It's been a confusing couple of weeks regarding the US governments position on Intel. President Trump heavily criticised its new CEO, Lip-Bu Tan last week, calling for his resignation, before changing his mind after a face-to-face meeting mere days later and singing his praises instead. Now Bloomberg is reporting that sources have said the Trump administration is in talks with Intel to take a stake in the company, and the chipmaker's share price appears to have bounced as a result.

According to its sources, Bloomberg says that the plans stemmed from the earlier meeting between Trump and Tan, which appears to have gone so well that he's now interested in using US government funds to pay for the stake. No final deal is said to have been made, but it's a surprising turn around from Trump's previously-voiced opinions that Intel's new CEO was "highly conflicted" in regards to his ties to Chinese firms.

Intel's share price climbed by 7% on Thursday, in reaction to the reports that such a discussion was underway. The idea of the US government stepping in to prevent Intel from declining too far into the red have been mooted before, but often in regard to forcing a split between the companies' chip design and foundry business.

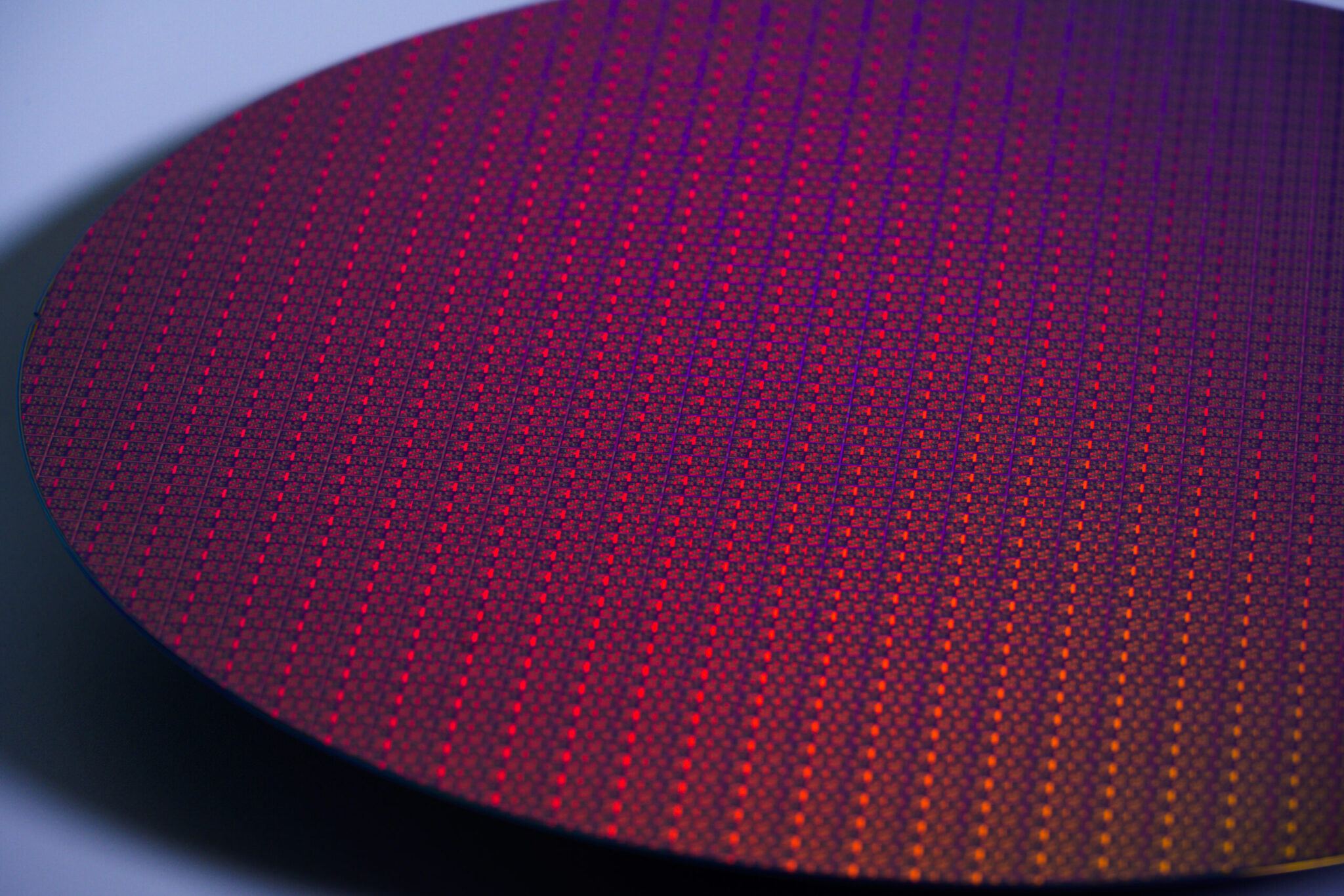

However, directly shoring up its finances and giving Intel the tacit seal of approval from the US Government would certainly tie in with the Trump administration's lofty plans for homegrown US chip manufacturing in the face of significant Taiwanese competition. Intel's foundry business has struggled in recent years, with previous CEO Pat Gelsinger's plan to "bet the entire company" on its 18A process node appearing to have been a non-starter, but the jury's still out.

After a dismal 2024 for Intel, Pat Gelsinger retired, with Lip-Bu Tan taking his place in March of this year. Intel's new CEO was quick to criticise the company for its previous failures, and has since indicated that Intel's new 14A node may not necessarily be a saving grace for the company.

"Unfortunately, the capacity investment we made over the last several years were well ahead of demand and were unwise and excessive. Our factory footprint has become needlessly fragmented… Our last full fiscal year of positive adjusted free cash flow was 2021. This is completely unacceptable" Tan said in an Intel earnings call last month.

The company indicated that it would also be prepared to "pause or discontinue our pursuit of Intel 14A" in the event that significant external customers were not found.

Still, while Intel has had a few tumultuous years I'm sure it would rather forget, it's current expansion plans may still represent a major development in US chipmaking capability, and that's exactly what the Trump administration has been pushing for of late.

It would also potentially keep a major US tech company from falling further from grace, which is good PR no matter which way you look at it. Regardless, whether anything comes of these talks, or they simply end up being nothing but hot air, remains to be seen.