Tempus AI, Inc. (NASDAQ:TEM) will release earnings results for the second quarter before the opening bell on Friday, Aug. 8.

Analysts expect the Chicago, Illinois-based company to report a quarterly loss at 25 cents per share, versus a year-ago loss of 63 cents per share. Tempus AI projects to report quarterly revenue at $297.76 million, compared to $165.97 million a year earlier, according to data from Benzinga Pro.

On July 16, Tempus AI announced that it received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its ejection fraction software.

Tempus AI shares gained 5.8% to close at $58.74 on Thursday.

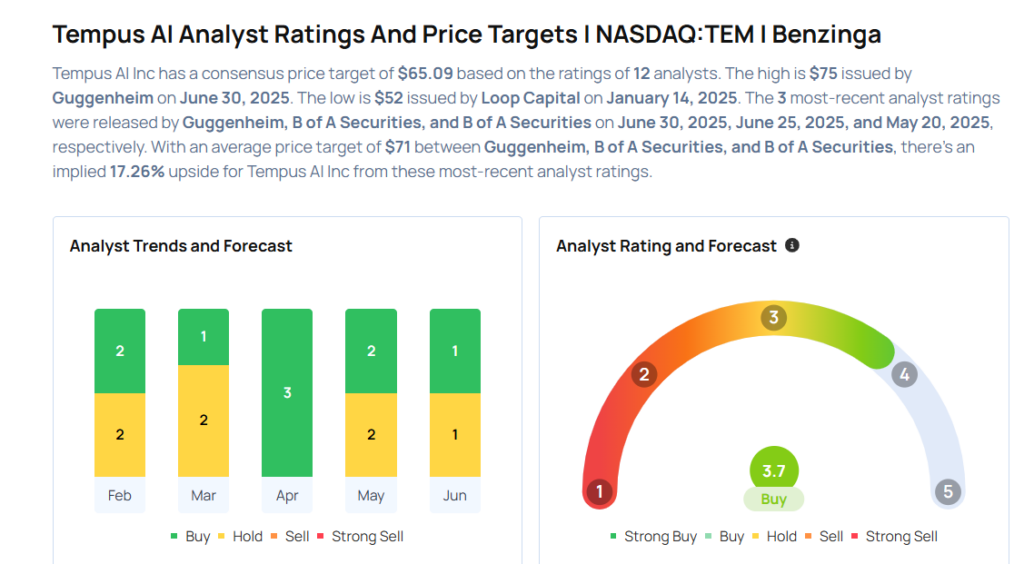

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Piper Sandler analyst David Westenberg maintained a Neutral rating and increased the price target from $55 to $70 on May 15, 2025. This analyst has an accuracy rate of 63%.

- Needham analyst Ryan MacDonald reiterated a Buy rating with a price target of $70 on May 7, 2025. This analyst has an accuracy rate of 62%.

- BTIG analyst Mark Massaro initiated coverage on the stock with a Buy rating and a price target of $60 on April 21, 2025. This analyst has an accuracy rate of 72%.

- JP Morgan analyst Rachel Vatnsdal downgraded the stock from Overweight to Neutral and raised the price target from $50 to $55 on Feb. 25, 2025. This analyst has an accuracy rate of 66%.

- TD Cowen analyst Dan Brennan reinstated a Buy rating with a price target of $74 on Feb. 5, 2025. This analyst has an accuracy rate of 63%

Considering buying TEM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock