China and the U.S. are engaged in a technology tit-for-tat with each side ratcheting up the stakes.

Concern that U.S. companies are over-reliant on China as a supplier has led many companies, including Apple, to discuss diversifying to other countries. And fear that using non-domestic next-gen technology, such as artificial intelligence, could expose each country to risks has led to restrictions from both sides.

Last year, China reportedly told government and state buyers to shun Apple iPhones for those made domestically by the likes of Xiaomi and Honor. Meanwhile, the U.S. enacted restrictions to curb the sale of high-end technology, including AI chips and semiconductor equipment, to Chinese buyers.

More recently, it appears China’s rules will phase out the use of other semiconductor chips from top U.S. companies like AMD and Intel to boost the use of its domestic chipmakers.

China tech tensions with the U.S. increase

The tech tensions cast a shadow over China’s attempts to rekindle foreign investment, which has slowed, and this past weekend’s high-profile China Development Forum, a conference attended by many of the world’s biggest corporate leaders.

Related: Apple stock slips after CEO Tim Cook pitches China

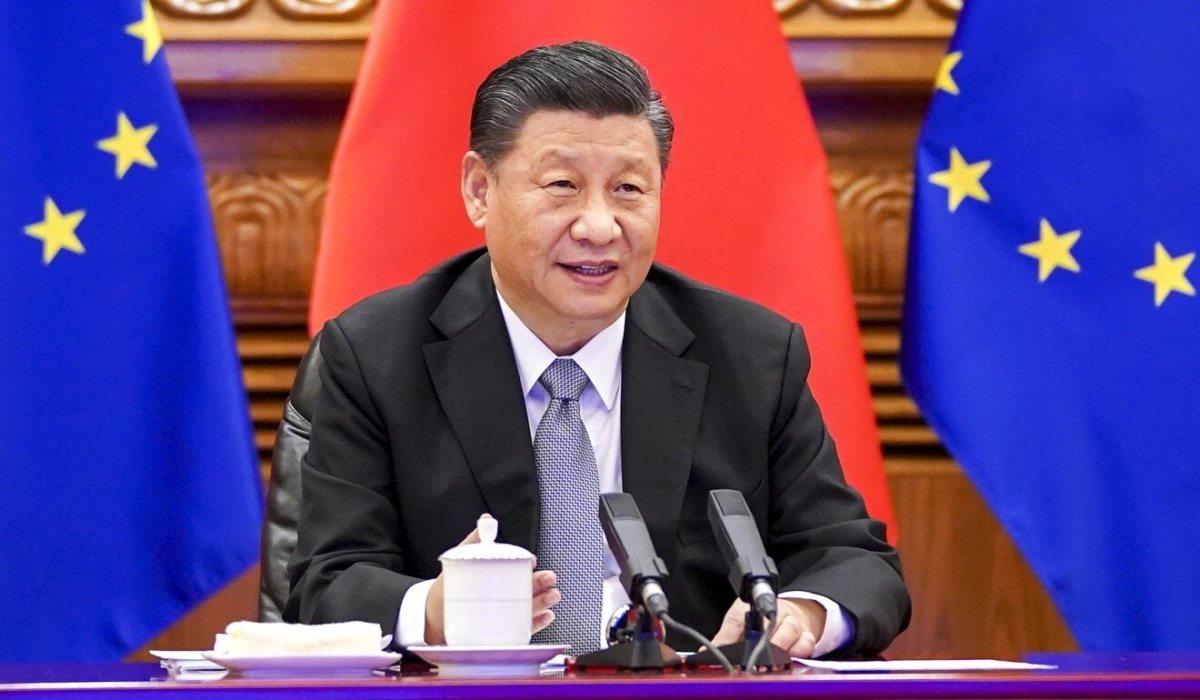

Perhaps, to reshape the narrative, China President Xi Jinping reportedly extended an invitation to meet with some CEOs on Wednesday, causing them to readjust their travel plans.

“Company chiefs are flirting outrageously in the hopes of winning greater access for their products, while also fearing the disapproving gaze over their shoulder of their U.S. government chaperones,” said TheStreet Pro’s Alex Frew McMillan. “Wednesday’s corporate meeting with Xi, if it proceeds, would provide unrivaled access to the key decisionmaker driving Chinese policy.”

A key message to business leaders at the forum was that its economy is still open for business. McMillan points out that foreign direct investment in China sagged 8% last year.

Related: AMD stock analysts overhaul price targets after China news

The impromptu meeting seems to reverse a prior decision by the leadership to skip a formal meet and greet with C-suite execs.

“The Chinese premier normally headlines the forum and gives a briefing to international CEOs at the end of the event, a rare opportunity for executives to mingle with policymakers. But current Premier Li Qiang, who gave the keynote address, did not hold that meeting this year,” said McMillan.

The stakes for U.S. tech companies (and their investors) are high.

“There’s little to lose for services companies such as financial institutions or restaurant chains in terms of petitioning for greater access to the Chinese market,” said McMillan. “But for tech companies such as Broadcom, whose CEO Hock Tan is among the forum delegates, the ground is rockier, the politics harder to traverse.”

Apple sales are down in China, but it still pocketed nearly $21 billion in revenue there during the fourth quarter. China accounts for around one-third of Broadcom’s sales. It accounts for about 25% and 15% of revenue at Micron (MU) and Advanced Micro Devices (AMD) .

It’s unclear if executives at those companies were extended an invitation, and if so, if the conversation will be friendlier than what's been publicly reported regarding technology restrictions.

Related: Veteran fund manager picks favorite stocks for 2024