Tesla Inc. (NASDAQ:TSLA) bull and Wedbush Securities' investor Dan Ives has expressed optimism over the EV giant's affordable models as well as the Full Self-Driving (FSD) V14.1 updates.

Check out the current price of TSLA stock here.

Lower-Priced Model First Step Towards 500K Deliveries

In a new investor's note released on Tuesday following the announcement of affordable models in the company's lineup, Ives reiterated his bullish stance on the company's stock performance. "We believe the launch of a lower cost model represents the first step to getting back to a ~500k quarterly delivery run-rate," Ives said in the note.

However, he conceded that the affordable Model Y and Model 3 trims, which boast a similar price point to the already-available variants with the EV credit, could pose a challenge. "We are relatively disappointed with this launch as the price point is only $5k lower than prior Model 3's and Y's," Ives said.

FSD V14.1 Could Help Tesla Reach $2 Trillion Market Cap

On FSD's latest 14.1 update, Ives hailed the improvements to the system, which now promise fewer interventions as well as updated arrival options for parking in streets, garages and more.

"We believe Tesla could reach a $2 trillion market cap early 2026 in a bull case scenario and $3 trillion by the end of 2026 as full scale volume production begins of the autonomous and robotics roadmap," Ives said, adding that an AI-driven march for Tesla's valuation has begun.

Ives also said that the "FSD and autonomous penetration" as well as Tesla's acceleration of the Cybercab development represents "the golden goose for Musk & Co." Ives maintained an "Outperform" rating and a $600 price target for Tesla.

Tesla’s Robotics And AI Push

Ives had earlier said that autonomous driving and robotics present a trillion-dollar market opportunity for Tesla. The EV giant has recently begun its push towards AI and robots with its Master Plan IV, with Tesla also debuting the Optimus robot during a red carpet event.

It's also worth noting that Tesla quietly revised the meaning of the FSD system following the unveiling of Elon Musk's $1 trillion pay package, which stipulates a milestone of 10 million active FSD subscriptions to make Musk eligible for receiving a tranche of the compensation award.

Analysts Criticize Tesla For Affordable Models

The news comes as Tesla has faced criticism from analysts for releasing the affordable models, with Future Fund LLC's Gary Black saying that the models wouldn't sell as they offer fewer features for the price.

Meanwhile, Ross Gerber, co-founder of investment firm Gerber Kawasaki, also criticized the affordable Model Y, cautioning people against buying Tesla vehicles. Gerber also predicted a difficult Q4 awaits Tesla despite strong Q3 deliveries.

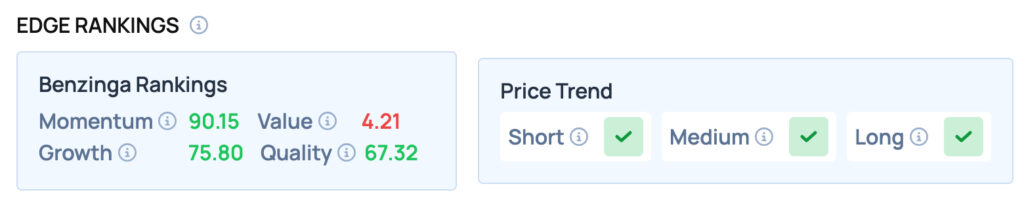

Tesla scores well on Momentum, Growth and Quality metrics, but offers poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Around the World Photos On Shutterstock.com