Authorities in Norway have proposed to revise incentives offered on EVs, in what could be a potential setback for Tesla Inc.'s (NASDAQ:TSLA) European goals as sales decline in the region.

Check out the current price of TSLA here.

‘The Goal Has Been Achieved,' Norwegian Authorities Say

Battery Electric Vehicles accounted for over 98% of total vehicles sold in the country during September, following which authorities in Norway said that the goal to transition to fully-electric vehicles "has been achieved," Reuters reported on Wednesday.

"Therefore, the time is ripe to phase out the benefits," the Scandinavian country's Finance Minister Jens Stoltenberg said in the statement.

Norway had exempted taxes on EVs applied to ICE-powered vehicles, but then introduced a 25% VAT (Value-Added-Tax) for EVs priced above 500,000 Kroner (approximately $49,500). The move affected the prices of high-end EVs. However, a revised proposal now suggests reducing the cap to under 300,000 Kroner (roughly $29,700).

How It Could Affect Tesla

Tesla's Model Y, which was the best-selling model from the automaker in the country and helped Tesla defy European sales slump, retails for 389,990 Kroner (approximately $38,600). Meanwhile, the Model 3 retails for 324,990 Kroner (approximately $32,200), meaning none of the Tesla vehicles now qualify for the incentives.

The rolling back of the incentives could affect the automaker's sales in a market that is usually pro-Tesla, as it has been in the Norwegian market for over 12 years and was the first country outside North America where Tesla introduced the Model S.

Tesla Gigafactory Texas 500k Milestone, Germany Production Boost

The news comes as Tesla's Gigafactory in Texas announced it reached the 500,000 units produced milestone recently. The factory primarily produces the Model Y and the Cybertruck.

Tesla's Gigafactory in Germany will also be ramping up production, citing positive feedback and increased demand from the markets it supplies to, according to the EV giant's head of production in the country.

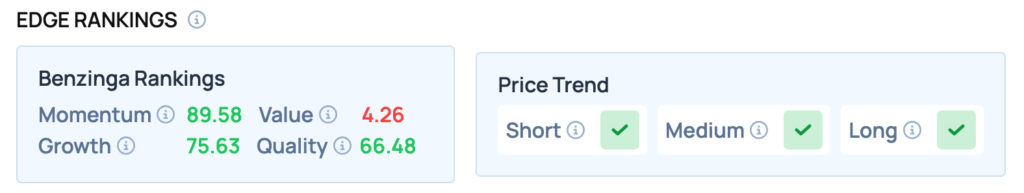

Tesla scores well on Momentum, Quality and Growth metrics, but offers poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Jonathan Weiss on Shutterstock.com