A stalwart in the tax software arena, TaxCalc has been around for a long time, with origins that stretch back to the 1980s. Originally from the Which? brand, TaxCalc got sold to Intuit in the early 2000s. Then, in 2005, Acorah software acquired the program TaxChecker, bought back the TaxCalc name from Intuit, married the two together and the modern version of TaxCalc was born.

Today, it boasts quite a bit of popularity with more than 60,000 individual, business and accountancy practice customers that are submitting nearly 1 million returns annually. TaxCalc is just one of several tax software options that include FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow.

- Want to try TaxCalc? Check out the website here

TaxCalc: Pricing

TaxCalc offers a variety products both for individual and corporate UK tax filing needs. Most individuals will likely start off with the SA100 Individuals and Self-Employed to complete their return, which includes up to six SA100 Individual tax returns for £38.

To this, you can also add up to four Trust tax return submission (SA900), at £52 each, plus there’s a Dividend Database add-on for £7.50 that provides a database of dividends of FTSE350 and AIM 100 listed companies for the current tax year.

The £15 What If? Planner is quite good too, as it’s another add-on that calculates a future tax liability for the next tax year and enables the creation of tax planning scenarios.

Limited companies can pay for a slightly different plan, which still includes up to six self assessment substitutions, but also a single CT600 Limited Company return. It's £130+VAT, with further options for SA900 Trust tax returns, a Dividend Database and a What If? Planner.

SA800 Partnership and SA900 Trust and Estates plans are also available, but a major shortcoming is that there is no free tier, nor free trial.

TaxCalc: Features

Recognized by HMRC and award-winning for its simplicity, TaxCalc streamlines the onboarding and setup process by allowing users to import previous years' data. Then, TaxCalc incorporates its SimpleStep feature that has the user fast forward to the parts of a return that need completion. It's meant to reduce return completion time down to as little as 30 minutes, in theory.

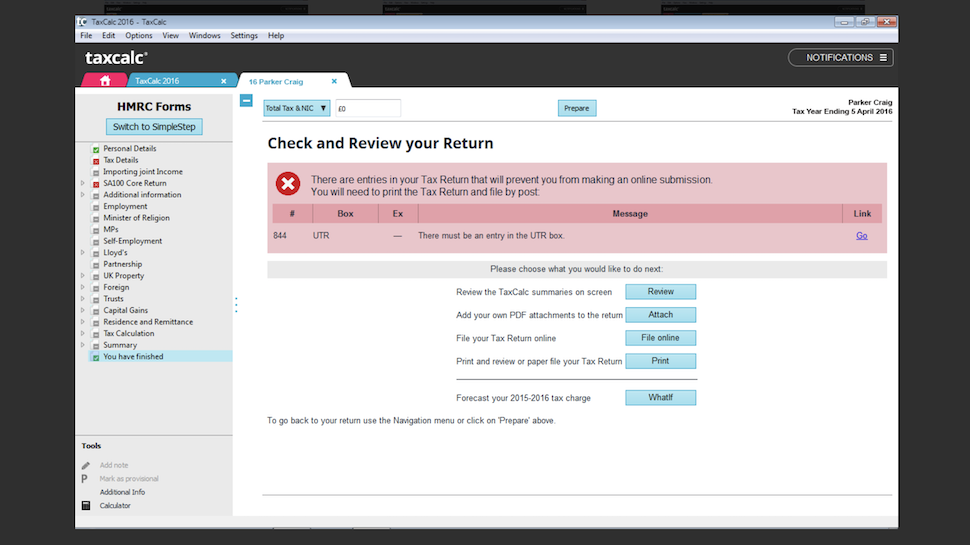

Thankfully, TaxCalc also works extra hard to avoid erroneous data input (and subsequent run-ins with HMRC) this with its Check and Finish feature. This will go through the tax return, inform you if a needed entry is either missing, or if the result does not tally up. This gives the user the opportunity to fix these errors, and make it right before submitted the return.

While TaxCalc uses a simple interface, it can still handle a variety of more complicated tax situations. These cover the gamut, and include capital gains tax, income from trusts, pension and benefit income, foreign income tax relief, and multiple sources of income.

It even covers some less common tax situations such as ministers of religion, non-UK tax residence, and being a Lloyd’s member. Along the way, TaxCalc keeps a running total of the potential refund, or tax payment to show it on-the-fly as entries are made, and what the impact on the tax burden is.

Integration support for third-party platforms like Xero, QuickBooks Online, FreeAgent, Singable, SmartVault and more means you can combine free or cheap bookkeeping software with TaxCalc's affordable submissions.

TaxCalc also boasts of handy wizards to help with things like company car fuel, mileage claims, Class 2 National Insurance, capital allowances and capital gains tax.

TaxCalc: Performance

Users report fast and reliable tax calculations, with automated checks that make it easy to keep tabs on what adds up and to reduce the risk of costly errors.

The user interface isn't as modern or simplistic as other rivals, but at least TaxCalc offers an easy-to-navigate platform with effective data import tools and solid integrations.

However, the requirement for installation (rather than browser access) means users must dedicate one single device to TaxCalc, and it won't be accessible from other computers.

CloudConnect, a private cloud database solution for syncing data across multiple devices, does exist, but it still requires desktop app installation so isn't a full browser-based SaaS product.

TaxCalc: Ease of Use

TaxCalc shows its 1980s origins, because the software has a dated look all-round. However, support is wide and covers Windows 10/11, macOS 13+ and even Linux.

The software is also available for older operating systems, right back to Windows 8 and Mac OS X 10.15 Catalina, but TaxCalc stresses that Microsoft and Apple no longer support these operating systems, so it doesn't test against them.

There is no mobile app support so don’t plan on doing your taxes on your smartphone with this software. Also, the software is downloaded and installed to the computer, and not cloud based. This has the potential advantage of a higher level of security, assuming your desktop is indeed secure, but you'll want to make sure you're making regular backups with the lack of cloud syncing.

TaxCalc: Support

Importantly, there is help available to users. It takes the form of either email, or telephone support, but the best part is that customers can have unlimited support with any license, during working hours.

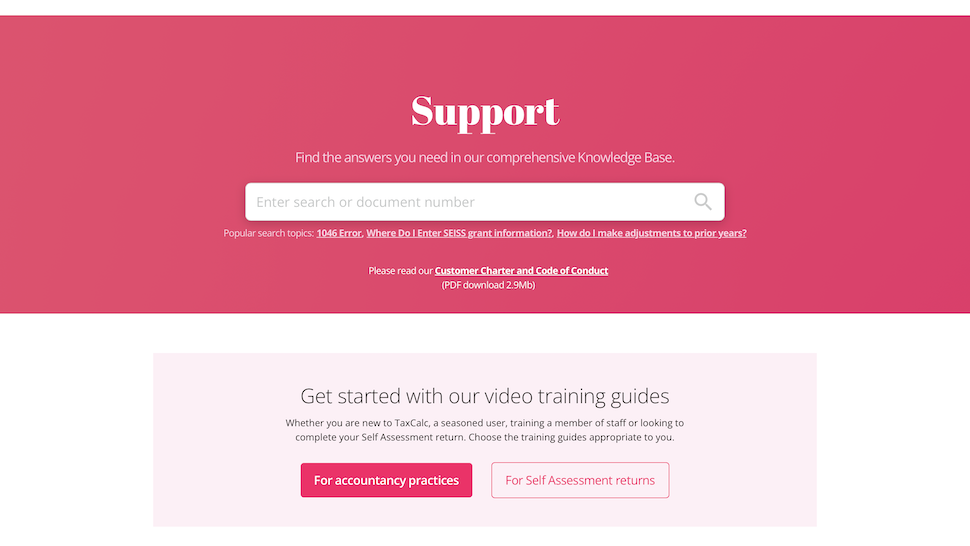

On the whole, support is prompt and responses are helpful, but a fairly detailed knowledge base portal could answer many questions without ever requiring a human interaction.

TaxCalc: Final Verdict

TaxCalc is a solid choice for completing a UK-based tax return. We appreciate the streamlined interview process that focuses the questions on the relevant tax situation, and not peppering the user with endless inquiries into tax situations that do not apply to them.

We find the cost affordable, and the single tier makes this an easy purchase, although we would like to see a free tier for simpler filings, or at least to be able to take TaxCalc out for a test drive via a time limited free trial.

However, as long as you plan to use a desktop or laptop computer to do your taxes, and are okay with forgoing doing this on a mobile device, TaxCalc will get the job done, and more speedily than the competition.

On the whole, TaxCalc provides a compelling and affordable alternative to large cloud-based platforms with a handy balance of simplify and performance, we think think there are more rounded solutions out there.

- We've also highlighted the best tax software