U.S. stocks have experienced some volatility in recent days. While markets sold off on Friday, Oct. 10, after President Donald Trump announced 100% tariffs on China, they recovered yesterday, as the president toned down his rhetoric. Stocks are trading lower today again after China retaliated against Trump’s moves by imposing sanctions on five U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean.

Such countermeasures between the two countries have been a recurring theme this year. Frequent tariff changes have led to chaos, and while the broader market rose to record highs, shrugging off trade war fears, they have been quite volatile.

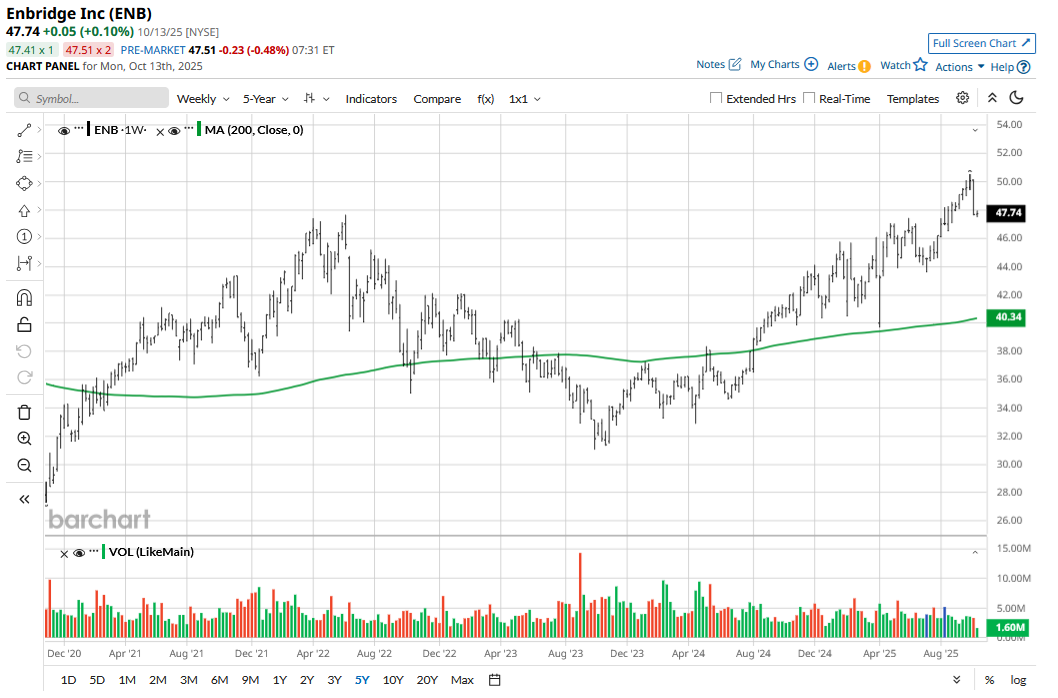

For those spooked by volatility and trade war fears while seeking a regular income from their investment, midstream energy company Enbridge (ENB) stock appears to be a good bet, particularly for those who crave stocks with a high dividend yield.

What Makes Enbridge an Attractive Dividend Stock?

I find Enbridge an attractive and reliable dividend stock for the following three reasons:

- Stable and Predictable Earnings: According to Enbridge, 80% of its EBITDA is generated by assets that either have a revenue inflator or have regulatory mechanisms to recover an increase in costs. This provides a reliability to its earnings, which is well exemplified by the fact that the company has met its financial guidance for 19 consecutive years.

- High Payout Ratio: Enbridge has paid dividends for 70 consecutive years and has increased them for the last 30 years at a CAGR of 10%. It’s a Dividend Aristocrat that strives to target a payout ratio between 60% and 70% of its distributable cash flows (DCF). The current dividend yield stands at 5.7%, which looks quite healthy.

- Positive Outlook for Earnings and Dividends: Enbridge expects to post average annual earnings and DCF growth of 5% until the end of this decade. The outlook for Enbridge’s dividend growth looks positive, and the company expects to return between $40 billion and $45 billion to shareholders over the next five years. For context, the corresponding number in the previous five years was $35 billion.

Stars Are Aligning for Enbridge

I have been bullish on ENB stock for quite some time now and believe that the stars are aligning well for the company. To begin with, high-yield dividend stocks might come back into favor with the Fed beginning its rate cuts.

Secondly, data center energy demand is a big opportunity for Enbridge, and the word “data center” unsurprisingly popped up 18 times during the company's Q2 2025 earnings call. Specifically, the company said that 29 new data centers are within 50 miles of its natural gas systems.

Natural gas liquids (NGL) export is another opportunity for Enbridge, and during the Q2 earnings call, it said that it is connected to all of the Gulf Coast's operating liquefied natural gas (LNG) export capacity.

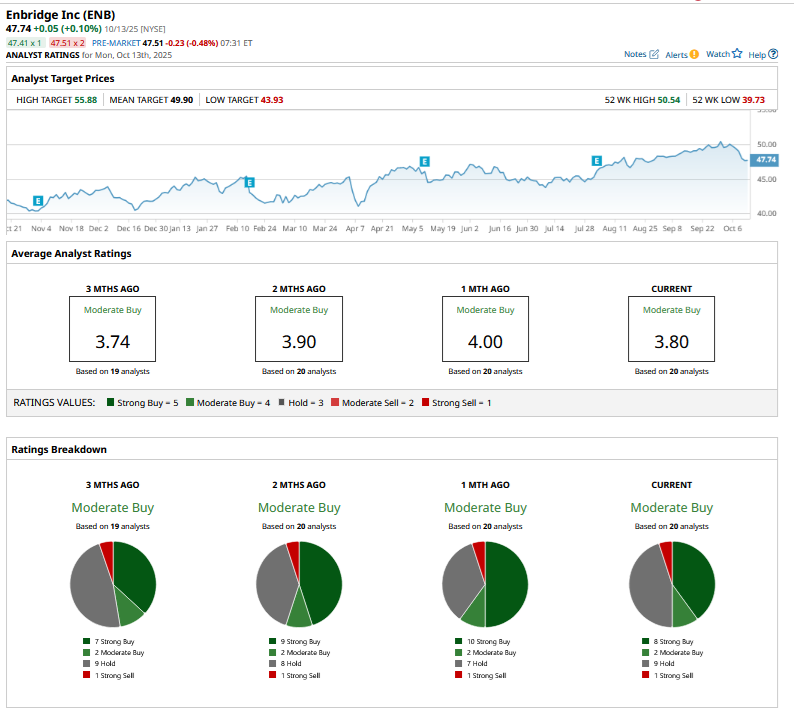

ENB Stock Forecast

Of the 20 analysts covering ENB stock, eight rate it as a “Strong Buy” and two as a “Moderate Buy.” Nine analysts rate ENB as a “Hold,” while one analyst has a “Strong Sell” rating on the stock. ENB's mean target price is $49.90, which is just about 4.5% higher than the Oct. 13 closing price.

The low upside potential is possibly due to the run-up in Enbridge’s valuation, and the forward price-to-earnings (P/E) multiple of 21.96x is higher than historical averages. However, the multiple expansion should be seen in the light of where broader market valuations stand as well as the growth opportunity in the form of data center and energy exports.

Overall, while I don’t find Enbridge stock a mouthwatering buy at these levels, it is definitely a name that can be nibbled at amid the trade war-driven weakness in broader markets.