- More non-Tesla drivers have started using Superchargers as their default network as it opens up to all EVs.

- This migration towards Superchargers has reduced utilization at some non-Tesla networks.

- The overall deployment of public fast charging stations cooled marginally in Q3 compared to Q2.

- America is still on track for record fast charger deployment by the end of the year.

The U.S. continued to deploy electric vehicle public fast-charging stations at a robust pace in the third quarter, even though growth slowed marginally compared to the previous quarter. Tesla spearheaded this deployment with by far the most new stalls, while other networks also stepped up their efforts.

Charging companies added 699 public fast-charging stations nationwide between July and September, a 12% decline compared to the 794 ports added in the second quarter of this year, EV charging data platform Paren said in a report.

The figure is lower compared to the U.S. Department of Energy’s report of 780 new fast charging stations in Q3. Paren data accounts for stations that have come online for a more accurate number, whereas the DOE is possibly reporting stalls installed, but ones that haven’t yet been switched on.

Still, charger growth seems to be surviving the second Trump administration, which has broadly rolled back clean energy programs and only recently unlocked previously frozen federal funds for chargers following a court ruling.

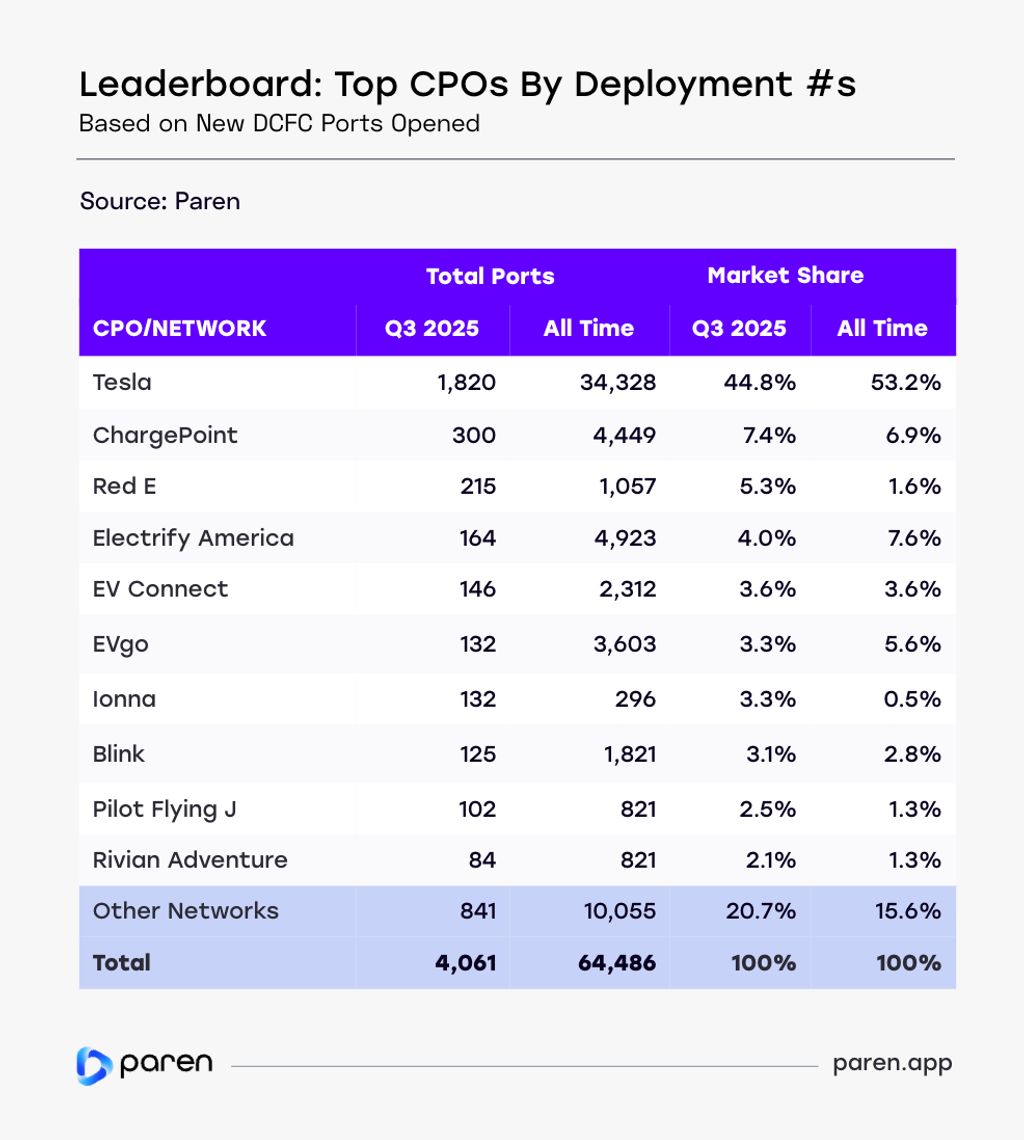

Seven hundred new stations in the third quarter may seem like a small number, but they together provide 4,061 new DC fast-charging ports. We reported previously that the U.S. is deploying fewer stations, but those have more ports at each location, with higher-powered stalls delivering faster charging speeds.

Tesla was comfortably ahead of the pack. Of the 4,061 new ports added, 1,820 were part of the Tesla Supercharger network. That’s more than the next nine networks combined. ChargePoint ranked a distant second with 300 new ports, followed by Michigan-based charging company Red E with 215 new ports.

As of writing, Tesla’s all-time port deployment in the U.S. stood at a whopping 34,328 stalls, accounting for 53.2% of the entire market. But third quarter deployment was lower at 44.8%, as rivals have started adding more chargers amid soaring EV sales over the past few years.

The Supercharger deployment is still remarkable, especially considering last year’s tumult at the company’s charging division.

In April 2024, CEO Elon Musk fired nearly 500 members of Tesla’s Supercharger team following a reported dispute with Rebecca Tinucci, the company’s former senior director of charging infrastructure, who had resisted further cuts after laying off 15% to 20% of her staff two weeks earlier. This represented basically the entire Supercharger team at the time.

Tesla ultimately re-hired some of these employees and resumed the buildout of the Supercharger network in the following quarters as more automakers switched to the now-standardized J3400 charging port—more commonly called the North American Charging Standard (NACS) plug—which Tesla developed.

Tinucci was not among those who returned to Tesla. She went on to spearhead Uber’s electrification efforts.

With Tesla expanding Supercharger access to pretty much all EVs, usage patterns are also shifting, Paren said in its report. Some non-Tesla networks are seeing lower utilization as more drivers make Superchargers their default option for charging.

I’ve seen this shift firsthand. Every press loaner I’ve tested this year that arrived with a built-in NACS port—I ended up charging them exclusively at Superchargers. They’re just reliable, simple and easy to use.

The list of new EVs with the native NACS connector is long. It includes the latest model years of the Hyundai Ioniq 5, Ioniq 9, Kia EV6, EV9, Toyota bZ, Subaru Solterra, Nissan Leaf, Lucid Gravity, Cadillac Optiq and more.

All said, Tesla was not the only top mover in the U.S. EV charging space in the third quarter.

The Ionna network, which is a consortium of eight U.S. automakers including General Motors and Toyota, added 12 new stations and 132 new ports in Q3. The network is just over a year old, but has ramped up rapidly in the past 12 months and continues to do so.

And Red E, which started by deploying dual-cable charging stalls in its home state of Michigan, is now expanding nationwide. Red E is rolling out DC fast charging stations at the Aldi grocery chain as well as smaller convenience stores.

Analysts have forecasted that EV sales will slow down in the coming months and weeks due to the expiration of the $7,500 federal tax credit. But charger deployment might not necessarily follow that same curve.

Charging networks are still expanding, installing new, higher-powered stalls for quick top-ups that are located conveniently near restaurants and restrooms. They’re building ahead of demand, betting that EV sales could rebound in the future in case of a slowdown in the interim.

Have a tip? Contact the author: suvrat.kothari@insideevs.com