Shares of Teladoc Health Inc (NYSE:TDOC) are surging Friday morning after Citron Research posted bullish comments on the telehealth provider, asserting they were “not wrong, just early” on the stock’s potential. The commentary sparked renewed investor interest, pushing the stock higher in early trading.

What To Know: Citron’s renewed confidence stems from the performance of Teladoc’s chronic care division, Livongo. The firm highlighted a recent Bank of America report indicating that Livongo’s usage had jumped 55% year-over-year, marking the most significant increase since January 2025.

Citron drew a sharp contrast between this strong user growth and the company’s current stock price of around $8.50, noting that Teladoc traded above $15 the last time Livongo’s user metrics were at similar levels.

While identifying Livongo as the “SaaS backbone of Teladoc,” Citron suggested that the performance of the BetterHelp therapy service has weighed on the stock. Looking ahead, the firm posited that a resolution to the current government shutdown could act as a significant catalyst for the shares.

Investors will be closely watching for the company’s next earnings report, scheduled for October 29. Wall Street analysts are forecasting a quarterly revenue of $625.62 million and a net loss of 29 cents per share.

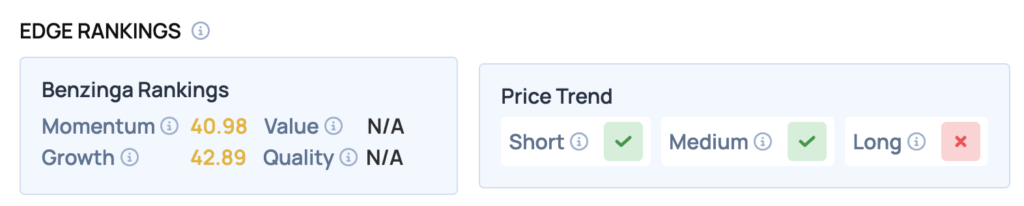

Benzinga Edge Rankings: Reflecting Friday’s positive sentiment, Benzinga Edge analysis shows the stock’s price trend is positive for the short and medium term, though its long-term trend remains negative.

TDOC Price Action: Teladoc Health shares were up 10.5% at $9.37 at the time of publication Friday, according to Benzinga Pro. The stock is trading within its 52-week range of $6.35 to $15.21.

The stock is trading above its 50-day ($7.65) and 100-day ($7.64) moving averages, indicating a bullish trend. Key resistance is observed around the 200-day moving average at $8.42, while support may be established near the recent low of $8.50.

Read Also: USA Rare Earth Stock Jumps On White House Talks — Will Trump Take A Stake?

How To Buy TDOC Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Teladoc Health’s case, it is in the Health Care sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock