Tesla (TSLA) stock has been bouncing between 300 and 360 for the best part of two months.

Tesla recently reported Q2 earnings that missed expectations, with automotive revenue down 16% year-over-year and vehicle deliveries falling 14% to 384,000 units.

The expiration of the $7,500 U.S. federal EV tax credit and the phase-out of regulatory carbon credits are expected to further pressure margins.

Tesla has begun testing its robotaxi service in Austin and is pushing forward with its Optimus humanoid robot initiative, aiming for large-scale production within five years.

Meanwhile, regulatory challenges in Europe and China are delaying full self-driving approvals, and rising competition from lower-cost EV makers continues to erode Tesla’s market share

Today, we’re looking at a calendar spread on Tesla stock.

Calendar spreads are an option trade that involves selling a short-term option and buying a longer-term option with the same strike.

Traders can use calls or puts and they can be set up to be neutral, bullish or bearish with neutral being the most common.

When doing bullish calendar spreads, we typically use calls to minimize the assignment risk. Likewise, if the calendar is set up with a bearish bias, we use puts.

Neutral calendars can use calls or puts, but calls are more common.

Let’s look at an example using Tesla.

Tesla Calendar Spread Example

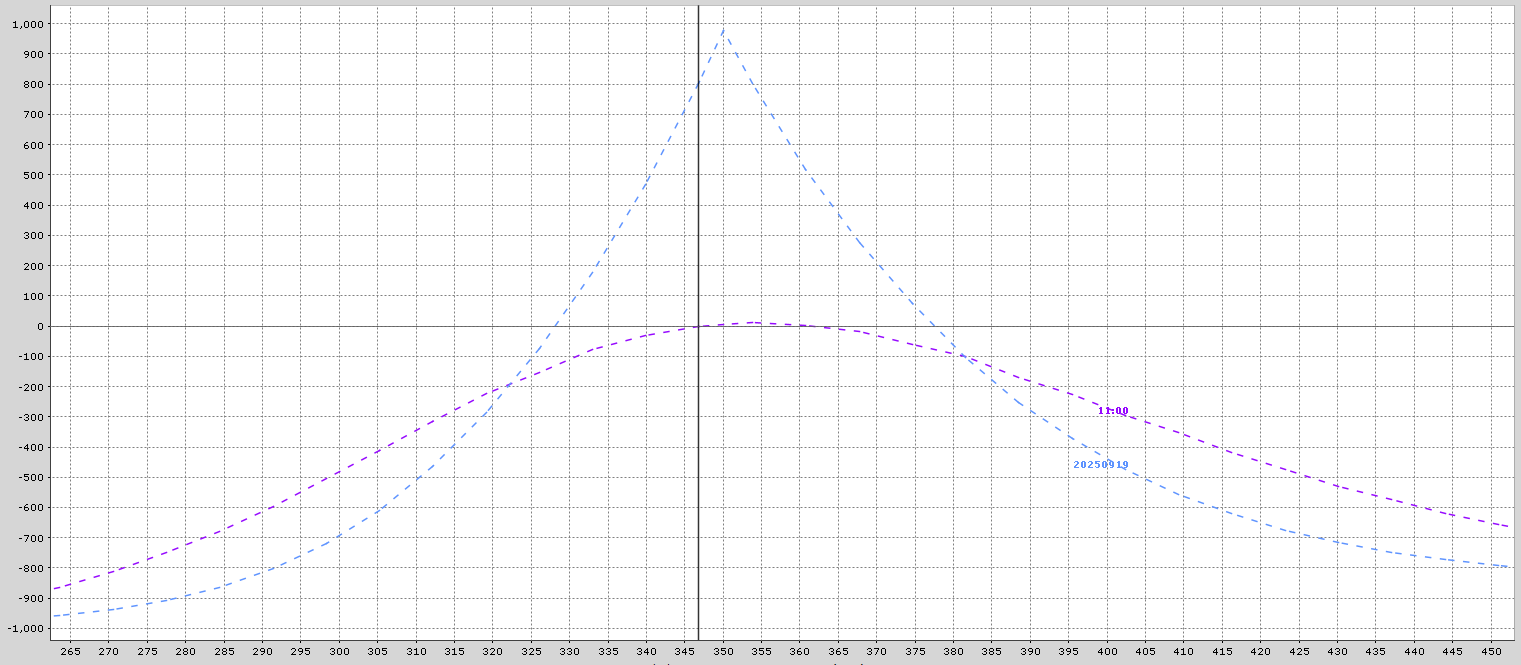

With Tesla stock trading around $350, setting up a calendar spread at $350 gives the trade a neutral outlook.

Selling the September 19 call option with a strike price of $350 will generate around $1,620 in premium, and buying the October 17, $350 call will cost approximately $2,610.

That results in a net cost for the trade of $990 per spread, and that is the most the trade can lose.

The estimated maximum profit is $1,000, but that could vary depending on changes in implied volatility.

The idea with the trade is that if TSLA stock remains around $350 for the next few weeks, the sold option will decay faster than the bought option allowing the trade to be closed for a profit.

The breakeven prices for the trade are estimated at around $328 and $378 but these can also change slightly depending on changes in implied volatility.

In terms of trade management if TSLA broke through either $330 or $375, I would look to adjust or close the trade.

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

Tesla Company Details

The Barchart Technical Opinion rating is a 56% Buy with a Average short term outlook on maintaining the current direction.

Tesla is the market leader in battery-powered electric car sales in the United States, with roughly 70% market share.

The company's flagship Model 3 is the best-selling EV model in the United States.

Tesla, which has managed to garner the reputation of a gold standard over the years, is now a far bigger entity that what it started off since its IPO in 2010, with its market cap crossing $1 trillion for the first time in October 2021.

The EV king's market capitalization is more than the combined value of legacy automakers including Toyota, Volkswagen, Daimler, General Motors and Ford.

Over the years, Tesla has shifted from developing niche products for affluent buyers to making more affordable EVs for the masses.

The firm's three-pronged business model approach of direct sales, servicing, and charging its EVs sets it apart from other carmakers. Tesla, which is touted as the clean energy revolutionary automaker, is much more than just a car manufacturer.

Mitigating Risk

Thankfully, calendar spreads are risk defined trades, so they have some build in risk management. Position sizing is crucial to ensure that minimal damage is done if the trade suffers a full loss.

One way to set a stop loss for a calendar spread is close the trade if the loss is 20-30% of the premium paid.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.