/Tapestry%20Inc%20retail%20by-%20Lynn%20Watson%20via%20Shutterstock.jpg)

With a market cap of $23.8 billion, Tapestry, Inc. (TPR) is a global house of iconic brands, bringing together Coach and Kate Spade New York to deliver timeless craftsmanship, modern innovation, and meaningful experiences for customers and communities. The Amplify strategy empowers the brands and their teams to grow boldly, fostering creativity, inclusivity, and the courage to be authentic.

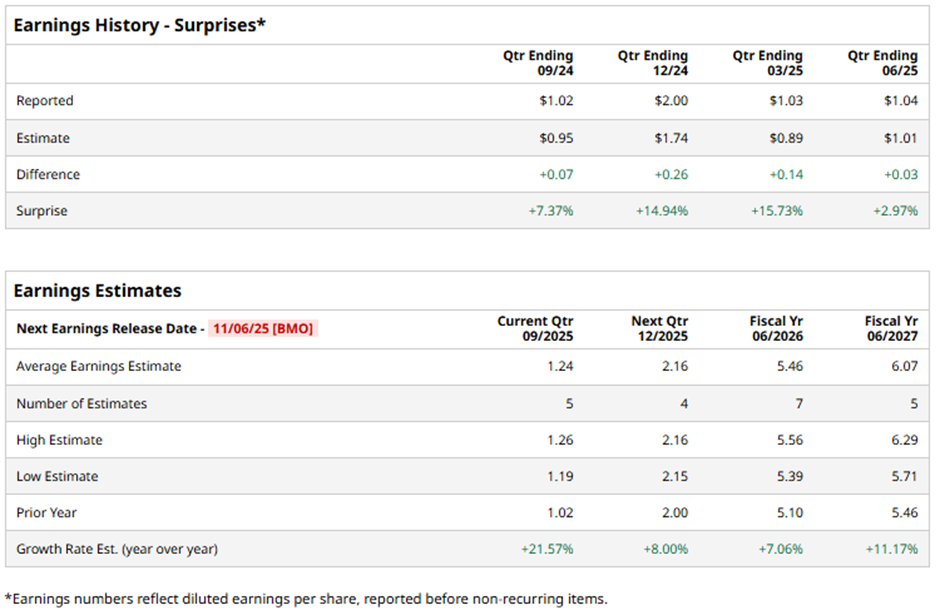

The New York-based company is expected to announce its Q1 2026 results before the market opens on Thursday, Nov. 6. Ahead of this event, analysts expect Tapestry to report an adjusted EPS of $1.24, up 21.6% from $1.02 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts expect the maker of high-end shoes and handbags to report an adjusted EPS of $5.46, a 7.1% rise from $5.10 in fiscal 2025. Moreover, adjusted EPS is anticipated to increase 11.2% year-over-year to $6.07 in fiscal 2027.

Shares of Tapestry have climbed 158.5% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) nearly 17% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.5% increase over the period.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $1.04 and revenue of $1.72 billion, Tapestry’s shares plunged 15.7% on Aug. 14 due to a weaker fiscal 2026 profit forecast of $5.30 per share - $5.45 per share, below expectations. The company warned that tariffs imposed by President Trump would cost about $160 million in fiscal 2026, including a $0.60 hit to annual profit.

Additionally, Tapestry announced plans to cut 30% of Kate Spade handbag styles as tariffs and slowing demand force retailers to narrow assortments.

Analysts' consensus view on TPR stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 22 analysts covering the stock, 14 recommend "Strong Buy," two suggest "Moderate Buy," and six indicate “Hold.” The average analyst price target for Tapestry is $121.45, indicating a potential upside of 5.4% from the current levels.