/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

Tesla (TSLA) is set to report its Q3 2025 earnings on Wednesday, Oct. 22. The Elon Musk-run company is entering the confessional on a strong note after reporting record deliveries for the quarter. The stock, which was in the red for much of this year, has turned positive even as its returns trail that of the average S&P 500 Index ($SPX) constituent. In this article, we’ll analyze the expectations from Tesla’s Q3 earnings and examine whether the stock is a buy or a sell ahead of the report.

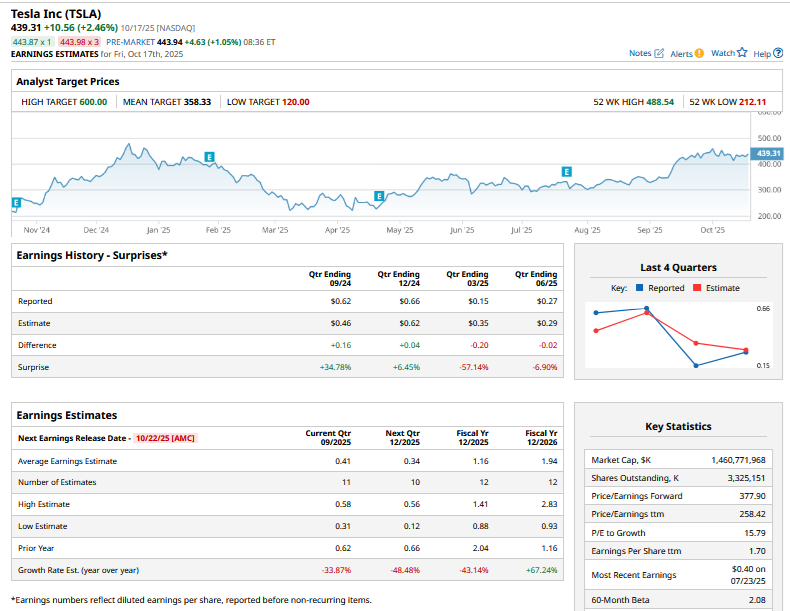

Tesla Q3 Earnings Estimates

Analysts expect Tesla’s Q3 revenues to rise 5.5% in the September quarter. I find the estimates a bit conservative given the 7% rise in deliveries and the expected growth in the company’s energy business. While pricing might continue to be a headwind for Tesla, I expect the company to beat top-line estimates in the quarter.

However, there looks to be no respite on the bottom line and analysts expect the company’s per-share earnings to fall 33.9% to $0.41 in Q3. Along with pricing pressure, Tesla will also face headwinds from lower sales of regulatory credits, as legacy automakers don’t necessarily need to buy these after the changes made by President Donald Trump’s administration. These credits have been a key driver of Tesla’s profits and there have been quarters where if not for these, the company would have posted a loss.

The impact was visible in the Q2 earnings also and Tesla’s sales of regulatory credits dropped to $439 million as compared to $890 million in the corresponding quarter last year

What to Watch in Tesla’s Q3 Earnings

Here is what I will watch in Tesla’s Q3 earnings report.

- Delivery Forecast: While Tesla’s deliveries rose on a year-over-year basis in Q3, they are still down in the first nine months of the year. Last year, Musk touted up to a 30% YoY rise in 2025 deliveries – a prediction the company has gradually toned down. During the Q3 earnings call, I will watch out for any comments on 2025 delivery guidance, in particular on whether Tesla expects its deliveries to grow this year. Also, while it might be a bit early, the company could face questions about the outlook for 2026, given the tepid demand environment in the U.S. – Tesla’s biggest market – following the withdrawal of the EV tax credit.

- Low-Cost Model: Musk has long touted the low-cost platform and it was also baked into his “20%-30% delivery growth” prediction for 2025. The company did launch a stripped version of its best-selling Model Y and Model 3 earlier this month, and during the earnings call, I will watch out for comments on whether these were the new models that the company has been talking about or if we should expect another model. On a similar note, I will watch out for comments on the projected margins for the newly launched models.

- Update on FSD: Earlier this year, Musk reiterated his often-repeated comments and said that he is “confident” about unsupervised full self-driving (FSD) being available “by the end of the year.” The Tesla CEO has made these “end of the year” predictions for the last many years, and while the company has made progress in autonomy, it’s not yet fully autonomous. During the earnings call, I will watch out for any comments on unsupervised FSD and whether it will be available this year or if we have yet another deadline. Notably, the National Highway Traffic Safety Administration (NHTSA), which has often been at odds with Tesla over FSD, recently opened yet another investigation into the technology fitted in nearly 2.9 million vehicles.

- Robotaxi Expansion: Tesla’s robotaxi operations might get a lot of attention during the Q3 earnings call. The company has been expanding the service and geofenced area gradually and is looking to add more cities by the end of this year.

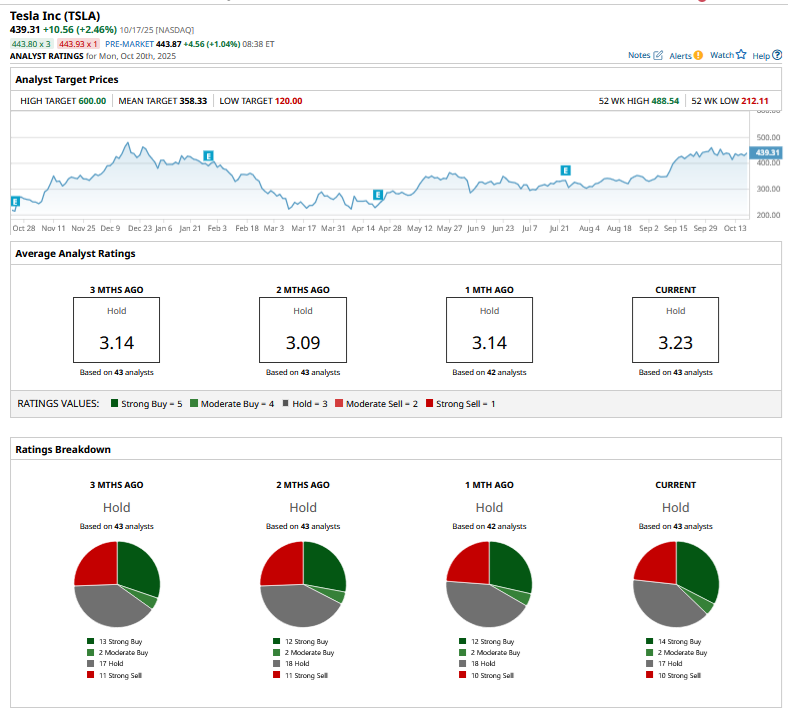

Tesla Stock Forecast

While several brokerages have raised Tesla’s target price heading into the Q3 print, the stock continues to trade above its mean target price and has a consensus rating of “Hold” from the analysts covering the stock. It is not unusual for Tesla – perhaps the most polarizing stock of our times – to trade ahead of consensus price targets.

All said, I am constructive on Tesla stock ahead of the report and don’t expect the stock to fall as it did following the Q2 confessional. However, the extent of the rise following the Q3 earnings will depend on the kind of outlook Musk outlines for the robotaxi business.