/Carrier%20Global%20Corp%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Carrier Global Corp. (CARR) stock is up today on news that the Trump Administration has made several Asian trade and tariff deals. That has sparked unusual out-of-the-money (OTM) CARR put options trading, signaling investor interest in the stock.

CARR is up over 5% at $80.58 in midday trading, but the unusual options trading implies it may have further to go. A closer look shows it could be worth at least 18% more at $95 per share.

Moreover, the unusual put option trading highlights a good way to play CARR stock - shorting long-dated out-of-the-money (OTM) puts to set a lower buy-in price and generate income in the process.

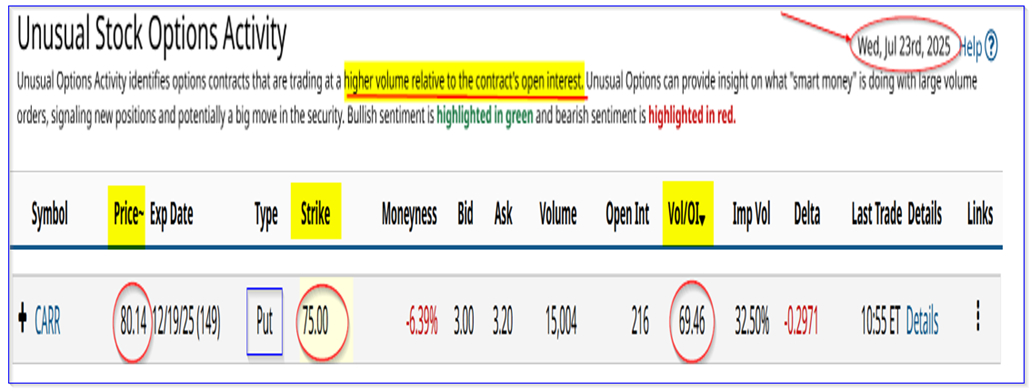

The unusual options trading in CARR puts can be seen in Barchart's Unusual Stock Options Trading Report today.

It shows that over 15,000 put option contracts traded at the $75.00 put option strike price for expiry at the end of 2025 (149 days from now on Dec. 19, 2025).

The premium received by short sellers of these puts is about $3.10 in the midpoint, or a 4.133% short-put yield (i.e., $3.10/$75.00) over 5 months. That works out to about 0.83% per month for 5 months.

More importantly, it allows a potential investor in CARR stock to set a lower breakeven point, i.e., if CARR falls to $75.00 anytime during this period. For example, $75.00 - $3.10 = $71.90, which is almost 12% below today's price.

That makes shorting these puts a great way to potentially invest in CARR stock. Its value could be significantly higher by then. Let's see why.

Trade Deals and Growth Prospects

In April, CARR took a hit as the Trump Administration began its aggressive campaign to raise tariff rates on American trading partners. Carrier Global Corp. manufactures refrigerated boxes and related transportation items, which are heavily used in global trade for HVAC and refrigerated applications.

However, yesterday the Administration announced several Asian trade deals. It established a 15% tariff rate with Japan, securing one of America's largest trading partners in a strong trade agreement. According to reports, another deal with the Philippines has also been finalized.

This augurs well for the possibility of further trade deals. After all, the Trump Administration's August 1 deadline to set deals seems to be hard and fast.

As a result, things could be looking up for Carrier Global Corp. Moreover, last quarter, it said in its Q1 earnings release that it had fully mitigated the effect of tariffs on its business. The market may have been a little skeptical about this.

In fact, the company reaffirmed its guidance for the year, despite sales having fallen 4% YoY in Q1. It guided that it expects to see sales of $23 billion (up from a prior estimate of $22.5 to $23 billion). This is higher than the $22.4 billion in sales last year.

The recent news may imply that sales guidance could rise. That may be what is pushing CARR stock higher.

Strong Free Cash Flow and FCF Margins

On top of this, Carrier Global reaffirmed that it expects free cash flow (FCF) to range between $2.4 and $2.6 billion this year. That implies its FCF margin (FCF/sales) could rise.

For example, given management's guidance on sales, we can project at least a 10.9% FCF margin over the next 12 months (NTM):

$2.5b FCF /$23 billion sales = 10.9% FCF margin

Given that analysts foresee sales ranging between $23 billion and $24.3 billion, or $23.65 billion NTM:

$23.65 billion NTM sales x 10.9% FCF margin = $2.58 billion NTM FCF

That is significantly higher than the $526 million in FCF it made over the last 12 months, according to Stock Analysis, and the $2.5 billion midpoint range of its guidance for 2025. This could push CARR stock higher.

Target Prices for CARR Stock

FCF Yield Target Price. For example, let's assume that the market will give Carrier Global stock at least a 3.0% FCF yield if Carr Global makes $2.5 billion FCF this year and $2.58 billion over the next 12 months:

$2.58 billion FCF / 0.03 = $86 billion market value

That works out to an increase of up to 26% over today's market cap of $68.37 billion, according to Yahoo! Finance:

$86b /$68.37b mkt cap = 1.258 -1 = +25.8% upside

In other words, CARR stock could be worth 25.8% more over the next 12 months:

$80.58 price today x 1.258 = $101.37 target price

Dividend Yield Target Price. Another way to value CARR stock is to use its historical dividend yield (and assume that the stock reverts to that mean yield).

For example, Yahoo! Finance reports that its 5-year yield has averaged 1.12%, Seeking Alpha says it's been 1.11% and Morningstar reports 0.91%. So, the survey's historical mean is 1.04% over the past five years.

Given that the company pays out an annual dividend per share (DPS) of 90 cents, we can forecast where the stock's price target:

$0.90 / 0.0104 = $86.54 target price

Upside: +7.4%

However, it seems likely that CARR will raise its DPS next year. Assuming it raises the quarterly 22.5 cents DPS by 5%, here is the NTM DPS forecast:

$0.225 + $0.225 + $0.23625 +$0.23625 = $0.9225 NTM DPS

Therefore, the NTM price target is:

$0.9225 / 0.0104 = $88.70 price target

Upside = +10%

Summary Price Target. As a result, using a FCF yield method, the price target is $101.37, and using a dividend yield metric, it's $88.70. That works out to an average price target of $95.04 per share, or +18% over today's price.

This is higher than analysts' price targets, as the average of 19 analysts surveyed by AnaChart.com shows $84.10 per share.

However, this could change next week when the company releases its Q2 earnings results on July 29.

The bottom line is that investors are getting bullish on CARR stock, given the recent trade deals and the company's outlook. Moreover, its price targets could rise if Carrier Global maintains or increases its sales and free cash flow (FCF) guidance in its Q2 results release.