/Teledyne%20Technologies%20Inc%20logo%20on%20website-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of around $27.6 billion, Teledyne Technologies Incorporated (TDY) is a differentiated technology powerhouse operating at the intersection of defense, industrial monitoring, and high-end digital imaging. Far from a typical industrial conglomerate, Teledyne's portfolio is built around "enabling technologies," highly specialized sensors, electronics, and systems, that are critical to government, aerospace, and deepwater exploration customers.

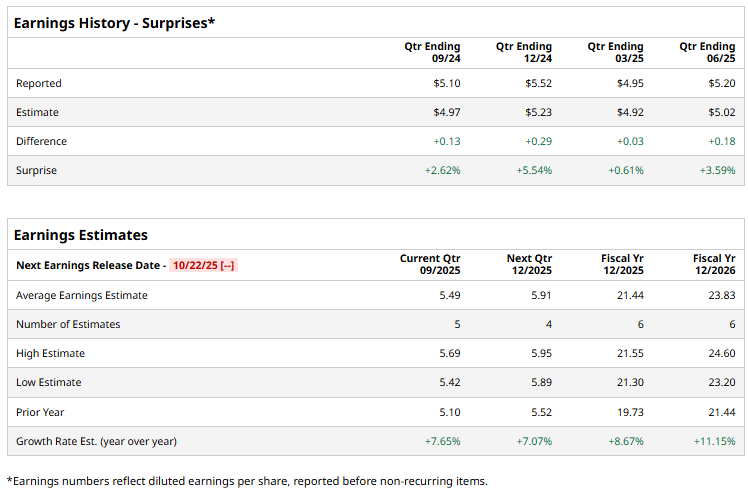

The Thousand Oaks, California-based company is expected to announce its fiscal Q3 2025 earnings results soon. Ahead of this event, analysts expect TDY to report an adjusted EPS of $5.49 per share, a 7.7% growth from $5.10 in the year-ago quarter. It has consistently exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts expect the company to report adjusted EPS of $21.44, representing an 8.7% increase from $19.73 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 11.2% year-over-year to $23.83 in fiscal 2026.

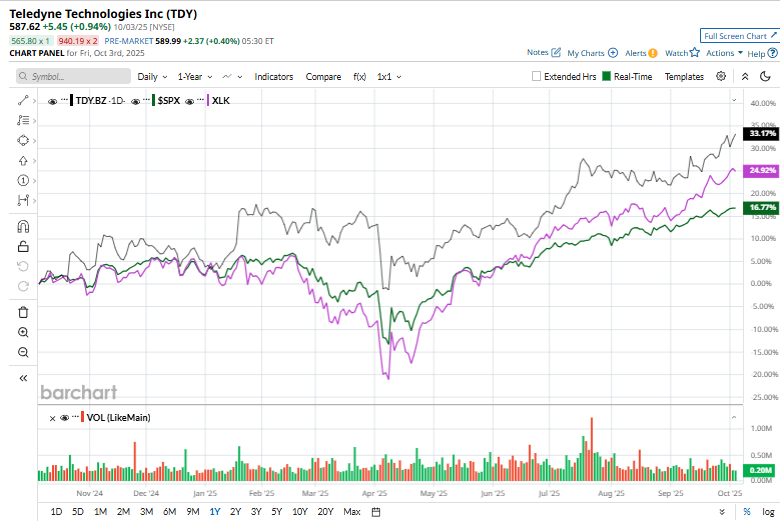

Shares of Teledyne Technologies have gained 33.7% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 17.8% return and the Technology Select Sector SPDR Fund's (XLK) 27.8% rise over the same period.

On Jul. 23, TDY reported Q2 results, with revenue rising 10.2% year-over-year to a record $1.5 billion, surpassing consensus estimates by 2.7%. Moreover, its adjusted EPS of $5.20 grew 13.5% from the same period last year and came in 3.6% ahead of analyst expectations. Although the market initially pushed the stock to a new 52-week high of $570.56, it closed down by 1.7%.

Analysts' consensus view on Teledyne Technologies stock remains very bullish, with a "Strong Buy" rating overall. Out of 11 analysts covering the stock, eight recommend a "Strong Buy," one "Moderate Buy," and two "Hold." TDY’s average analyst price target of $607.40 indicates a premium of 3.4% from the current market prices.