/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) is back in focus following the abrupt departure of its highest-ranking sales and delivery executive for North America, Troy Jones. It is the latest of several high-profile executive departures that have come as the electric car pioneer struggles to overcome sluggish sales and growing investor angst.

The automanufacturer is experiencing a tumultuous 2025 as its auto sales have fallen in key markets and as CEO Elon Musk’s political involvements create reputational damage. Tesla’s delivery miss in Q2 has further raised questions about its ability to recover demand and preserve margins.

In the days leading up to July 23 earnings, everyone is eager to know if the company can reframe its story, or if leadership shuffles are merely the beginning of its structural issues.

About Tesla Stock

Currently valued at $1 trillion, Tesla (TSLA) is a true giant in the electric vehicle and clean energy industry. However, that has not protected it from volatility.

In the last 52 weeks, TSLA has varied between $182.00 and $488.54. Shares are currently trading at the $330 level, down more than 30% from their 52-week high and down 19% in the year to date.

Tesla has a price-earnings multiple of 244.77x and price-sales multiple of 10.61x, significantly above its industry peers. Despite the very high valuation, profit margins are stretched at 7.3%, and year-over-year net earnings fell 71% last quarter. These high multiples, once justified by hypergrowth expectations, appear stretched now as sales decline and demand dips. Tesla stock, on most comparisons, is pricey based on its growth profile.

Tesla Misses on Earnings

Tesla’s Q1 2025 earnings missed Wall Street expectations across the board. Adjusted EPS came out as $0.27, way below the predicted $0.39, and revenue equaled $19.34 billion, lower than the forecasted $21.11 billion.

Vehicle revenue decreased 20% year-over-year to $14 billion, due to declining Model 3 and Model Y deliveries and increasing price competition. Net earnings fell to $409 million, down significantly from $1.39 billion for the same quarter last year. Operating earnings fell 66%, as operating margins fell to 2.1%, the lowest since Q1 2020.

Management attributed the miss to seasonal factory line updates for the upgraded Model Y, as well as sturdier sales incentives and weaker price power. Still, the company gave no conclusive 2025 forecast and only said that it would “revisit” estimates in its July 23 Q2 earnings report.

Tesla is pressing ahead with its Austin robotaxi pilot and is due to begin assembling humanoid robots later this year.

What Analysts Foresee for Tesla Stock

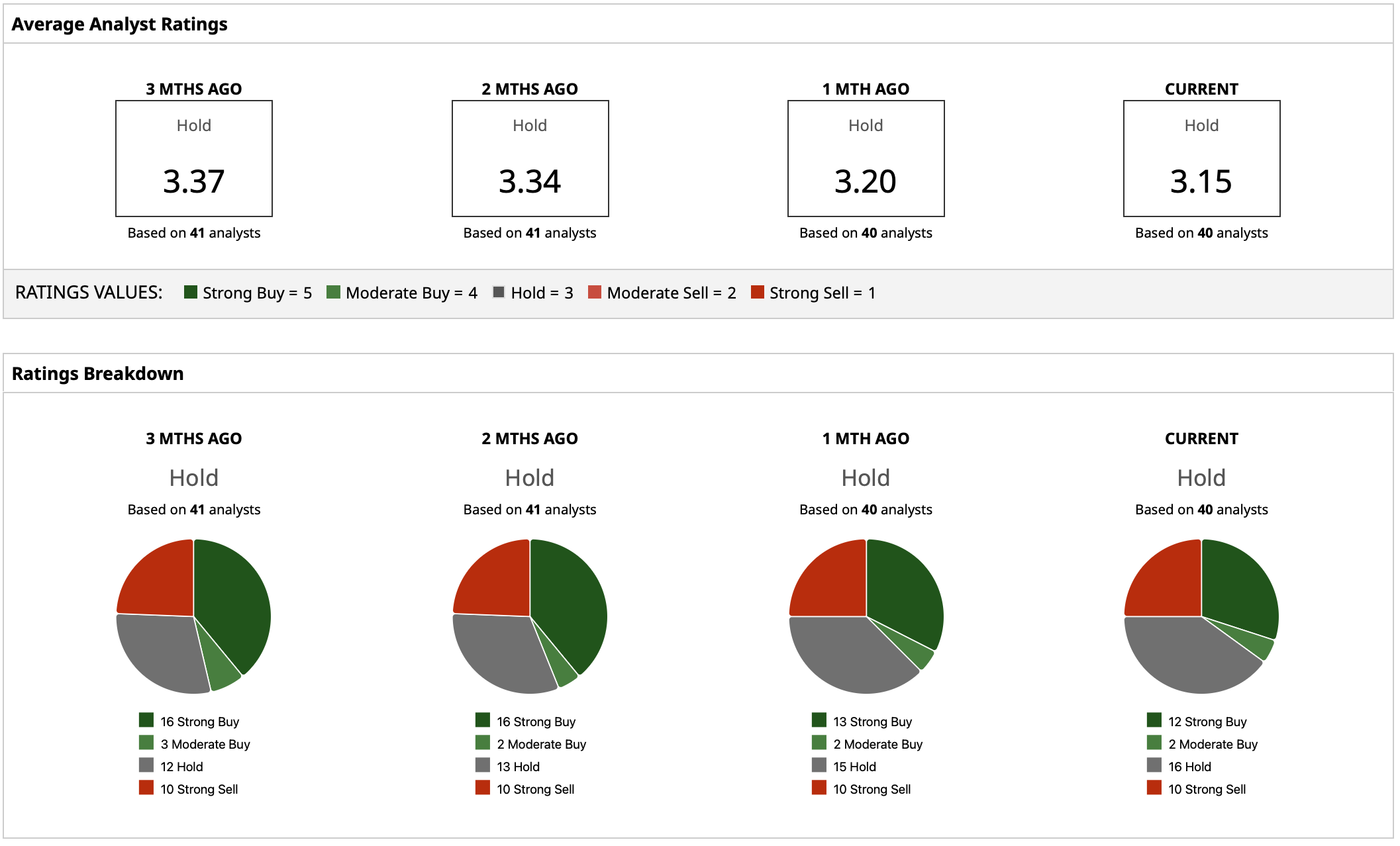

Tesla earns a “Hold” rating consensus. Long-term conviction in its innovation pipeline persists, but sentiment has deteriorated for the near term.

Tesla’s mean price target is $296, which is 10% down from its current trading price. Such an outlook, combined with mixed sentiment and slowing delivery growth, argues that the market is waiting for Tesla to reassert an appealing growth story before re-rating the shares.