Tesla Inc. (NASDAQ:TSLA) and General Motors Co. (NYSE:GM) EV battery supplier Contemporary Amperex Technologies Ltd. (CATL) has topped the global EV battery market, leading the sector with a healthy lead over closest rival BYD Co. Ltd. (OTC:BYDDY) (OTC:BYDDF).

CATL Captures 37.5% Of Global EV Battery Market

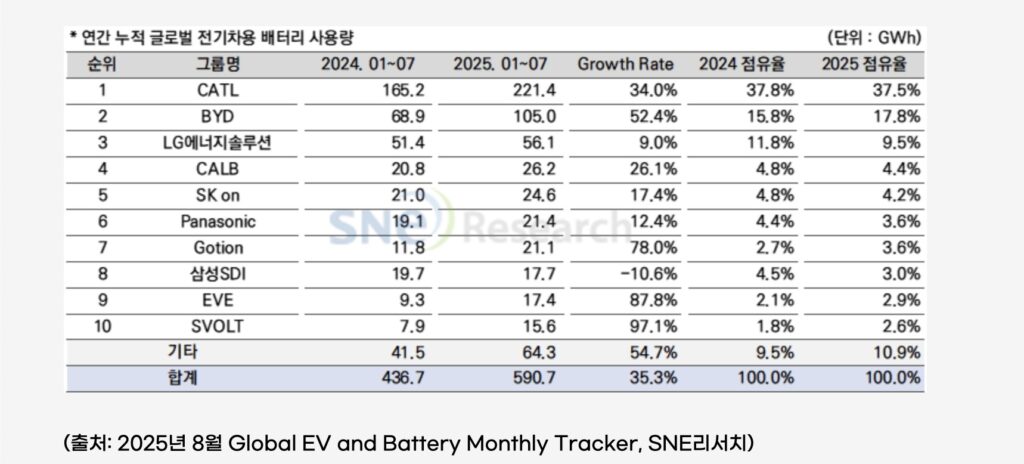

The Chinese EV giant boasts a market share of 37.5%, supplying over 221.4 GWh of batteries in the global market, which stands at 590.7 GWh from January to July 2025, data released by South Korean research firm SNE Research showed on Tuesday.

CATL recorded a 34% YoY growth when compared to last year. Meanwhile, BYD surged 52.4% with over 105 GWh of battery installations from January to July, up from 68 GWh last year during the same period. BYD holds 17.8% of the global market. Together, both companies capture more than half of the global market.

South Korean Companies Grow As Well

South Korea's LG Energy Solutions held the third spot on the chart, with 56.1 GWh battery installations, experiencing a 9% YoY increase and capturing 9.5% of the market. SK On, another South Korean battery manufacturer, holds over 4.2% of the market, the data suggests.

CATL's Deal With GM, Ford Partners With SK On

The news comes as GM recently announced a partnership with CATL to supply LFP batteries for the upcoming Chevrolet Bolt EV, which would be the company's most affordable EV at $30,000.

GM's deal with CATL is a ‘stop-gap' agreement and will last until 2027, when partner LG Energy Solutions would ramp up production of EV batteries at its domestic battery plant in the U.S.

Meanwhile, Ford Motor Co. (NYSE:F) has kicked off EV battery production at its BlueOval SK multi-billion dollar plant in Kentucky. The plant was built in collaboration with SK On and will produce batteries for the F-150 Lightning Pickup Truck.

Elsewhere, GM also recently announced it sold over 21,000 EVs in the U.S. during August, a monthly record for the company, which holds the #2 spot on the U.S. EV maker charts.

Tesla’s Robotics Push, BYD Profit Slips

Tesla, on the other hand, released the company's Master Plan IV, which focuses on Robotics and AI growth. Following the release, CEO Elon Musk predicted that the Optimus Robot would make up for over 80% of Tesla's value in the future.

BYD’s shares recorded a 6% decline on the Hong Kong stock exchange as the company reported a 30% decline in profits owing to China’s EV Price War, among other reasons.

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock