TD SYNNEX (NYSE: SNX) posted better-than-expected third-quarter results on Thursday.

The company reported revenue of $15.65 billion, which not only surpassed the analysts' expectations of $15.11 billion but also marked a 6.6% increase from the previous year's figure of $14.69 billion.

TD SYNNEX reported adjusted earnings of $3.58 per share for the quarter, comfortably exceeding the forecasted $3.05 per share. This performance represents a notable 25.2% growth compared to the earnings of $2.86 per share recorded a year ago.

"Our third quarter non-GAAP gross billings and diluted earnings per share established new records for our company," said Patrick Zammit, CEO of TD SYNNEX. "Our performance is a clear result of our teams' strong execution, a differentiated go-to-market strategy, and a global, end-to-end portfolio of products and services that is unrivaled."

Looking ahead to the fourth quarter of 2025, the company anticipates adjusted earnings to range between $3.45 and $3.95 per share. This forecast is higher than the market's expectation of $3.33 per share. The revenue outlook for the coming quarter is projected to be between $16.50 billion and $17.30 billion, which also eclipses the anticipated $15.99 billion.

TD SYNNEX shares gained 1% to $161.30 on Friday.

These analysts made changes to their price targets on TD SYNNEX following earnings announcement.

- B of A Securities analyst Ruplu Bhattacharya maintained TD Synnex with a Buy and raised the price target from $170 to $180.

- Barclays analyst Tim Long maintained the stock with an Equal-Weight rating and raised the price target from $140 to $164.

- Morgan Stanley analyst Erik Woodring maintained TD Synnex with an Overweight rating and raised the price target from $173 to $181.

- RBC Capital analyst Ashish Sabadra maintained the stock with an Outperform rating and raised the price target from $165 to $180.

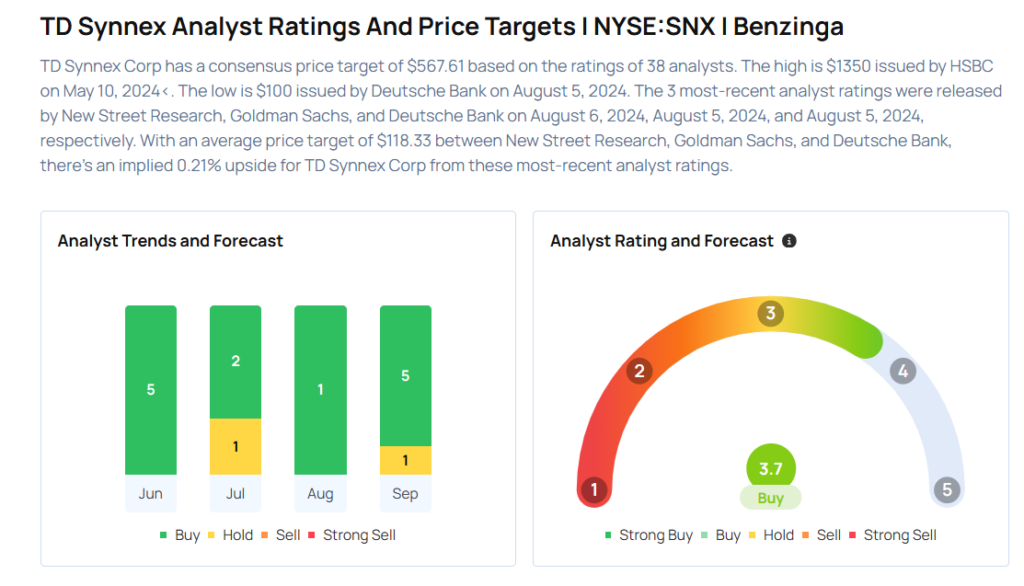

Considering buying SNX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock