The average transaction price for a new EV in the U.S. slipped 2.2% in July as automakers rushed to move units off the lot before the $7,500 Federal EV Credit ends on September 30.

New EV Prices Fall 4.2% YoY In July, EV Incentives Soar 40%

The ATP for new EVs in July came in at $55,689, down 2.2% from June's $56,915, Kelley Blue Book data showcased on Monday. The average price also fell 4.2% in July compared to the previous year.

The average incentives offered on EVs also rose to over 17.5% of the ATP, a marked increase of 40% YoY and the record incentives offered on modern EVs, the data suggests.

“The urgency created by the administration’s decision to sunset government-backed, IRA-era EV incentives was expected to create serious demand for EVs in the short term,” Stephanie Valdez Streaty, an analyst cited in the report, said. She added that the trend points towards a “best-ever Q3” for automakers as “July sales were near an all-time monthly record.”

Tesla Leads The Price Cuts

Tesla Inc. (NASDAQ:TSLA) led the price cuts for EVs in July, with the ATP for a vehicle from the company coming in at $52,949. The ATP was down 9.1% YoY. "A higher mix of core Model 3 and Model Y products helped pull prices lower for Tesla," the report said.

Tesla Sales Fall Yet Again, Ford Readies New EV Platform

Tesla continued its sales decline, with the company's July Model Y and Model 3 sales down in China by 15% and 40% YoY, respectively. Tesla sales also fell by over 60% in the UK.

However, Tesla still dominates used EV sales in the U.S. with data from Carvana Co. (NYSE:CVNA), with the Model 3, the Model Y and the Model S comprising the top 3 spots on the platform.

Elsewhere, Ford Motor Co. (NYSE:F) has unveiled a new EV platform, which will form the basis of the company's affordable electric vehicle plans, as it will underpin a $30,000 EV from the company.

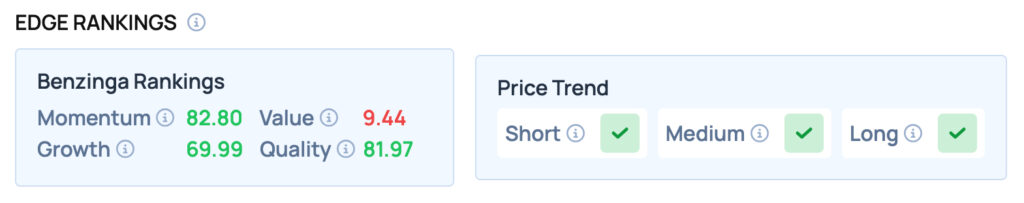

Tesla scores well on Momentum, Quality and Growth metrics, but offers poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: VTT Studio / Shutterstock.com