Tesla’s (TSLA) dominance in the global electric vehicle (EV) market has been under mounting pressure, and nowhere is that more evident than in Europe. The latest data revealed yet another steep decline for the company in the region, raising serious questions about its competitive position and long-term growth trajectory outside the U.S.

For years, Tesla has enjoyed first-mover advantage, capturing consumer imagination and market share across Europe. But that lead is eroding quickly. Chinese rivals like BYD (BYDDY) are aggressively expanding in the region, while European legacy automakers are stepping up their EV offerings. As a result, Tesla’s market share is shrinking, even as overall EV adoption in Europe accelerates.

Against that backdrop, the big question emerges: with TSLA stock still buoyed by investor enthusiasm for AI, robotaxis, and future tech promises, how long can the disconnect between the narrative and the numbers last? And at what point should investors finally consider walking away from TSLA stock? Let’s take a closer look!

About Tesla Stock

With a market cap of $1.46 trillion, Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation.

Shares of the EV maker have gained 9.4% on a year-to-date (YTD) basis. TSLA stock rallied in September, buoyed in part by CEO Elon Musk’s $1 billion stock purchase, which some view as a signal of confidence in the company’s future. Broad optimism surrounding AI and robotaxis also contributed to lifting the stock this month.

Tesla’s European Sales Continue to Struggle

Last Thursday, Tesla shares dropped more than 4% after data showed another month of declining sales in Europe, intensifying concerns over the EV maker’s shrinking global market share. The European Automobile Manufacturers’ Association reported that Tesla sold 8,220 vehicles in the European Union in August, down about 37% from the same month last year. This came as sales of fully electric vehicles and plug-in hybrids in Europe continued to grow at a strong pace last month. For instance, BYD sold 9,130 vehicles in the EU, a 201% year-over-year (YoY) increase, beating Tesla for the second straight month.

When factoring in the U.K., Norway, and other European Free Trade Association (EFTA) countries, Tesla outpaced BYD with 14,831 cars sold versus BYD’s 11,455. The key point, however, is that Tesla’s sales fell 22% YoY, while BYD’s surged 216%.

Zooming out, Tesla has sold 133,857 vehicles in the EFTA YTD, a 33% decline from last year, while BYD has sold 95,940, up 280% YoY. So, it’s clear that Tesla’s sales have been trending downward, while BYD’s are growing rapidly. In other words, it’s likely only a matter of time, probably a short one, before BYD surpasses Tesla here as well.

Tesla has struggled to grow car sales in Europe this year, reflecting both a backlash to CEO Elon Musk’s political activities and intensifying competition from China and elsewhere. Interestingly, the source of Tesla’s struggles in the region may run even deeper. In my pre-market report last Monday, I highlighted a European Central Bank study showing that Eurozone consumers have adjusted their consumption habits in anticipation of U.S. tariffs, shifting away from American goods.

Meanwhile, Tesla’s market share in the EFTA dropped to just 1.9% in August, down from 2.5% in the same period last year. And Europe isn’t the only place where Tesla is struggling with market share. Earlier this month, Cox Automotive reported that Tesla’s share of the U.S. EV market dropped to 38% in August, the lowest on record, even as EV sales surged in the country ahead of the expiration of federal tax incentives. With that, investors are eagerly awaiting Tesla's third-quarter delivery figures.

All Eyes on Tesla’s Q3 Deliveries

Tesla is scheduled to release its third-quarter delivery numbers this week. The data is likely to arrive on Wednesday or Thursday. Tesla doesn’t set a fixed date for reporting quarterly deliveries and production, typically releasing global figures a few days after the quarter ends.

Let’s take a moment to go back to the estimates from Cox Automotive. According to the analysts, Tesla’s U.S. sales in August totaled around 55,500 vehicles, up 3% from July but down nearly 7% compared to August 2024. This comes as U.S. EV sales hit a record high, with Cox estimating 146,147 vehicles sold in August, representing nearly 10% of total auto sales. And that’s how they arrive at Tesla’s U.S. market share of 38% for August. Cox anticipates that third-quarter U.S. EV sales will hit an all-time high, noting that the phase-out of Biden-era IRA incentives “is driving urgency in the market right now.”

Meanwhile, Tesla sales estimates on Wall Street have been gradually rising in recent weeks. FactSet’s consensus estimate is 448,000 EVs sold globally for the quarter, compared with 463,000 in the third quarter of 2024. Some analysts anticipate Tesla will report above-consensus figures, largely driven by U.S. sales that were likely boosted by the looming expiration of the Biden-era IRA credit. However, Cox’s estimates don’t appear to support this thesis.

Along with delivery figures, Tesla will also report data from its energy storage division. More precisely, the company will report the amount of storage it deployed in Q3, measured in gigawatt-hours. I will be watching this data closely, given that the company’s deployments fell in both Q1 and Q2.

In addition, Tesla typically announces the date for its quarterly earnings release in its delivery updates. The company is expected to release its third-quarter financial results in mid-October. Analysts expect Q3 earnings per share of $0.50, down 30.54% YoY, on revenue of $25.04 billion, representing a 0.55% decline.

What Do Analysts Expect for TSLA Stock?

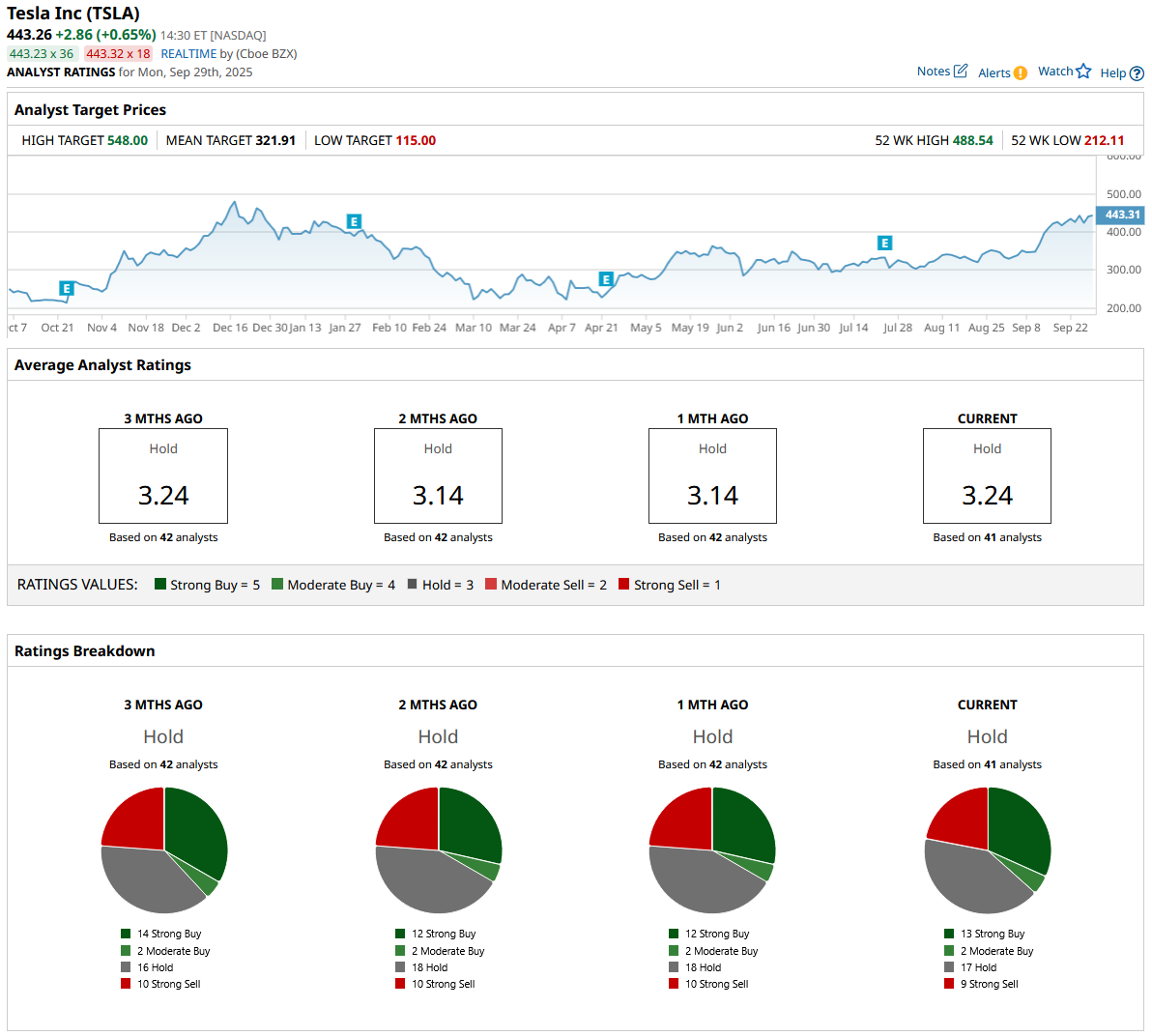

Wall Street community remains split on Tesla, with TSLA stock carrying a consensus “Hold” rating. While 13 analysts assign TSLA a “Strong Buy” rating and two a “Moderate Buy,” 17 advise holding, while nine recommend a “Strong Sell.” Following its September rally, the stock is now trading well above its average price target of $321.91.

Tesla bulls argue that the company’s golden goose lies beyond EVs, with its future growth more closely linked to AI, autonomous driving, robotaxi technology, and humanoid robots. At the same time, analysts warn that Tesla may face a rough patch as U.S. tax incentives expire at the end of September, just before the rollout of its long-promised low-cost EV later this year. In other words, the absence of tax incentives will likely put significant pressure on Tesla’s U.S. EV sales, with only the launch of a lower-cost model expected to offer some relief for its auto business. CEO Elon Musk cautioned about the possibility of “rough” quarters ahead during the company’s Q2 earnings call.

Putting it all together, I see two ways to play TSLA stock here. Firstly, European weakness seems to be largely priced in, as reflected in the stock’s drop after the data release. So the first catalyst I’m watching for is Tesla’s Q3 delivery numbers. If the figures disappoint, I would recommend selling TSLA stock, as this would, in my view, effectively mark the beginning of the “few rough quarters” Musk warned about. If the figures come in above consensus, they will likely lend support to TSLA stock, buying us time before the company’s Q3 report. And following the company’s Q3 report, whether strong or weak, I believe it will be an opportune time to sell, as Tesla is heading into a very challenging period where staying on the sidelines may be the wiser move.