Valued at a market cap of $48 billion, Take-Two Interactive Software, Inc. (TTWO) is a leading global video game publisher and developer known for creating, publishing, and marketing interactive entertainment content. The New York-based company generates revenue through digital and physical game sales, in-game purchases, subscriptions, and licensing. It is scheduled to announce its fiscal Q2 earnings for 2026 after the market closes on Thursday, Nov. 6.

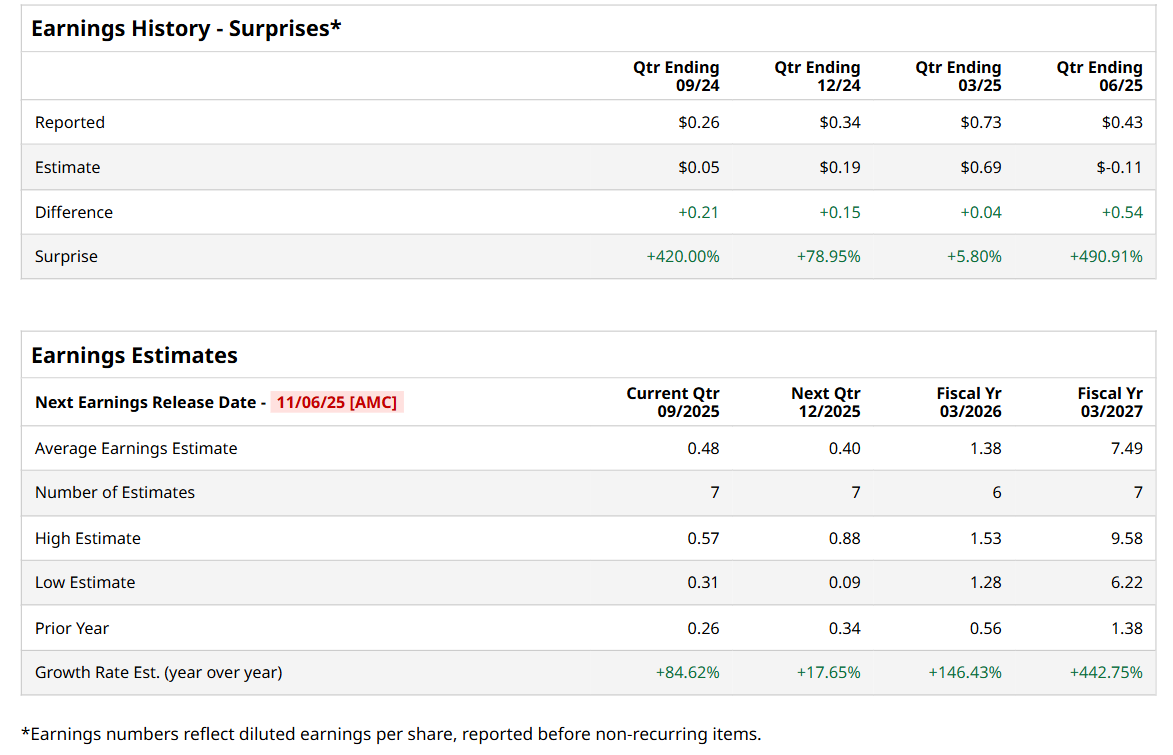

Ahead of this event, analysts expect this Grand Theft Auto publisher to report a profit of $0.48 per share, up 84.6% from $0.26 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters. In Q1, TTWO’s EPS of $0.43 outpaced the forecasted figure by a staggering 490.9%.

For fiscal 2026, analysts expect TTWO to report a profit of $1.38 per share, up by a notable 146.4% from $0.56 per share in fiscal 2025. Furthermore, its EPS is expected to grow by an even more impressive 442.8% year-over-year to $7.49 in fiscal 2027.

Shares of TTWO have rallied 65.9% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) 15.1% return and the Communication Services Select Sector SPDR Fund’s (XLC) 28.4% rise over the same time frame.

On Aug. 7, TTWO reported better-than-expected Q1 results. Due to robust ongoing demand for its core franchises, the company’s total revenue improved 12.4% year-over-year to $1.5 billion, surpassing consensus estimates. Moreover, its total net bookings increased 16.8% from the year-ago quarter to $1.4 billion. Noting this strong start to the fiscal year, TTWO raised its fiscal 2026 net bookings guidance to $6.1 billion to $6.2 billion. On the earnings front, its adjusted EBITDA also increased significantly from the prior-year quarter to $225.5 million. Despite these positives, its shares plunged 4% in the following trading session.

Wall Street analysts are highly optimistic about TTWO’s stock, with an overall "Strong Buy" rating. Among 27 analysts covering the stock, 21 recommend "Strong Buy," three indicate "Moderate Buy,” and three suggest "Hold.” The mean price target for TTWO is $268.37, indicating a 3.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.