/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) remains in focus this morning after the automaker posted its strongest quarter ever, delivering 497,100 vehicles in the third quarter as buyers rushed to lock in the now-expired EV tax credits.

The company’s quarterly delivery number came in well above the Wall Street’s forecast of 448,000 and topped the 384,122 units that it delivered in the prior quarter and 336,681 in Q1.

At the time of writing, Tesla stock is up roughly 100% versus its year-to-date low set in early April.

Q3 Deliveries Remove an Overhang From Tesla Stock

The quarterly deliveries update helps remove a major overhang on TSLA stock that has been under pressure in recent months due to concerns of a growth slowdown.

Tesla has faced skepticism this year over weakening demand and pricing pressure, but this record-setting quarter flips the narrative.

The electric vehicles firm not just exceeded expectations, it did so by a wide margin, indicating strong inventory drawdown and robust consumer appetite, especially for its Model Y and Model 3

With momentum returning and tax credit-driven demand peaking, TSLA may be entering a new phase of operational strength.

William Blair Reiterates TSLA Shares at ‘Market Perform’

A William Blair analyst maintained his “Market Perform” rating on Tesla shares today but said the firm’s delivery strength is hard to ignore.

On Thursday, Jed Dorsheimer raised his estimates for the electric vehicle maker, noting the demand pull-forward related to the tax credit expiration was “stronger than we originally estimated.”

In his research report, Dorsheimer also highlighted that U.S. interest in the refreshed Model Y has been particularly encouraging while demand in China and other regions seems to be recovering as well.

In short, “it’s getting hard to stick with our neutral stance,” the investment firm admitted, signaling TSLA execution is outpacing expectations even if valuation remains a concern.

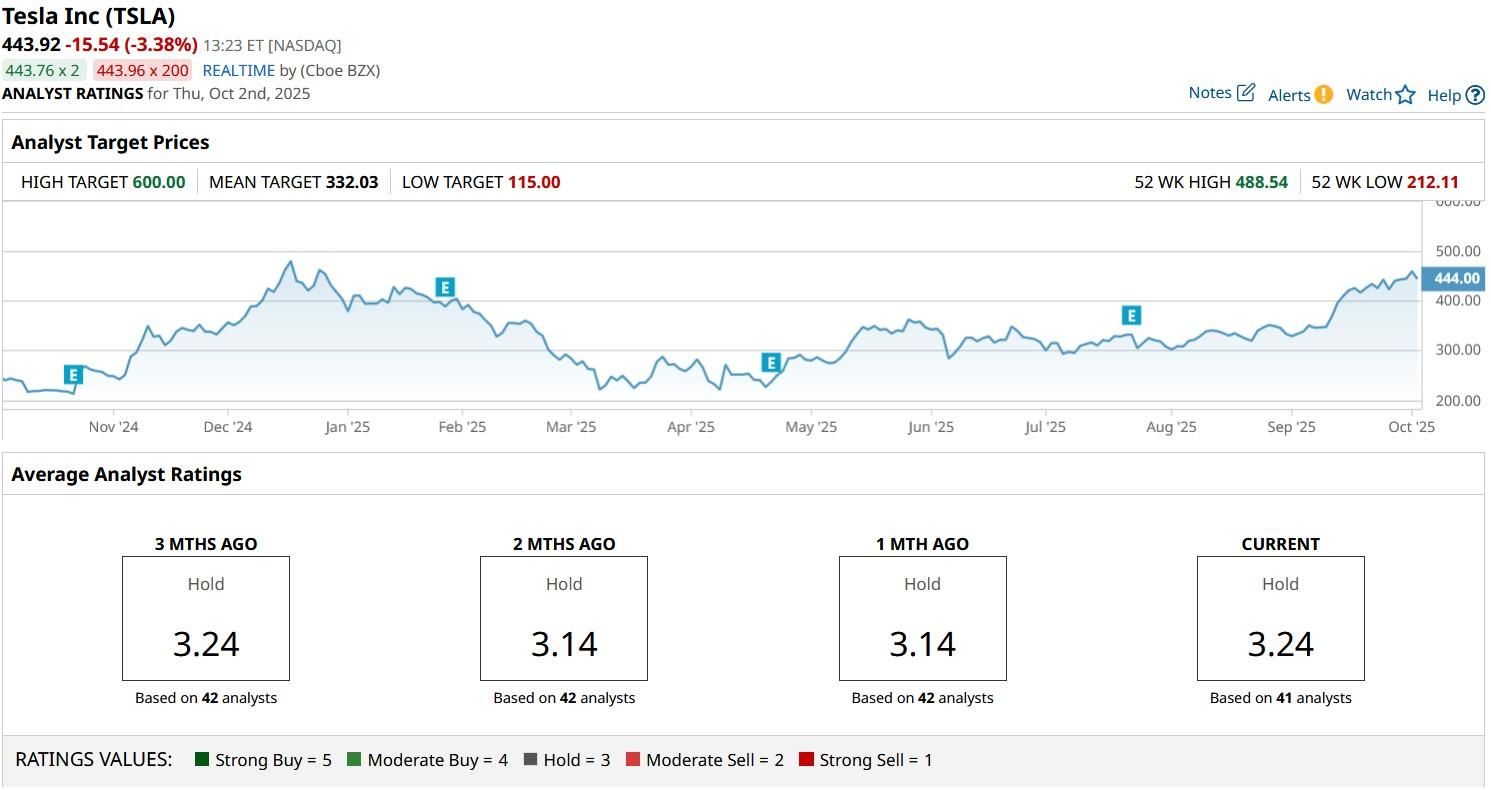

Wall Street Says Tesla Could Crash Hard From Here

Despite the deliveries uptick, Wall Street more broadly remains bearish on Tesla stock, at least for now.

According to Barchart, the consensus rating on TSLA shares sits at “Hold” currently, with the mean target of about $347 indicating potential downside of more than 22% from here.