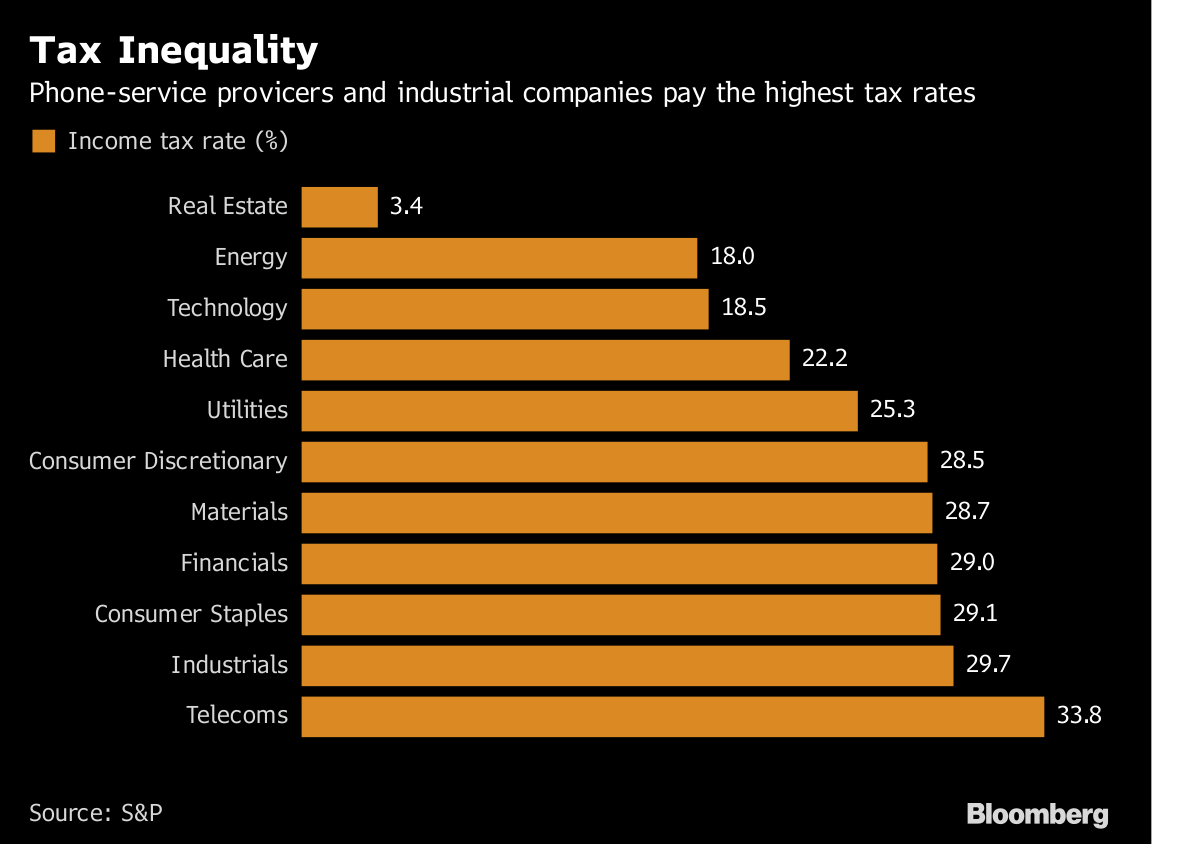

Trying to explain the Nasdaq 100’s worst drop in three months? Check out the various tax rates American industries actually end up paying the federal government.

While not usually a liability, one problem for technology stocks right now is that they don’t pay that much. Among sectors, the 18.5 percent effective tax rate enjoyed by the group is the third-lowest among U.S. large caps, according to S&P Global data. And that means less potential bounty should Republican legislation moves through Congress.

“It’s the tax bill hurting tech,” said Frank Ingarra, head trader at Greenwich, Connecticut-based NorthCoast Asset Management LLC, which oversees $1.8 billion. “When you have something that’s got so extended and done so well, and people start thinking about these things, of course you’re going to have profit taking.”

Equities were caught in another violent rotation Wednesday, with financial stocks posting the best two-day rally in more than a year as the Nasdaq 100 fell the most since last August’s meltdown. Companies from Nvidia Corp. to Facebook Inc., up more than 50 percent in 2017, sustained losses of 4 percent or more. Their effective tax rates are 6.5 percent and 10.1 percent, respectively, data compiled by Bloomberg show.

Not that tax reform has been required for Nasdaq stocks to buckle in the past. Wednesday’s rout bore striking resemblances to other stormy sessions in the U.S. stock market this year, most notably Aug. 9, when the index tumbled 2.4 percent and the S&P 500 was little changed. Then as now a plausible explanation was the reconsideration of a rally that has sent groups like semiconductor makers up almost 40 percent in 2017.

“This rotation is not connected to the tech sector fundamentals, but it’s just investors asking themselves, tech has had a great run this year, but which sectors may be benefit from the tax reform?” said Mark Kepner, managing director and equity trader at Themis Trading LLC in Chatham, New Jersey. “Part of the selloff is that we also have the seasonality effect as people buy into sectors like financials in anticipation of pension money flowing in in January.”

Another theme recurring from June is rallying banks. The S&P 500 Financials Index is up 4.4 percent in two days, buoyed by congressional testimony yesterday by Federal Reserve nominee Jerome Powell in which he previewed a lighter hand on regulation. The Russell 2000, whose domestic-focused constituents have made it somewhat of a proxy for the progress of tax reform, has gained 1.9 percent in two days.

“Is it tech versus financials or is it large cap versus small cap? It seems like there’s a lot of themes overlapping there,” Mike Bailey, director of research at FBB Capital Partners in Bethesda, Maryland, said by phone. On tax legislation, he said: “The magnitude of the move today to me suggests that’s probably not the only driver of what’s going on. There wasn’t some magical announcement that came out and said we’re definitely having a tax cut for sure, black and white. On the margin that could be something helping financials and maybe hurting tech.”

--With assistance from Lu Wang

To contact the reporters on this story: Sarah Ponczek in New York at sponczek2@bloomberg.net, Elena Popina in New York at epopina@bloomberg.net.

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2017 Bloomberg L.P.