Takeda Pharmaceutical Co.'s decision to spend a great amount of money to acquire Irish drugmaker Shire PLC was made in a bid to survive in the competitive global environment crowded with enormous drug companies. Takeda may have bought time to grow by expanding its size, but there are downside risks to the pressure that the purchase could put on its financial situation.

Global tide of acquisitions

"This is a unique opportunity to accelerate Takeda's transformation, which has been very successful so far," Takeda President Christophe Weber stressed during a telephone conference on Tuesday

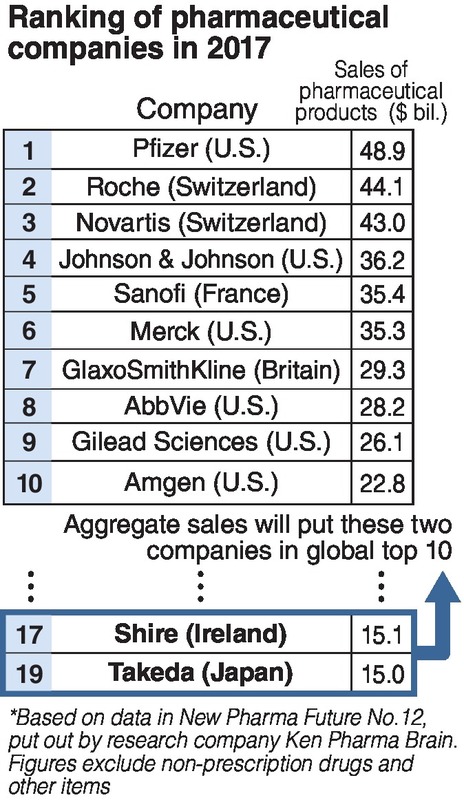

Since 2008, Takeda has made large acquisitions in the 1 trillion yen range, but it remains far behind the big drugmakers of Europe and the United States. According to market research firm Ken Pharma Brain, Takeda ranked 19th in the world in terms of medical product sales in 2017, less than one-third those of No. 1 Pfizer Inc. of the United States.

Developing new drugs is becoming more difficult every year. The success rate of development is reported to be one in every 30,000. To shorten development periods that can stretch over a decade and keep down costs, European and U.S. drugmakers have repeatedly purchased other firms that possess promising candidates for new drugs.

This has created enormous pharmaceutical companies with several trillion yen in annual sales. In 2014, Pfizer offered to buy AstraZeneca PLC of Britain for more than 100 billion dollars. Though the offer was later withdrawn, it was an example of the wave of corporate expansion occurring in the pharmaceutical industry.

In early April, shortly after it was revealed that Takeda was considering the acquisition, an executive emphasized its potential significance, saying, "It's bad for Japan if there continues to be no Japanese drugmaker capable of competing globally." To do so, Takeda has decided to take a big gamble.

Shire's strengths lie in rare diseases, a field where there is little competition and drugs demand high prices. Much of its sales are in the United States, the world's largest market. One of the advantages of the purchase is that it would quickly increase Takeda's profits, immediately bringing it into the top 10 worldwide.

The Bank of Japan's negative interest rate policy has created an environment in which it is relatively easy to procure funding at low interest rates. "If an acquisition is significant, we'll provide robust support," an executive at one of the megabanks said in mid-April.

Takeda plans to obtain the 30.85 billion dollar (about 3.3 trillion yen) it would need for the purchase through a bridge loan from a major U.S. investment bank JPMorgan Chase & Co., Sumitomo Mitsui Banking Corp. and MUFG Bank Ltd.

Fiscal risk high

Yet the purchase carries no small risk to Takeda's future financial health. Shire is larger in terms of market capitalization. As this would be a case of a smaller company buying a bigger one, Takeda's fiscal situation would worsen. As of the end of 2017, Takeda had more than 1.1 trillion yen in interest-bearing debts, which would only grow if the purchase goes through.

Investors do not like it when a company's fiscal health deteriorates, and since the acquisition plan was announced Takeda's stock price has been on a downward trend. If drug development does not accelerate as planned and profits do not grow, interest payments would become more burdensome.

The rating agency S&P Global Ratings said Tuesday it may lower Takeda's long-term and short-term ratings.

The rating agency said, "Should Takeda not take steps necessary to reduce its debt levels, we believe its financial burden to fund the acquisition will significantly outweigh the expected benefits to its business risk profile."

There are also concerns about Shire's ability to grow. It has grown through repeated purchases of companies with promising new drugs. However, "the patents on many of its drugs will expire in the next five years or so. If it doesn't generate new candidate drugs in that time, there's no future for Takeda," an analyst said.

The acquisition will require approval at both companies' general shareholders meetings. If Takeda were to issue new shares, it would reduce the value of those held by existing shareholders. Thus it remains uncertain if it can obtain the consent of the required two-thirds of shareholders.

Read more from The Japan News at https://japannews.yomiuri.co.jp/