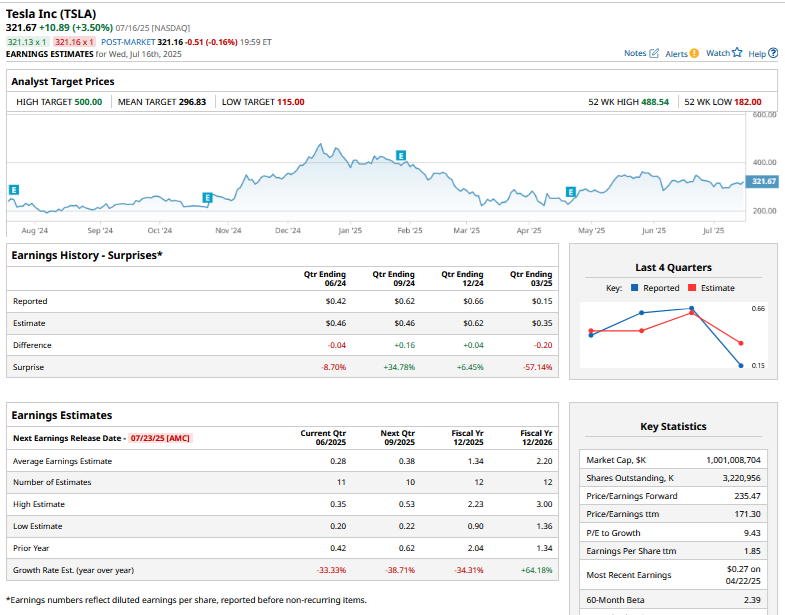

Consensus estimates call for Tesla’s Q2 revenues to fall 12.3% year-over-year. The estimates aren’t surprising, as Tesla’s deliveries, which closely approximate vehicle sales, fell 13.5% year over year in the quarter. The decline was higher than the 13% fall in Q1 and was the worst ever for the company.

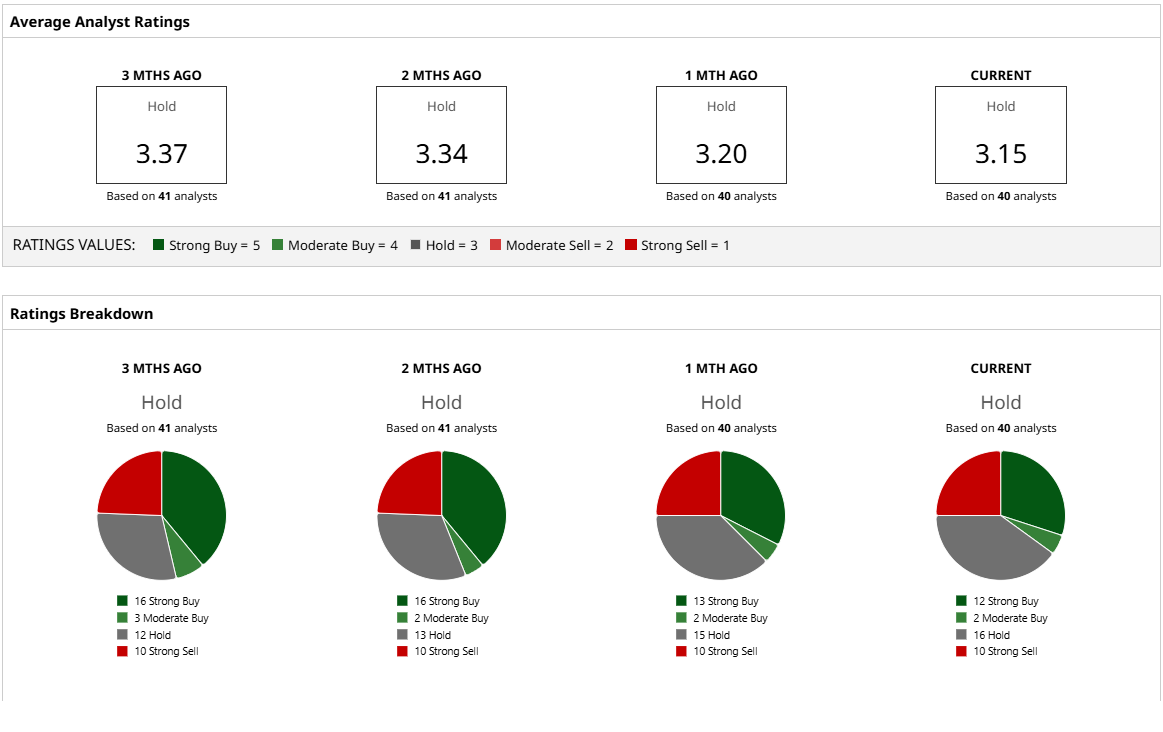

Analysts expect Tesla’s Q2 earnings per share (EPS) to fall 33.3% as compared to the corresponding quarter last year. For the full year, the company’s EPS is expected to be 34.3% lower than last year.

Tesla’s Q2 Earnings Call Could Be About AI and Robotaxis

Tesla’s Q2 earnings call could be more about artificial intelligence (AI), robotaxis, and Musk’s politics. The company might discuss the Austin robotaxi rollout and provide color its plans to expand the service to other cities. Tesla might also provide an update on its Optimus humanoid robot, which Musk believes is a multitrillion-dollar opportunity. Musk recently floated the idea of Tesla investing in his AI company xAI, and during the earnings call, we might get to hear more about that proposal.

Musk’s political activities, including his launch of a new political party, might also be in focus. Notably, the key reason Tesla stock rose sharply after releasing its Q1 earnings despite missing on both the top line and bottom line was Musk’s promises of scaling back his political activities. Musk subsequently left the Department of Government Efficiency (DOGE), but instead of pulling back on politics, the world’s richest person has doubled down.

5 Things I’ll Be Looking for in Tesla’s Q2 Report

Outside of AI and robotaxis, these are the things I’ll be listening out for:

- Update on the Low-Cost Model: Tesla had previously said that it would commence production of its affordable model in the first half of 2025, but so far, we don’t have any official update. During the Q2 earnings call, I will watch for an update on that platform.

- 2025 Delivery Guidance: With the electric vehicle (EV) tax credit set to end in September, the demand environment for the U.S. EV industry might only deteriorate. During the Q2 earnings call, Tesla might revisit its 2025 delivery guidance as the probability of yearly growth in deliveries looks bleak, even as I expect a bump in Q3, as buyers might rush to leverage the tax credits before they phase out in Q4.

- Cybertruck: The deliveries of Tesla’s Cybertruck pickup have underwhelmed, and the model is far from being a success story. Tesla started trade-ins for the uniquely shaped vehicle earlier this year, but the depreciation rates were reportedly too high. During the Q2 earnings call, I will watch for any discussion on the model that has failed to live up to expectations.

- Energy Business: Tesla’s Energy business has reported a sequential fall in deployments for two consecutive quarters. I will watch out for any discussion on the Energy business, which Musk once said has the potential to be even bigger than the automotive business.

- Margins and Profitability: Tesla’s once industry-leading margins have withered away amid the price war that it initiated with its massive price cuts. The company’s lucrative regulatory credit business also faces strains now as the One Big Beautiful Bill Act eliminates the penalties for non-compliance with Corporate Average Fuel Economy (CAFE) standards. Amid sagging profitability, sales of regulatory credits were a silver lining for Tesla, and if not for these, the company would have posted a GAAP loss in Q1. William Blair analyst Jed Dorsheimer estimates that sales of three-fourths of Tesla’s regulatory credits were linked to CAFE standards. That revenue stream is now at risk as automakers don’t necessarily need to buy these regulatory credits from Tesla to meet the standards. I will be watching for commentary on regulatory credits as a result.

Pre-Q2 Earnings Forecast for Tesla Stock

Sell-side sentiment towards Tesla is not quite bullish heading into the confessional, and last week, Mizuho and Goldman Sachs lowered their target prices while maintaining their respective ratings. William Blair went a step further and downgraded the stock from an “Outperform” to “Market Perform.” Tesla is trading above its mean target price of $296.59, which is something that’s not uncommon for the Elon Musk-run company.

All said, given Tesla stock’s propensity to react to Musk’s commentary and other non-fundamental factors, I would refrain from betting against TSLA even as it is among the most shorted stocks heading into the Q2 confessional. While I expect the stock to react positively to the report, as many negatives have been factored into it after the recent fall, I still won't add any Tesla shares, given the valuations and the slowdown in the core automotive business.