Xpeng Inc. (NYSE:XPEV) has announced it will expand into new markets in Europe as well as Asia, as the Tesla Inc. (NASDAQ:TSLA) rival joins several Chinese automakers looking to bolster global footprints.

Check out the current price of XPEV here.

Xpeng To Expand Into Estonia, Lithuania And Latvia

Announcing the expansion into Europe via a post on the Chinese X counterpart Weibo, the company said it was entering three new countries in the European market: Estonia, Lithuania and Latvia, as well as Cambodia in the Asian market. "Up to now, Xiaopeng Automobile’s global sales and service network has covered more than 49 countries and regions," the company said in the post.

Source: Xpeng via Weibo (originally in Chinese)

Xpeng's Austrian Facility

The news comes as Xpeng announced it would manufacture vehicles in Europe following its partnership with Magna International Inc. (NYSE:MGA) to build two EVs in Austria at one of Magna’s manufacturing facilities in the region. The facility came as Xpeng earlier announced its expansion into 5 other European countries, like Switzerland, Austria, Hungary, Slovenia and Croatia.

Chinese Automakers Expand Into Europe

Several Chinese automakers have been expanding into Europe, with Xiaomi Corp (OCT: XIACF) (OTC:XIACY) announcing that it has established an R&D center in Germany, ahead of its entry into the European market in 2027.

Meanwhile, Li Auto Inc. (NASDAQ:LI) CEO Xiang Li had earlier said that a global expansion was on the cards for the automaker. "The overseas market expansion has been one of the top medium to long-term strategies for Li Auto," the CEO had shared.

Tesla's Falling European Sales Amid BYD Growth

Meanwhile, Tesla recorded a 25% drop in its sales in Italy, according to data shared by Italian authorities, marking one of several markets globally that have recorded a downward trend for Elon Musk's company.

However, Tesla's decline coincides with the UK becoming the largest overseas market for rival and Chinese EV giant BYD Co. Ltd. (OTC:BYDDY) (OTC:BYDDF), as the company recorded selling 11,271 vehicles in the UK during September 2025, which was much higher than the 1,150 units it sold in the region during the same period in 2024.

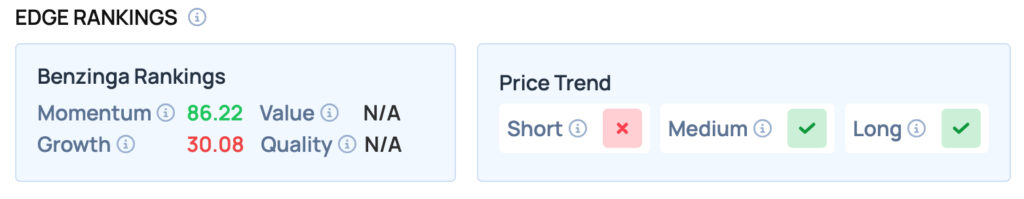

Xpeng scores well on the Momentum metric, but offers poor Growth metrics. It also offers a favorable price trend in the Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: THINK A / Shutterstock.com