Tesla Inc. (NASDAQ:TSLA) has announced November 6 as the date for the company's annual shareholder meeting amid mounting pressure from investors who are concerned about Elon Musk's political ambitions and mounting tensions with President Donald Trump.

Check out the current price of TSLA stock here.

What Happened: "The board of directors of Tesla has designated November 6, 2025 as the date of Tesla's 2025 annual meeting of shareholders," a filing by the EV giant with the U.S. Securities and Exchange Commission or SEC showed on Thursday.

The company will also present its proxy statement during the meeting, the filing shows.

Source: SEC

Amid the news hitting the wires, Wedbush Securities analyst Dan Ives weighed in on the matter in a post on social media platform X on Thursday. "Now the Musk new pay package will be the focus," Ives said in the post.

The pay package in question reportedly stands at over $56 billion, which was awarded to Musk following Tesla’s growth, a Reuters report from March suggests. The Tesla board approved Musk’s pay package, which could be among the highest CEO payouts ever, on two separate occasions.

Musk’s pay package was awarded to the CEO in 2018. However, a member of the Tesla board had filed a lawsuit objecting to the compensation for Musk. A court ruling in Delaware, Texas, rejected the pay package last year. Musk has since appealed to restore it.

Why It Matters: The date for the investors' meeting comes in after the Tesla BoD faced pressure from shareholders, with a group of 27 investors recently writing a letter to the board, urging it to set up a date for the annual shareholder meeting.

Tesla has also been under fire from analysts, with Gerber Kawasaki's co-founder Ross Gerber slamming Musk, claiming that the CEO has "hijacked the company" and that his America Party will be "an abject failure."

Ives, who has maintained Bullish views on the company, also called on the Tesla board to set up a 25% voting control for Musk and maintain oversight of his involvement in politics.

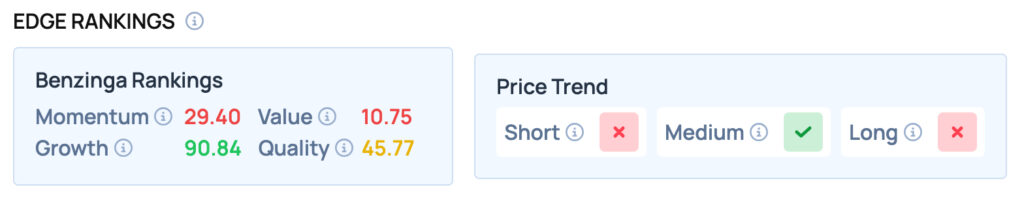

Tesla offers poor Momentum and Value, while scoring well on the Growth metric and offering satisfactory Quality. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock